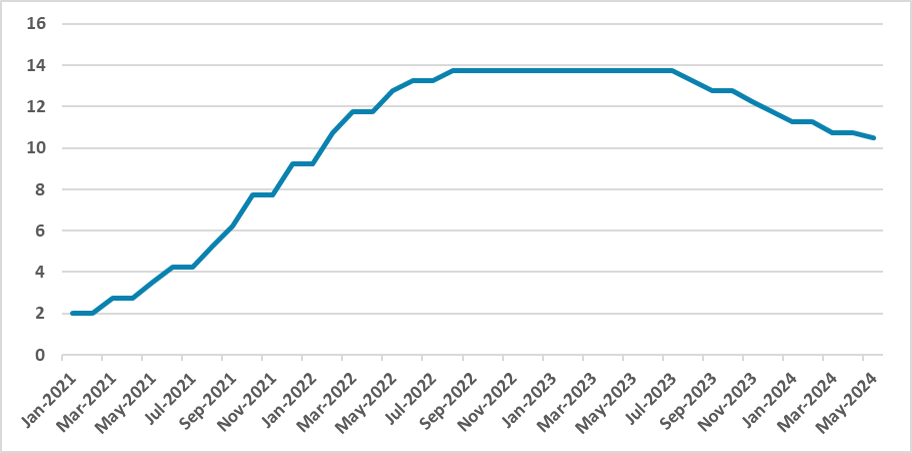

BCB Review: 25bps Cut, No Additional Guidance

The Brazilian Central Bank convened, opting against a 50bps cut, reducing it to 25bps, lowering the policy rate to 10.5%. A split vote ensued, with 25bps winning 5x4. The communique, vague possibly due to board division, noted labor market and economic activity surpassing expectations. Foreign market challenges increased due to the uncertainty regarding the easing of monetary policy in U.S. A divided board makes future policy predictions challenging. We await minutes for new forecasts.

Figure 1: Brazil Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has convened to decide on the policy rate. In line with the majority of the market participants, the BCB has not followed its past forward guidance of a 50bps cut and reduced the pace of the cut to 25bps, therefore, the policy rate was cut to 10.5% from 10.75% in March. What drew most attention was the split vote. The 25bps cut won by 5x4, with all the members appointed by the government voting for a 50bps cut while the others followed the lead of the BCB President, Roberto Campos Neto, and voted for a 25bps cut.

We think the communique was somewhat vague, possibly reflecting the division of the board over the cutting cycle. One major change in the outlook that appeared in the communique was that the performance of the labor market and economic activity exceeded expectations. We believe the state of the labor market will likely not be a problem for inflation convergence, and the mechanism by which it occurs is not automatic. Additionally, recent data shows some deceleration in wages.

Regarding the foreign market, the communique stated that the situation is more challenging due to the persistence and elevated uncertainty regarding the beginning of the easing of the monetary cycle in the U.S. and the velocity at which inflations will converge in advanced economies. Although this theme is relevant, the spread between the Brazilian policy rate and the FED Funds rate continues to be high, and we don’t see it as an impending factor to reduce the pace of the cuts. Still, inflation expectations are not fully aligned with the target but at least are within the bands of the BCB. For 2024, markets expect a 3.7% rise, and for 2025, a 3.6% rise.

The communique also omitted the usual forward guidance as the board probably could not agree on one. The communique only stated that they will evaluate according to prevailing conditions with a commitment to inflation conditions.

Clearly, we see a divided board, one clearly hawkish, which wishes to diminish the pace of the cutting, and they are the majority for now, while another wants to keep pace with the cutting cycle. However, with this configuration, the future path of the policy will be more difficult to predict. We will wait for the minutes to assess the view of this more hawkish wing of the BCB to come up with new forecasts for the policy rate in Brazil.B will continue to cut at a 25 bps pace in the second half and extend it a bit towards 2025, ending the cutting cycle at 8.5%.