BCB Review: Shock 100bps Hike

The Brazilian Central Bank raised the policy rate by 100bps to 12.25%, with plans for two more 100bps hikes, reaching 14.25% by early 2025—the highest in 18 years. The decision reflects fiscal concerns, inflation risks, and a 10% depreciation of the Real. The BCB aims to curb inflation and protect credibility amid worsening fiscal perceptions. While short-term inflation is stable, long-term expectations remain unanchored. Conditions for rate cuts may emerge by late 2025 as the economy cools and fiscal risks ease.

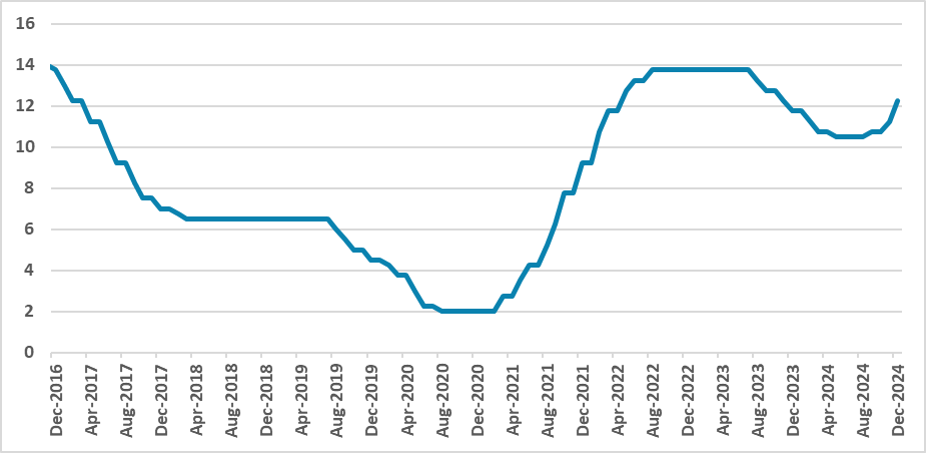

Figure 1: Brazil’s Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has convened to define the policy rate. While markets were expecting a 75bps hike, the BCB surprised by applying a 100bps hike and providing forward guidance of an additional two 100bps hikes in their next meetings. Therefore, the policy rate rose to 12.25% from 11.25%, and it will reach 14.25% by the end of the first quarter of 2025, the highest level in 18 years, equalling the rate during the 2014–16 crisis. The decision was unanimous, signaling unity among the BCB board members in tackling inflation, despite several complaints from government members about the high level of interest rates.

Justifying their decision, the board stated that the materialization of risks has made the scenario less uncertain and more adverse than at the last meeting. Although the minutes omitted which risks have materialized, we believe they are related to fiscal risks. The recent fiscal package (here) presented by the government was deemed insufficient to stabilize the debt/GDP ratio, affecting inflation expectations and increasing risk premiums. Moreover, the Brazilian Real has depreciated by around 10% since the announcement of the package.

In their balance of risks, the BCB admits a bias to the upside, with the following upside risks: (i) a de-anchoring of inflation expectations for a longer period; (ii) greater resilience in services inflation than projected due to a more positive output gap; and (iii) a conjunction of external and internal economic policies that have an inflationary impact, for example, through a persistently more depreciated exchange rate. Among the downside risks, the following stand out: (i) a more pronounced slowdown in global economic activity than projected; and (ii) the impacts of monetary tightening on global disinflation proving to be stronger than expected.

Due to the de-anchoring of expectations, a more depreciated exchange rate, and a prospective output gap that is in positive terrain, the BCB sees the need to be more aggressive with hikes. It is important to note that internal perceptions regarding fiscal risks are deteriorating, and the BCB is focusing more specifically on the Brazilian market. The BCB believes they could lose credibility if they do not act firmly. We believe they will keep the promise of setting the rate at 14.25%, and short-term inflation does not point to a clearer deterioration, despite long-term expectations being unanchored. As we move into 2025, it will likely become clearer that the fiscal situation is far from catastrophic, the economy will cool slightly, and the exchange rate will appreciate. By the last quarter of that year, there will likely be conditions to cut.