Brazil: Adoption of Continuous Targeting Means Not Much Change

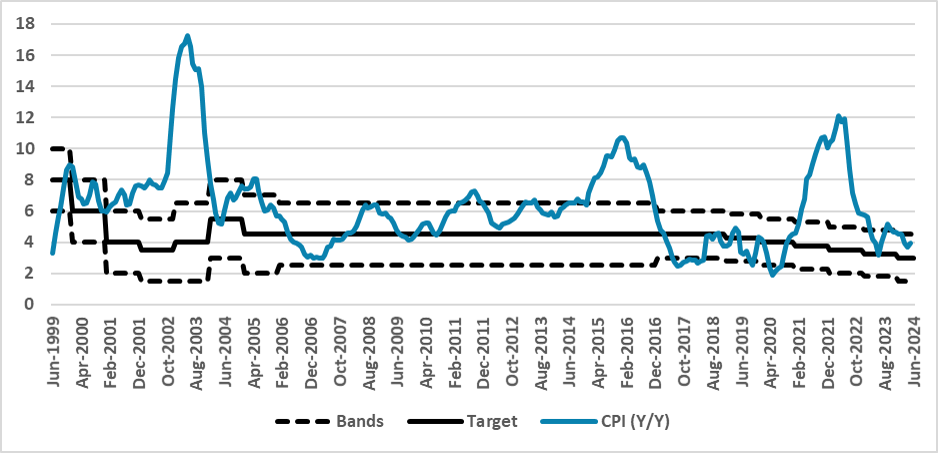

The Brazilian government has revised the BCB's inflation targeting framework, effective January 2025, to a continuous target system. If inflation exceeds the target bands for six consecutive months, the BCB must explain the discrepancy. The 3.0% target with 1.5% bands remains unchanged, alleviating concerns about a potential target increase for looser monetary policy. Historically, Brazil missed the target six times under the old framework and it would have been six periods in which Brazil would have missed the target in the new framework.

Figure 1: Brazil CPI and Inflation Target (%)

Source: BCB and IBGE

The Brazilian government launched a decree that changes the framework of the BCB's inflation targeting regime, starting in January 2025. The target will now be continuous, meaning that if inflation stays out of the target bands for six consecutive months, the target will be missed, and then the BCB will need to justify the reasons why they missed the target. Previously, the target was considered missed if, at the end of December each year, it was out of the target bands.

The good news comes from the set of targets. The government opted not to change the current 3.0% inflation target with 1.5% bands. There has been speculation that the government would seek to increase the inflation target to accommodate a looser monetary policy.

Historically, since the beginning of the adoption of inflation targeting, Brazil has missed the target in six years (2001, 2002, 2003, 2015, 2021, and 2022), according to the old framework. In the new framework, there would also have been six periods in which the target would be officially missed: from February 2001 to December 2003, a period in which Brazil suffered from high energy prices; from February 2005 to July 2005; April 2011 to December 2011; June 2014 to November 2014; February 2015 to November 2016; and May 2021 to February 2023.

We believe there will not be much change for the BCB. They will still need to pursue the 3.0% target and seek the convergence of expectations towards the center of the target. However, markets will likely be happier with the commitment to keeping the inflation targeting unchanged.