LatAm Outlook: Pausing the Cuts

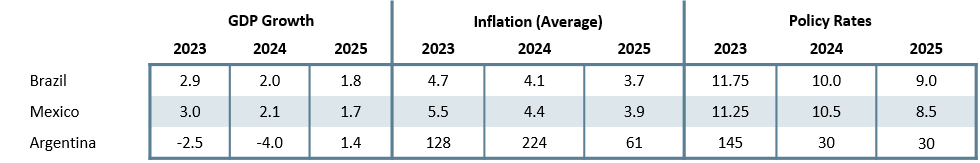

· Brazil and Mexico growth will decelerate from the growth rates in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust Agricultural growth will not repeat in 2023 while Mexico is on the limit of growing due to a tight labor market. Argentina will see a contraction in 2024 due to the strong fiscal and monetary adjustment while we expect some recover from it in 2025.

· Both Brazil and Mexico were able to reduce significantly their inflation rate. We see the fall of inflation to slow down in 2024 as result of inertia and core prices stickiness. We see inflation continue in 2024 and 2025 but slowly and we don’t see convergence towards inflation targets being achieved in 2025. In Argentina, inflation will likely end 2024 at 224% and it will slow down to 61% in 2025.

· In terms of interest rates, we see Brazil and Mexico applying a pause in the cutting cycle and resume cutting at the end of the year. In 2025, cuts will continue but both countries will need to keep the policy rates in contractionary terrain. Argentina is seeking a strategy of cleaning the Central Bank balance sheet and will likely maintain negative real rates.

· Forecast changes: From our March outlook, we have reduced marginally growth for Mexico in 2024 and 2025 and raised marginally our growth forecast for Brazil in 2024. We have significantly lowered our growth forecast for Argentina in consequence of the impacts Milei’s shock plan. We have risen our forecast for the policy rate of Brazil and Mexico as both countries will pause the cutting cycle. We have lowered a bit the inflation forecast for Argentina as the fiscal adjustment is helping to lower the level of inflation

