Brazil: Demand and Imported Prices Lead Inflation Rise

Our updated model shows that stronger-than-expected demand and BRL depreciation are driving Brazil’s inflation higher, while supply remains stable. Despite recent rate hikes, inflation expectations have risen, loosening monetary policy. We expect the BCB to implement two more 50 bps hikes before pausing, though additional hikes in 2025 remain a possibility if demand stays strong.

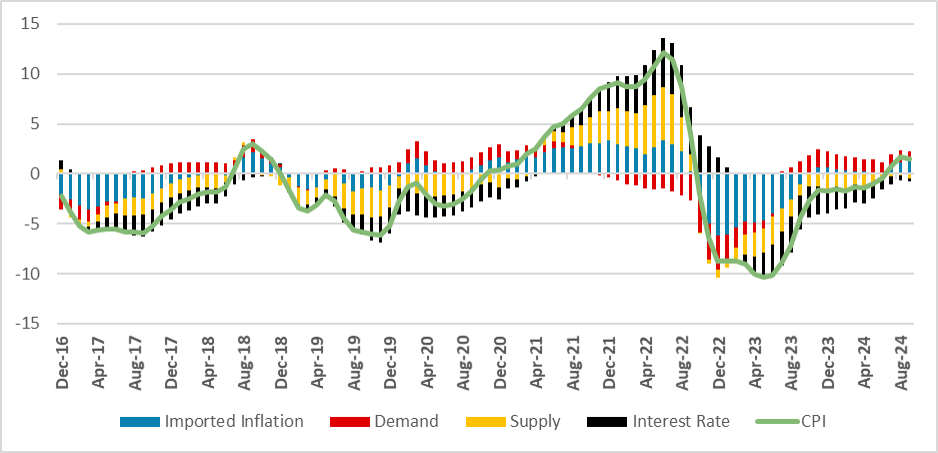

We have updated our inflation decomposition model (see here for the methodology) for Brazil. The main idea of the model is to decompose the contributions of imported inflation, supply, demand, and interest rate to the deviation of inflation from the mean. When we first ran it back in May, Brazil was in the middle of a rate-cutting cycle, and most expectations were that Brazil would continue to cut rates. However, the situation has since changed, and the BCB decided to resume hiking after a two-meeting pause.

Figure 1: Contribution for Inflation (%, deviation from mean)

Source: Continuum Economics

Our model indeed suggests a different situation. The biggest changes occurred in demand, which has strengthened in recent months. The strengthening of the economy was not anticipated by most market participants, nor by the BCB. Additionally, the recent depreciation of the Brazilian Real (BRL) has increased imported inflation, raising its contribution to the overall inflation numbers. Supply conditions continue to be stable, making a somewhat neutral contribution to inflation. Finally, the contribution of the policy rate to lowering inflation has diminished. This occurred because, although the policy rate was hiked, inflation expectations rose, making monetary policy looser.

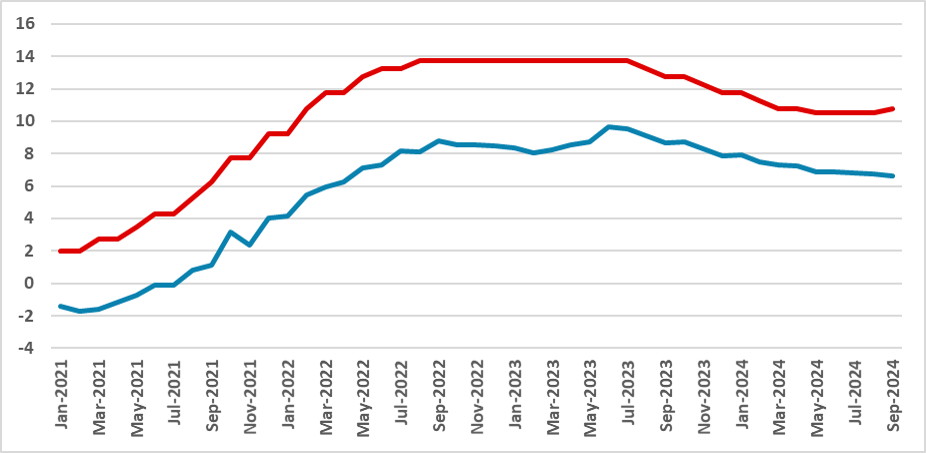

Figure 2: Policy Rate and Real Ex-Ante Policy Rate (%)

Source: BCB

In light of the results of this model, we believe the BCB will continue hiking to ensure that monetary policy contributes to lowering inflation. We now expect the BCB will likely implement two 50 bps hikes in the next meetings and then pause. However, if demand remains strong next year, we cannot rule out additional hikes in 2025, although we see this scenario as unlikely.