BCB Review: Maintaining the Course

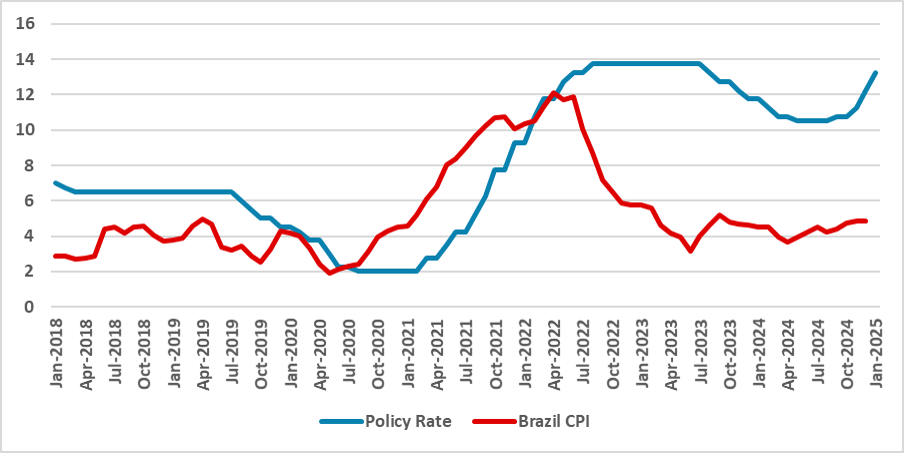

The Brazilian Central Bank (BCB) raised the policy rate by 100bps to 13.25%, signaling another hike in March while monitoring economic data. The statement had a neutral-to-dovish tone, with inflation risks stemming from services CPI, unanchored expectations, and fiscal policy. Market projections see rates peaking at 15%, but a stronger real and slowing economy may allow stabilization at 14.25%. The BCB remains cautious about global uncertainties, particularly U.S. trade policies, while reaffirming its commitment to inflation convergence.

Figure 1: Brazil CPI and Policy Rate

Source: IBGE and BCB

The Brazilian Central Bank (BCB) has convened to decide on the policy rate. In a widely expected decision and in line with its forward guidance, the BCB opted to hike the policy rate by 100bps, raising it to 13.25%. The communiqué had a somewhat neutral tone, leaning dovish, as most market participants anticipate the BCB will raise rates as high as 15%. Meanwhile, the BCB stated it would maintain its forward guidance of applying another 100bps hike in March and then act according to incoming data, which we believe is the right decision. This decision marks the first meeting presided over by Gabriel Galípolo.

Regarding foreign markets, the BCB highlighted the need for caution, as the new U.S. administration has been a source of uncertainty, particularly regarding the imposition of tariffs. They also stressed the strength of the labor market and inflation levels that are inconsistent with the BCB’s target. Inflation expectations have risen to 5.5% by year-end, contrasting with the BCB’s projection of 5.2%. The BCB has identified upward pressures in its balance of risks, particularly due to higher services CPI caused by a positive output gap, unanchored inflation expectations for an extended period, and a combination of fiscal and monetary policies that could lead to higher inflation, such as a more depreciated exchange rate.

The communiqué maintained language indicating that fiscal policy announcements have been impacting asset prices, although references to fiscal policy were suppressed in other parts of the statement. We believe this suggests a slight shift in tone, especially now that the BCB President has been appointed by the current government. However, maintaining its forward guidance also signals that the BCB remains committed to achieving inflation convergence. The tone of the statement suggests that the BCB would only raise rates to 15%, as the market projects, if conditions demand it. In our view, recent inflation expectations reports reflect some exaggeration from forecasters. Additionally, the recent appreciation of the Brazilian real and a marginal deceleration of the economy will likely allow inflation to converge, with the BCB maintaining a policy rate of 14.25%.