Forecasts

Source: Continuum Economic

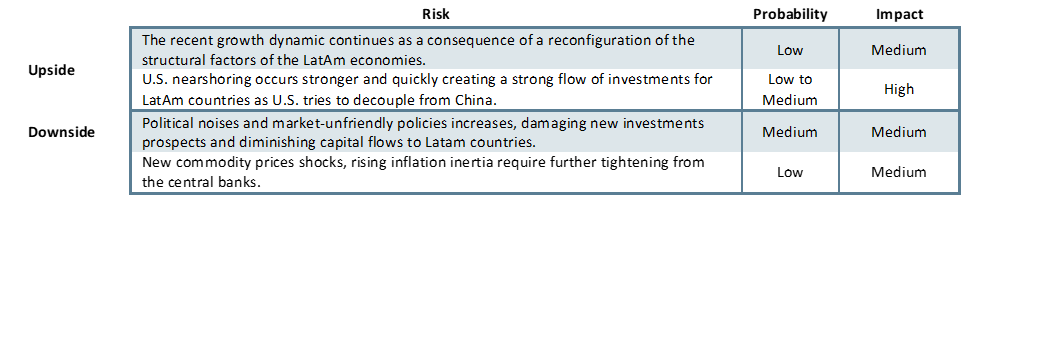

Risks to Our Views

Source: Continuum Economics

Brazil: A Pause in the Cutting Cycle

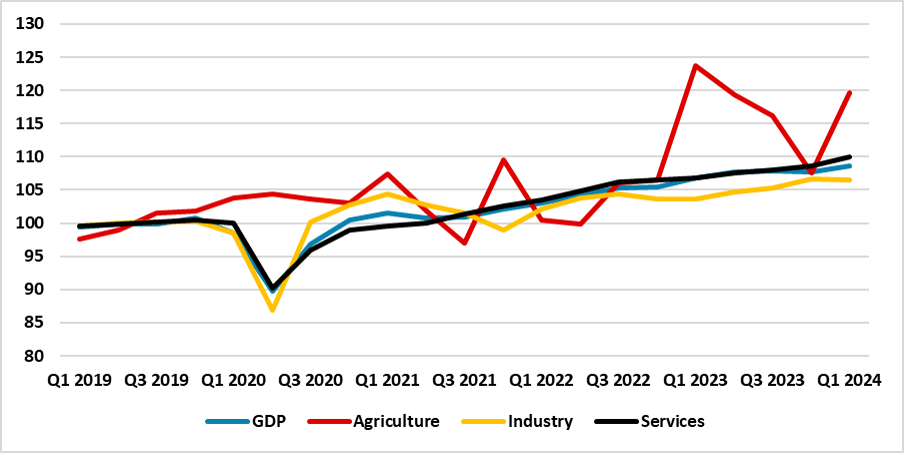

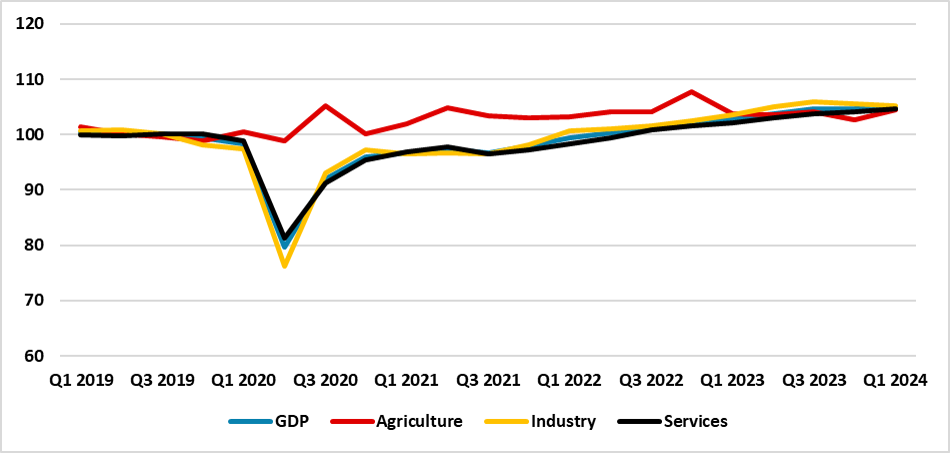

The Brazilian economy has been surprising in terms of growth recently. The 0.8% (q/q) growth in the first quarter has again surpassed expectations. However, unlike 2023, when the agricultural sector grew by more than 15%, this sector has stagnated this year, as the Agricultural survey points to a 3.0% growth in Brazilian harvests. Moreover, the climate risks regarding the intense rain in the southern region and droughts in the northeast will be a headwind for this sector.

Figure 1: Brazil GDP by Sectors (2019 = 100, Seasonally Adjusted)#

Source: IBGE

The main driver of growth in 2024 will likely be internal demand. Job creation continues to show resilience, although some deceleration is seen from 2024. The unemployment rate has fallen to 7.8%, approaching the minimum of its historical series (beginning in 2012). Additionally, the boost in social transfers, the minimum wage rise, and salary inflation point to increasing disposable income. This will lead consumption to grow during the year. We also see investment growing during the year, in response to the rise of the construction sector. Even though monetary policy will remain contractionary, credit is showing resilience, pushed by the growth of earmarked credit, influenced by the increase in the portfolio of state-owned banks. Our growth forecast for 2024 stands at 2.0%. One possible drag will be felt in the Q2 GDP due to the effect of the severe drought faced by the southern region of the country.

For 2024, we expect growth to decelerate a bit. The push from internal demand tends to dissipate, with little room for any additional fiscal impulse by the government, as the government will need to control the government debt trajectory. Monetary policy will also continue to be contractionary, while we see little room for external demand to be a push for the Brazilian economy. We still need to assess whether the impact of the floods could affect GDP, as the reconstruction of key infrastructure could cause some drag on growth. Our growth forecast for 2025 stands at 1.8%.

