EM FX Outlook: Domestic Drivers Key

In terms of spot EM FX projections domestic drivers remain critical, with a desire to avoid appreciation versus the USD for some countries. Fed easing in H2 2024 should however help EMFX more broadly and allow some recovery in spot rates (e.g. Indonesian Rupiah (IDR), South African Rand (ZAR)), though some countries will use it as an opportunity to cut rates or build FX reserves.

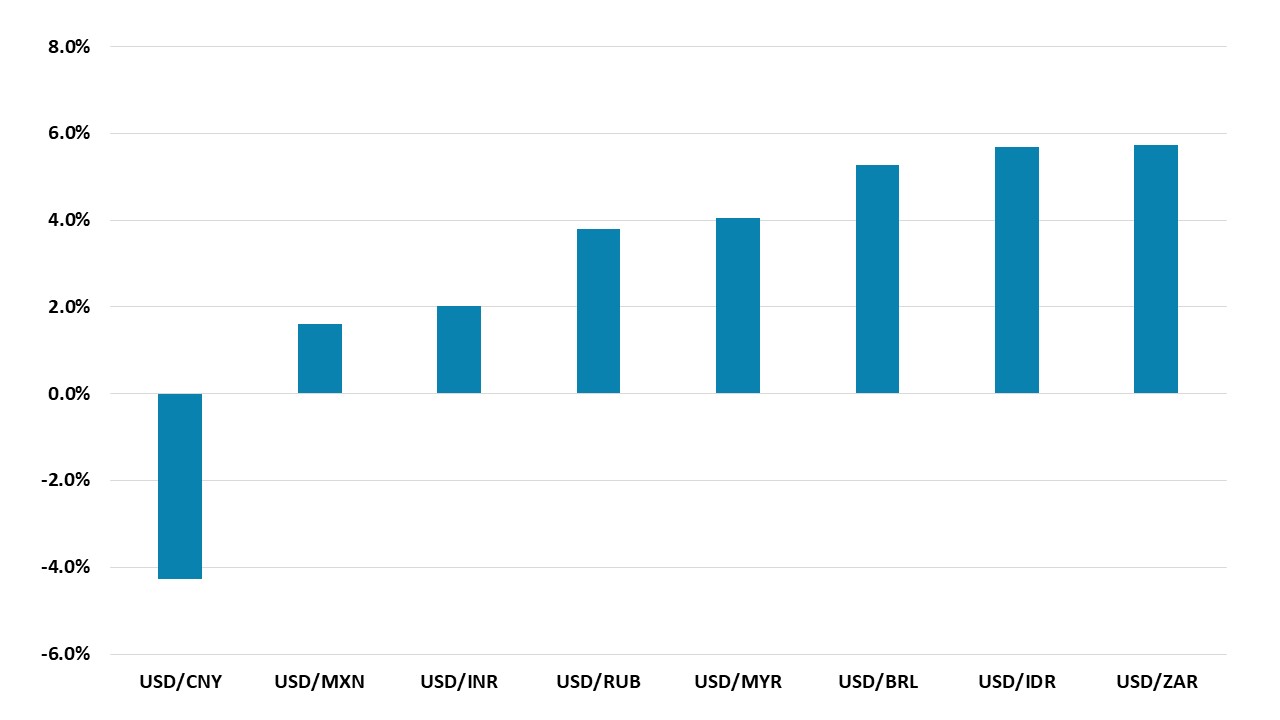

· From a total return viewpoint, the bias remains towards the Brazilian Real (BRL) for the remainder of 2024, given the still large yield pick-up (Figure 1). It is a similar story for the Mexican Peso (MXN) for the next 6 months, but Q4 will likely see profit-taking on carry trades just in case Donald Trump gets elected. IDR is also favored.

· We see a move to 7.40 for the Chinese Yuan (CNY) for USDCNY by end 2024, which is a balance of competing policy priorities between wanting to avoid a pick-up in capital outflows but wanting to help competitiveness (with net exports being hurt by some supply chains being switched away from China). Though our baseline is 7.40 for end 2025 on USDCNY, if Donald Trump is elected president then it will likely mean a trade war with China in 2025 and USDCNY at 7.80. Such a scenario would see other EM currencies looking to maintain competitiveness against the CNY and some temporary across the board EM currency weakening.

· In EMEA, we see ZAR volatility through the elections, but then a coalition government being formed and soothing political fears. With Fed rate cuts producing a softer USD across the board, we see USDZAR to 18.50 by end 2024. Elsewhere, we see USDTRY at 37.50, due to continued high inflation, though carry trades and improving tourism revenue will slow the pace of decline.

