BCB Review: Unanimous 50bps Hike

The Brazilian Central Bank raised its policy rate by 50 basis points to 11.25%, signaling heightened concerns over inflation risks driven by domestic dynamics and global uncertainties. While noting external volatility and fiscal policy impacts, the BCB emphasized that persistent inflation requires a stronger stance. With inflation expectations above the 3% target for 2024 and 2025, the BCB is likely to implement two more 50 bps hikes, potentially concluding the cycle at 12.25%, to ensure inflation converges.

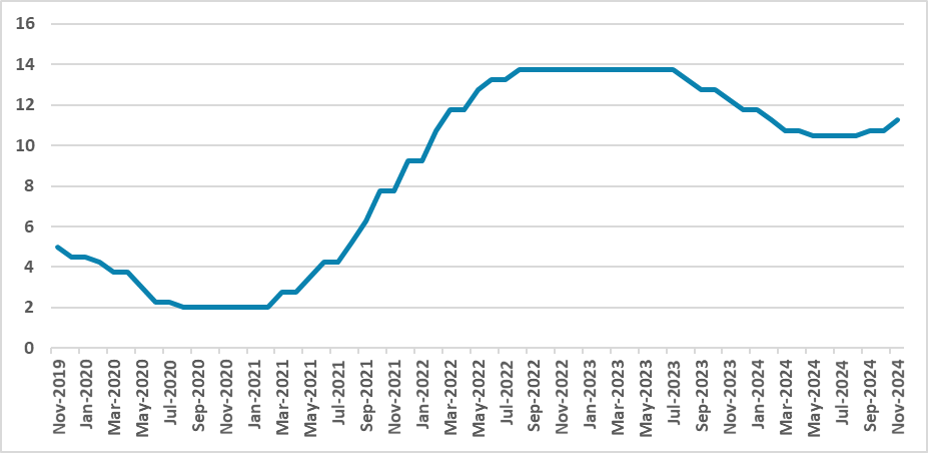

Figure 1: Brazil’s Policy Rate (%)

Source: BCB

The Brazilian Central Bank (BCB) convened to decide the policy rate. In a unanimous decision, the BCB opted to hike the policy rate by 50 basis points (bps) to 11.25%, accelerating from the previous 25 bps hike in September. This decision was in line with market expectations, according to the Bloomberg Survey.

In foreign markets, the BCB noted that the situation continues to demand caution from emerging economies, highlighting the misalignment in various countries' monetary policies and the uncertain situation in the U.S., especially following Donald Trump’s victory in the elections. Although external market volatility affects monetary policy, we believe internal factors are playing a more decisive role in this hiking cycle.

According to the BCB, domestic economic activity continues to show dynamism. The unemployment rate is reaching the lowest figure in the historical series, which began in 2012, and inflation expectations have continued to deteriorate, reaching 4.6% for 2024 and 4.0% for 2025—both above the BCB target of 3.0%.

The usual paragraph on fiscal policy was expanded during this meeting, with the BCB stating that they are closely following the discussions around Brazil's fiscal situation and the need to ensure that the debt-to-GDP ratio remains on a sustainable path. According to the BCB, expectations around Brazil's fiscal policy are impacting the risk premium, inflation expectations, and the exchange rate.

Finally, the BCB’s balance of risks is now skewed to the upside, a shift from their last meeting when the overall risk was deemed neutral. Inflationary risks include unanchored inflation expectations, the resilience of services inflation due to a tight output gap, and the depreciated exchange rate. Downside risks include a stronger-than-expected global slowdown and the impact of tighter global monetary policy.

Overall, we believe the BCB views inflationary risks as rising and is increasingly concerned about the persistence of inflation. There is a consensus in Brazil that monetary policy needs to be tighter for inflation to converge toward the target, and the BCB appears to be following this approach. We continue to anticipate two additional 50 bps hikes, which would conclude the hiking cycle at 12.25%.