Brazil: An Eye on the Lower Bound of the Fiscal Target

The Brazilian government will implement BRL 15 billion in contingency expenditures to meet fiscal targets, aiming for a 0.25% GDP primary deficit in 2024. This move, though addressing fiscal issues, pursues the lower target band and may undermine fiscal credibility. The contingency is due to revenue shortfalls and rising social benefits. Long-term fiscal stability hinges on expenditure control and economic growth. Additional measures will be needed to reinstate Brazil fiscal sustainability.

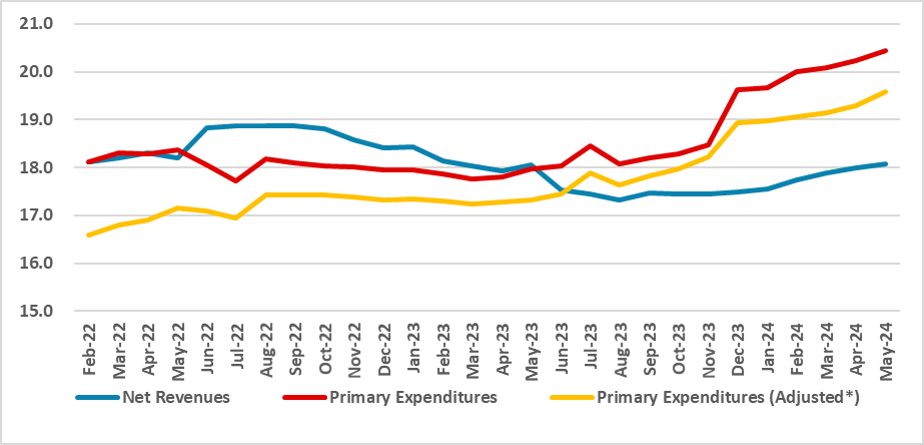

Figure 1: Primary Revenues and Expenditures (% of GDP, 12-months sum)

Source: STN

Note* Excluding Judicial Sentences and Extraordinary Credit

The Brazilian government has announced they will implement contingency expenditures worth BRL 15 billion (around USD 3 billion or 0.1% of GDP). This measure aligns with the fulfillment of the fiscal targets. For 2024, the government’s target for the primary result is 0% of GDP, although the target bands allow this to be missed by 0.25% of GDP. Government officials stated they will aim for the lower band of the target, meaning a BRL 28 billion deficit. Due to ongoing circumstances, the contingency of BRL 15 billion will be necessary to meet the targets.

The announcement has mixed consequences. First, it is clear that the government is trying to find a solution to the fiscal problem, and the contingency of expenditures is a positive sign in this regard. However, they are clearly pursuing the lower bound of the target when they should be aiming for the center of the target. We believe this undermines the credibility of the fiscal rule and will not be well received by the local market. To meet the proposed target (0% of GDP primary result), the level of contingency should have been at least triple, at BRL 45 billion.

The reasons given for the contingency relate to both expenditures and revenues. On the revenue side, the government will not count on revenues related to wage contributions from some sectors as Congress extended the payroll tax relief. The government projected this measure would end this year. On the expenditure side, social benefits are growing higher than expected. The government announced they will audit social benefits as they believe ineligible people are using the benefits. Expenditures related to the flood in the southern region of the country will be excluded from the target.

When we analyze government expenditures and revenues, we see that the main reason for the deterioration of public accounts is expenditures growing faster than revenues. Clearly, government efforts will need to concentrate on expenditures to ensure the credibility of fiscal policy. So far, the government has focused on raising revenues through new taxes.

Even to meet its own targets, a significant consolidation will be needed. Obligatory expenditures are almost impossible to cut, and the rising costs of the public pension system and the need to replace retiring public employees will make things difficult in the future. In May, the primary deficit was at 2.4% of GDP. Excluding judicial expenditures (precatories) and extraordinary credits, which do not form part of the fiscal rule, this deficit drops to 1.8%. We expect a primary deficit of around 0.9% of GDP, and excluding the precatories and extraordinary credits, the government will meet the lower bound of their target. However, we believe this will be achieved with additional contingency measures in the second half of the year and slightly higher revenue growth in the second half. Therefore, we see a downside risk that the target will be missed.

In the long term, the real test for the fiscal rule will occur in 2025. By then, it will be the first year in which expenditure growth will be restricted to 70% of the real growth of revenues, which will require the government to narrow expenditures that are somewhat rigid. Needless to say, fulfilling their goal will be contingent on the economy growing around 2.0% each year. Any recession would complicate matters. We will carefully watch the next steps of the government, as we believe additional measures will need to be taken to calm the markets regarding the fiscal situation. However, it is important to emphasize that we do not foresee any kind of insolvency for Brazil. Most of the debt is in local currency, and Brazilian financial markets can absorb the government’s financial needs, but this will likely come at the cost of a higher level of debt and interest rates.