BCB Minutes: Adding Some Hawkishness to the Communique

The Brazilian Central Bank raised the policy rate by 25 bps to 10.75%, citing stronger-than-expected economic activity and deteriorating inflation expectations. The committee highlighted rising inflationary pressures, especially in wages and credit growth. While future rate hikes are likely, no forward guidance was given, leaving room for a possible 50 bps increase if conditions demand it.

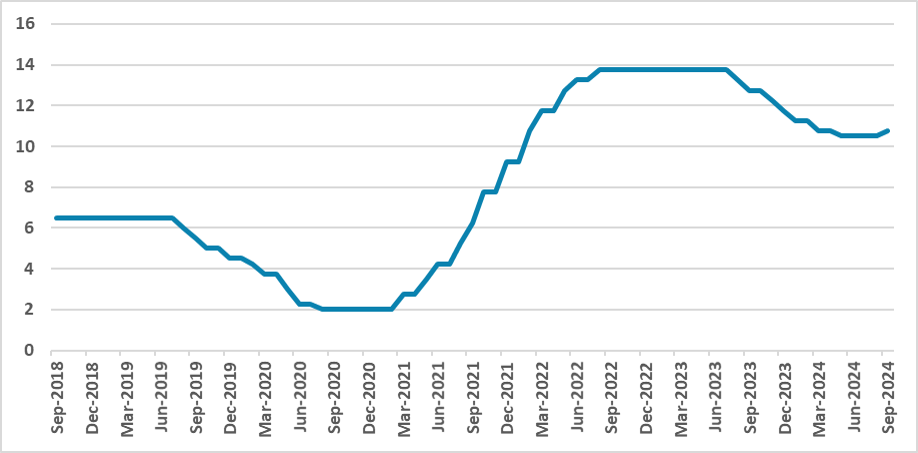

Figure 1: Brazil’s Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) has released the minutes of its last meeting (here), in which it raised the policy rate by 25 bps to 10.75%. The minutes provided some insights into the BCB's rationale, expanding on the arguments in the communiqué. Rather than short-term inflation, the motives for the hike were more related to economic activity, which has been stronger than anticipated, and inflation expectations, which are de-anchored and have deteriorated, especially in the medium term.

The Committee was unanimous in concluding that the output gap is now positive, reflecting recent developments in economic activity, the labor market, looser fiscal policy, and credit conditions. This suggests that inflationary pressures have increased. Regarding the labor market, the Committee is concerned about the pace of wage increases outstripping productivity growth. Although the transmission mechanism to inflation is not automatic, the board will continue to monitor whether this will generate cost pressures.

The situation in the credit markets was also cited, as credit growth has continued despite the high level of interest rates. This likely reflects several credit measures pushed by official banks. Despite the poorer quality of credit, no significant increase in the delinquency rate has been observed.

There was some mention of the exchange rate and its potential impact on inflation if it remains at higher levels, although this was seen only as an upside risk and was not elaborated on in the minutes. We believe the BCB views this movement as transitory, similar to our own assessment.

Regarding fiscal policy, the BCB was emphatic that a credible fiscal policy is needed to promote inflation convergence. Market distrust of the current targets is already imposing a risk premium on Brazilian assets, although BCB President Campos Neto considers this risk premium excessive.

The most hawkish tone came from the BCB's prospective actions. The BCB made it clear that after a discussion, most members preferred a gradual increase in the pace of hikes, justifying the 25 bps hike, but chose not to provide any forward guidance on future moves. This leaves the door open for an increase in the pace of hikes to 50 bps, rather than a pause. Another interpretation is that the BCB is sending a hawkish signal to markets to bolster its credibility, rather than providing a definitive indication of further hikes. We continue to expect the BCB to implement two more 25 bps hikes before pausing, but if the data surprises us, we may need to revise our policy rate forecasts.