Risks to our views: A serious economic slowdown or mild recession in the U.S. would likely mean a larger decline of the USD versus DM currencies on more proactive Fed cuts and spill over to benefit EM currencies. Alternatively, a low to modest probability of a renewed surge in U.S. 10yr yields could help the USD generally, but also cause funding problems for weak EM and frontier countries.

Figure 1: 9mth Total Returns Versus the USD (%)

Source: Continuum Economics

Asia

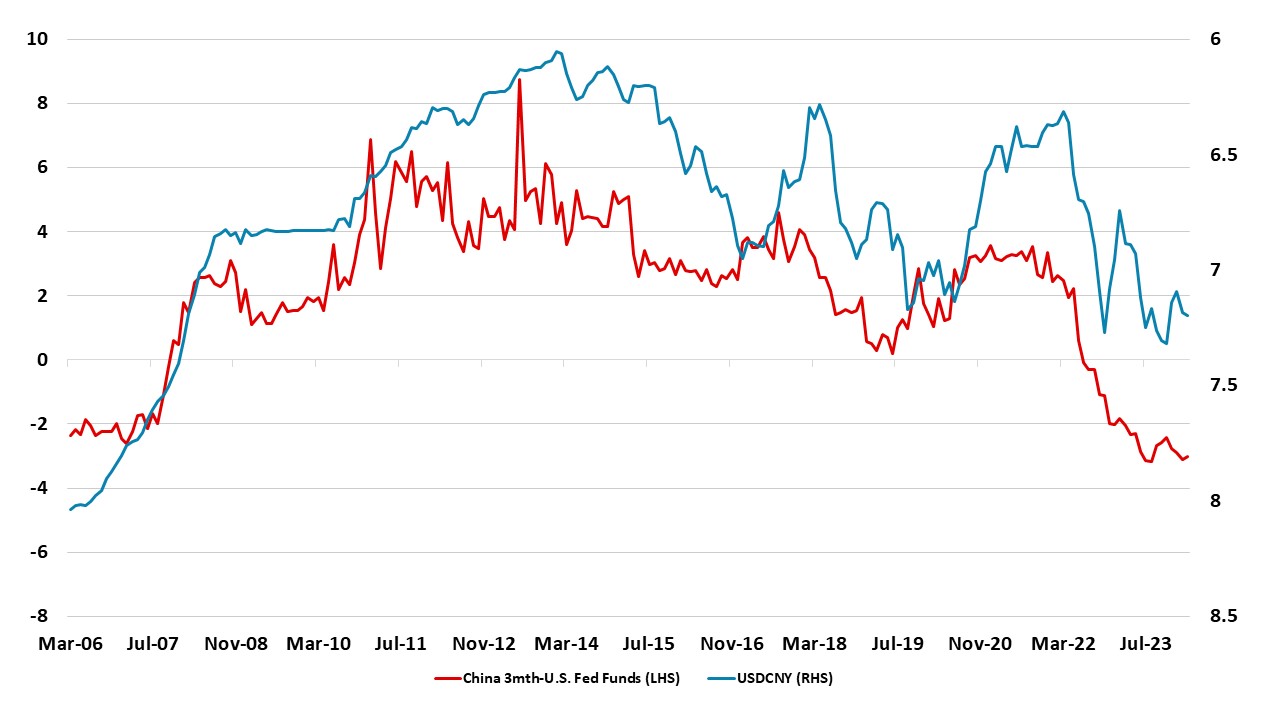

China authorities are fearful that Yuan instability could prompt capital flight and become a domestic political issue, which is the key reason behind the desire for Yuan stability. However, some controlled slippage in the Yuan should be allowed later in the year once the Fed starts easing, as the authorities are also concerned that net exports are becoming a drag on growth. Global companies are shifting some supply chains away from China and this is seeing China losing market share in Western economies. We see a move to 7.40 on USDCNY by end 2024, which balances these competing policy priorities.

Figure 2: USDCNY and China 3mth-U.S. Fed Funds Target (%)

Source: Continuum Economics

Our baseline 2025 CNY forecast includes no major changes in China/U.S. relations, both due to uncertainty about the U.S. presidential election and the fair possibility that the Democrats could control the House. The baseline is for 7.40 by end 2025, despite our forecast of a generally weaker USD across the board. If Trump were elected president and the House/Senate were Republican, then the USDCNY outlook would be for 7.80 by end 2025. A president Trump would likely increase tariffs on China again, though not to the penal 60% suggested. Just as in 2018, this would likely see China authorities allowing some controlled exchange rate decline to provide an offset. We are less worried about a China invasion or blockade of Taiwan, as China military capabilities will not be sufficient until the 2030’s to ensure a successful major seaborne operation (here).

