BCB Minutes: Deterioration of the Scenario Requires Higher Rates

The Brazilian Central Bank maintained the SELIC rate at 10.5%, emphasizing a unanimous, hawkish stance on inflation. Markets question BCB's inflation control with upcoming leadership changes. External uncertainties, domestic consumption surprises, and rising inflation expectations were highlighted. The BCB noted fiscal discipline issues and increasing neutral rates as challenges. Despite negative sentiment, we still see some room for cuts in the end of the year but the risk of no cuts at all are increasing.

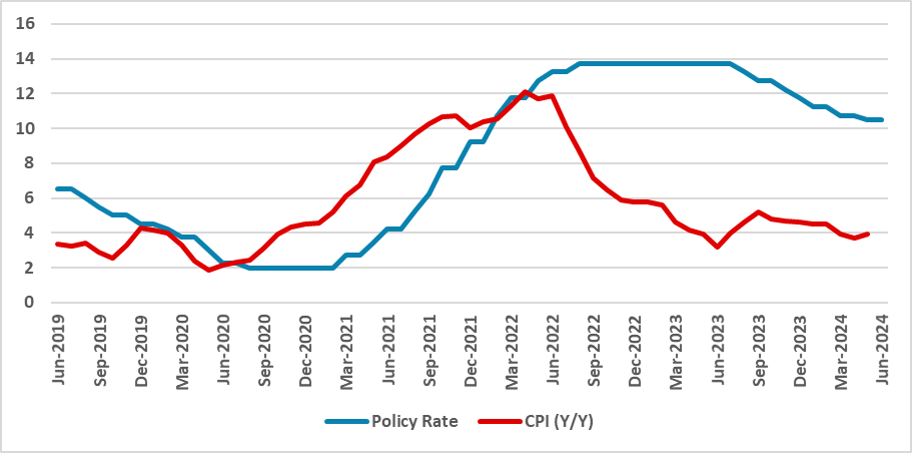

Figure 1: Policy Rate and CPI (%)

Source: BCB and IBGE

The Brazilian Central Bank has released the minutes from its last meeting (here), during which they kept the policy rate (SELIC) unchanged at 10.5%. The minutes showed a hawkish tone regarding the outlook and stressed the unanimity of the decision. At this moment, markets have several doubts about whether the BCB will be complacent with inflation in 2025 when the new BCB President will be appointed. With all members pointing in the same direction, the BCB is trying to send a message that they are committed to the inflation targets and that the same situation will be seen in the coming years.

Externally, the BCB stressed the uncertainty. There are still doubts about when the FED will cut rates and the pace of disinflation in most advanced economies. Central banks that have cut rates have started slowly and cautiously. Interestingly, not much was said about the recent depreciation of the BRL, but we believe that this devaluation is related to a big sell-off of EM currencies triggered by the expectation of high rates in the U.S. and some doubts related to Mexico and India's politics, rather than fiscal problems.

Domestically, the BCB stressed the surprise related to consumption. According to them, household consumption was expected to decelerate, but the recent numbers show the opposite. Consumption is likely responding to a heated labor market, boosted social transfers, and the payment of judicial decisions (Precatoriums). Additionally, inflation expectations have resumed rising, and regardless of the reasons for that, de-anchored expectations make the task of inflation convergence tougher. In this sense, the public advocacy for lower interest rates by President Lula is not helpful.

Regarding the floods in the southern region of the country, the BCB alerted for the possible destruction of capital with potential effects on the GDP and the possibility that food CPI may rise in some states of the country.

An interesting discussion regarding neutral rates appeared in the minutes. The BCB believes that neutral rates are around 4.5% - 5.0%. With a 4% inflation rate, the real policy rate stands at 6.5%, only 1.5% above the upper bound of neutral rates. This could justify the decision to change the course of the cutting cycle. Regarding the fundamentals that affect the neutral rates, the BCB stated that lack of commitment to fiscal discipline and structural reforms, increasing earmarked credit, and uncertainties regarding the stabilization of public debt are factors that could increase the neutral rates and, thus, increase the cost of lowering inflation.

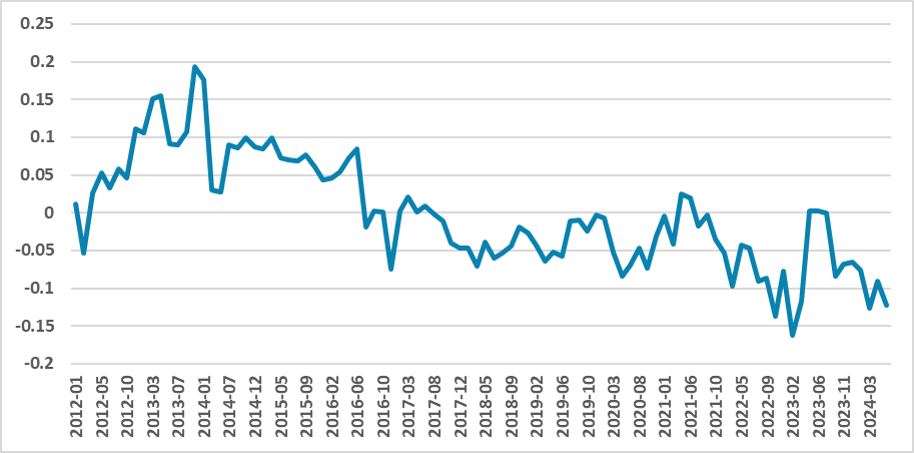

Applying our language tool, we can see that the minutes were more negative than the past ones, and the negative sentiment has been predominant in the last meetings. However, as we move towards the end of the year, there is still some room for cutting rates, but the risk now is that we might see no cuts until 2025. We keep our forecast for the end of 2024 at 10.0%.

Figure 2: Minutes Sentiment (Negative means more hawkish)

Source: Continuum Economics