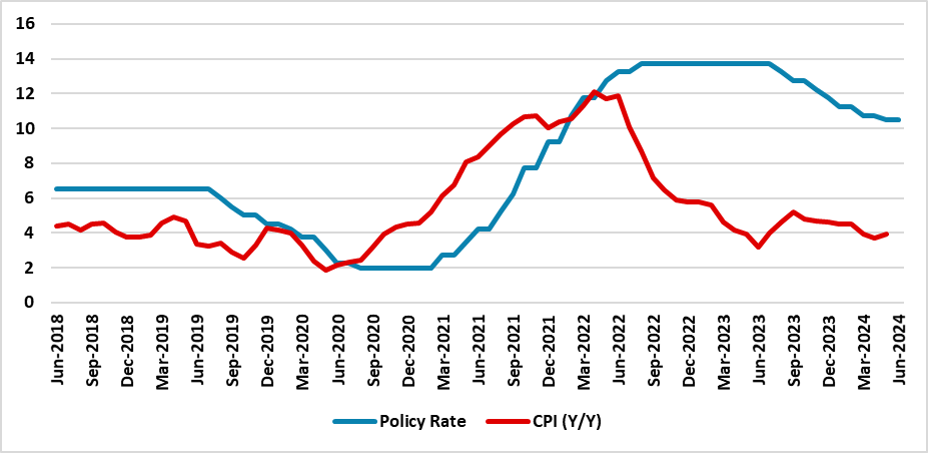

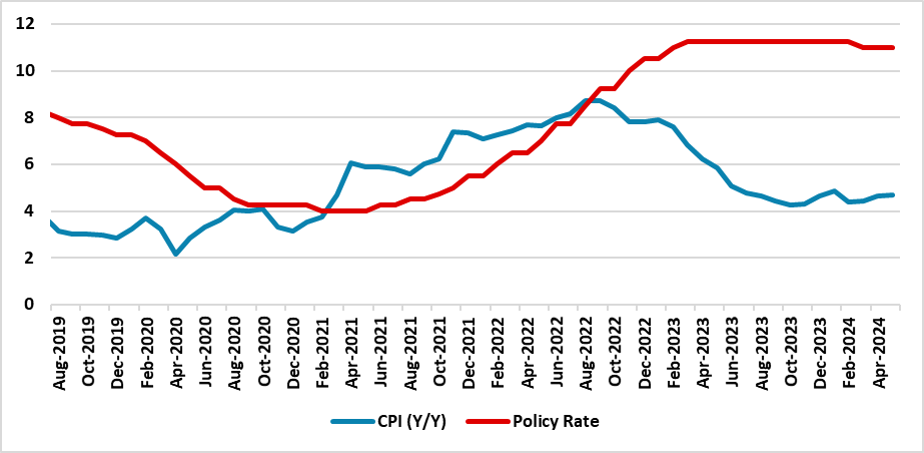

In terms of inflation, although there has been some clear progress, inflation is stubbornly running around the 4.0% mark. With a heated labor market and a possible shock on food CPI due to the floods, we continue to see the CPI showing some stickiness. The recent decline of the BRL also points to some inflationary pressures in the upcoming months, especially in goods inflation. We see inflation ending 2024 at 4.1%. In 2025, as we see the economy decelerating a bit and monetary policy continuing to be contractionary, we see inflation easing to 3.7%. The story around inflation now comes to whether the government regains market confidence regarding the fiscal situation. The new fiscal framework, which was already eased, is having some difficulty being implemented, and some conflicts between Finance Minister Fernando Haddad, who is now advocating for expenditure cuts, and other ministers, who want additional expenditures, are occurring. We maintain our view that the fiscal framework will be kept but that its effect will likely only be felt in 2026.

Figure 2: Brazil Policy Rate and CPI (%)

Source: BCB and IBGE

Moving towards the central Bank, the situation has changed since March. The inflation expectations have deteriorated, and the economy is likely stronger than previously forecasted. We now see the BCB applying a pause until October and then applying two 25bps cuts, meaning the policy rate will end 2024 at 10.0%. The space for cuts will come from lower expectations for 2026, which by then will be their main horizon, and some appreciation of the BRL by the end of the year. Then, we see the BCB continuing the 25bps cuts until it reaches 9.0%, when they will again pause and wait for a full alignment of inflation.

At the end of 2024, President Lula will appoint the new BCB President, who will serve a four-year term. The favorite to assume the position is Gabriel Galipoli, who is marginally more dovish than the current President. We don’t see the BCB trying to apply any experiment such as quickly lowering the policy rate, but rather to keep a technical view on policy setting.

Furthermore, municipal elections will be held in October. Most of the polls are showing a certain continuation of the current profile of mayors. Lula’s party, PT, will likely continue to face strong opposition from the conservative forces in Brazil, led by the figure of Jair Bolsonaro. Even though Bolsonaro is unelectable, there are many characters who follow his line in Brazil and who will surely gain a significant amount of votes.