Meanwhile in Indonesia, in 2024, we anticipate a modest strengthening of the IDR as the USD softens with Fed easing. Our forecast projects USDIDR at 15100 by end 2024. Investors are picking Indonesia as a beneficiary from shifts in supply chain away from China, while the government and fiscal situation is seen as stable. This can allow an IDR recovery in 2024. On the other hand the Malaysian Ringgit (MYR) has been weak on adverse interest rate differentials versus the U.S. coupled with apprehension over the spillover from unbalanced growth in China. However, a gradual rebound in Malaysian goods exports is anticipated to bolster the currency in the coming quarters, particularly following U.S. interest-rate cuts in June (and a mere 10bps in Malaysia), leading to a recovery from undervalued levels against the USD. We project USDMYR to trade at 4.49 for end 2024. 2025 will see a smaller rebound to 4.45, as MYR rates will remain below those in the U.S.

Into mid‑2024, we anticipate the Indian Rupee (INR) to maintain a narrow trading range against the USD dollar. The conclusion of monetary tightening by the Federal Reserve is expected to provide some stability to the INR, although this effect may be counteracted by diminishing risk appetite for the currency in anticipation of the national election. However, the anticipated victory of the BJP in the election is likely to bolster the INR in H2 2024. Furthermore, the inclusion of Indian government bonds in global indices starting from 2024 is poised to enhance stability further. As a result, we project the INR to strengthen to 83.0 at the end of 2024 and further to 82.8 by the end of 2025, though RBI will also intervene to avoid excessive INR strength. India's robust economic growth, coupled with easing inflation and robust capital inflows, will continue to underpin the INR's strength throughout 2025. Nonetheless, a persistent albeit narrow current-account deficit is expected to cap the currency during this period.

LatAm: General Strength to Continue Despite the Cuts

The Brazilian Real has continued to show notable stability during the first months of the year, holding around the 4.8-5.0 USDBRL mark. Strong growth along with a high yield spread with the U.S. sustained this stability. Additionally, strong export numbers fuelled by the agricultural sector have helped support the BRL. We are expecting this stability to continue in the next few months. Although the BCB is continuing to cut rates, diminishing the interest rate spread with the U.S. (Figure 3), this spread continues to be large and attractive. Additionally, with the BCB reducing the pace of the cuts and the Fed starting cutting in the second half we see no major reason to change this outlook. Our forecast on USDBRL for end-year 2024 is still at 4.95. In 2025, the de-synchronization between Fed cutting and the BCB stopping cutting in the first half is likely to continue to help underpin the BRL. In terms of fiscal policy, although the fiscal targets are not likely to be met, we believe the Brazilian fiscal policy is far from catastrophic with the projected primary deficit of 0.8% of the GDP being easily financed through the domestic market.

Figure 3: Brazil Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S.

Source: Datastream and Continuum Economics

The MXN has surprised during 2023, demonstrating remarkable resilience. Similar to Brazil, this strength can be attributed to the substantial interest rate differential with the United States and the outstanding performance of Mexican exports, particularly to the U.S. We believe this scenario is set to continue in 2024 with the Mexican economy continuing to be strong. Although, Banxico has started their cutting cycle we see no reason for a weakening of the MXN due to the wide interest gap and the beginning of the cutting cycle in the U.S. We forecast USDMXN to end 2024 and 2025 at 17.4. If Donald Trump were elected U.S. president, then we would see downside risks, as investors reduce MXN asset exposure on trade fears.

Argentina is the country in which we see the most uncertainty around the exchange rate. The government has announced a strong devaluation of the official exchange rate in a clear attempt to unify the official rate with the black market rate. We foresee a series of reforms to harmonise the multiple exchange rates while keeping the restrictions preventing the general public accessing the scarce Central Bank FX reserves. This harmonisation has strongly increased our forecast for Argentina. We now see the UD/ARS ending 2024 at 1300 and 2025 at 1900 ARS/USD.

EMEA

EMEA FX outlook projections are dominated by domestic fundamentals and elections in H1 2024.

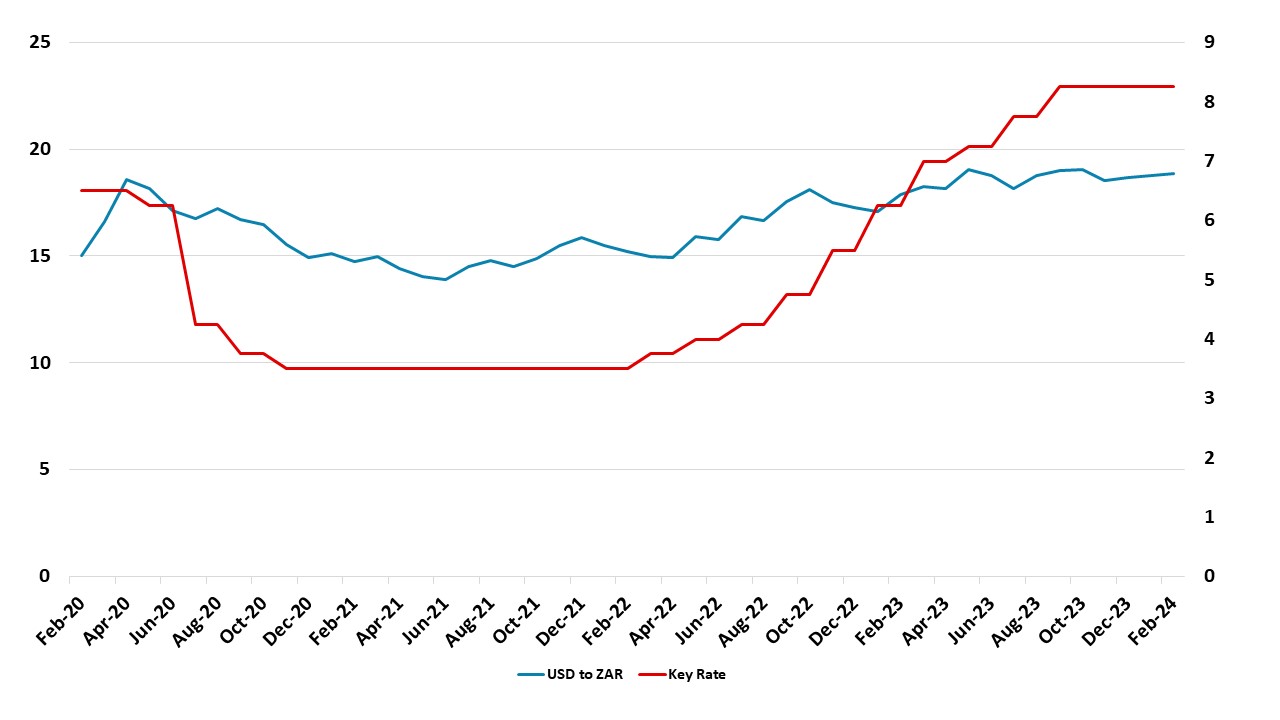

In South Africa, the pressure on ZAR remains high due to increasing inflation, a shrinking trade surplus, China’s slowdown and upcoming elections on May 29. Meanwhile South African Reserve Bank (SARB) also halted monetary tightening to ensure that the rate differential with the Federal Reserve remains modest.

We envisage some moderate volatility in Q2 and Q3 as the country will hold presidential elections and global investors want to see the outcome of the elections. An ANC victory would be a positive surprise for the ZAR, but an ANC coalition with the Democratic Alliance and other smaller parties would likely lead to a weaker ZAR, particularly if there is a coalition government without clear fiscal and power cuts (load shedding) policy. ZAR volatility will likely rise in Q2 depending on opinion polls and changes in expectations on the election outcomes, and the currency can get hurt on a spot basis occasionally. We think SARB will likely start easing in Q3 2024 which will help fixed income returns, helping the ZAR to stabilize, but this will depend on the inflation outlook. We think Fed easing in H2 2024 should support ZAR more broadly and allow some recovery in spot rates as South Africa can use it as an opportunity to cut rates. We see ZAR strengthening against the USD to 18.5 by end 2024.

In 2025, SARB’s domestic inflation sensitivity, further Fed/softer USD and bettering foreign trade balance could mean a bounce to 18 by end 2025 on USDZAR, if the new government shows determination in solving fiscal and power cut problems.

Figure 4: USD/ZAR Rate and Key Rate (%), February 2020 – February 2024

Source: DataStream/Continuum Economics

Turkish Lira (TRY) losses are set to accumulate on still wide inflation differentials and domestic vulnerabilities, though carry trades are slowing the decline. Elevated inflation, twin deficits and low foreign direct investment (FDI) will continue to dent the currency. We continue to forecast USDTRY moving to 37.5 by the end of 2024, and further weakening to 45 in 2025. We see losses for TRY in 2025 as the current account continues to deteriorate, foreign capital inflow remains weaker than expected, and exporters and domestic industry continue to push for a more competitive TRY.

Moving to the Russian Ruble (RUB), it remains mostly uninvestable due to the ongoing war in Ukraine creating severe economic risks and sanctions. Our forecast for USDRUB by the end of 2024 and 2025 are 98.2 and 103, respectively, as we expect no immediate return by foreign investors as a credible peace deal is unlikely, and RUB will be under pressure with ongoing sanctions. Taking into account that the current account surplus is shrinking, inflation spiking and the budget deficit increasing, currency volatility will remain in the medium term as the sanctions continue to hurt. We anticipate further worsening in the trade balance is likely in 2024 and 2025, particularly if war related sanctions and the Russian oil price cap remain. It appears buoyant public sector and consumer demand continue to contribute to pump up imports, which has been a trigger factor for the RUB to lose value.