Mexico: Election Turmoil

The biggest news in Mexico was the strong victory of MORENA, Lopez-Obrador's party, in the June elections. MORENA was able to elect the new President, Claudia Sheinbaum, the first woman to be President in Mexico. Sheinbaum’s victory was already expected by most, but the surprise came in the legislative houses. MORENA’s coalition with the Greens and the Labor Party was able to gather more than 2/3 of the seats in the Chamber of Deputies but fell short by 2 seats of gathering 2/3 in the Senate. However, they could partner with the Citizen Movement to reach the 2/3 in the Senate.

The 2/3 majority in both legislative houses will allow MORENA to make the constitutional changes that Lopez-Obrador failed to pass during his tenure. This unexpected result frightened markets as fears of institutional weakening arose. This caused the MXN to lose almost 10% of its value in relation to the USD. Some of the proposed constitutional changes are related to reforms in the judicial and electoral systems, which could be used to perpetuate MORENA in power.

Sheinbaum will inherit a country that has seen strong economic growth in the past two years (growing above 3.0%), but its economy has been more or less stagnant in the past two quarters. We are expecting the economy to rebound in the second half of the year as government construction projects kick in. As the U.S. economy slows down, we see internal demand being the main source of growth for Mexico in the upcoming quarter. Our forecast for the Mexican economy is that it will grow 2.1% in 2023, decelerating from the 3.2% in 2022.

Figure 3: Mexico GDP by Sectors (2019 = 100, Seasonally Adjusted)

Source: INEGI

We believe that more important for Mexico will now be the elections in the U.S. In recent years, under the Biden administration, the ties between Mexico and the U.S. have been closer and the prospect of U.S. companies nearshoring to Mexico has fueled optimism in Mexico. However, we don’t see significant numbers of FDI and new companies installing fresh plants in Mexico. We are rather seeing the current ones expanding their production. A Donald Trump victory in the U.S. elections could jeopardize Mexico-U.S. relations and all the prospects of nearshoring, as Trump would likely pick a fight with Mexico over immigration.

In terms of growth, 2025 will see a further deceleration for Mexico. First, monetary policy will likely continue to be contractionary. Then, we are including in our baseline that Mexico will see fiscal consolidation from the current fiscal push, which will also be a drag on growth. Furthermore, with a 3.0% unemployment rate, there is little room for Mexico to grow through increasing labor absorption. We see the Mexican economy growing 1.7% in 2025.

Figure 4: Mexico CPI and Policy Rate (%)

Source: INEGI and Banxico

In terms of inflation, the most significant change from our March outlook is the degree of stickiness we are seeing. With the labor market still being heated, services inflation is dropping more slowly. There are also other risks related to the fiscal push this year and some surge in food inflation. We believe that in this second phase of disinflation, the drop in inflation numbers will be slower. Additionally, the recent depreciation of the MXN will also have some impact on the goods CPI. We are forecasting the CPI to finish 2024 at 4.4% (Y/Y average), still quite far from the 3.0% target. For 2025, we see the Mexican economy decelerating, which will likely contribute to a drop in inflation numbers, helped by still-tight monetary policy. Our forecast for the Mexican CPI stands at 3.9% (Y/Y average).

In terms of monetary policy, Banxico has changed its strategy. In March, they opted to cut the policy rate by 25bps, indicating they could finally begin the cutting cycle. However, in May, they switched back to pausing the interest rates and indicated the next decisions will be data-dependent. At the moment, there is little room for them to resume cutting due to the MXN depreciation and the tendency of the economy to accelerate in the next months. However, we still see some room for them to cut in the final months of the year, applying two 25bps cuts. This means the policy rate will end 2024 at 10.5%. For 2025, we expect the cuts to continue at a 25bps pace, and as the economy decelerates, there will be room to cut until the end of the year while keeping the policy rate in the contractionary terrain. Our forecast is that the policy rate will end 2025 at 8.5%.

Argentina: Keeping up With the Shock Plan

The first months of Javier Milei have been sort of chaotic but the strategy of tackling inflation with a shock therapy seems to be working. Argentina has registered four consecutives primary surplus preventing the Central Bank of Argentina from printing money to cover the deficit. However, the liberalization of the prices and the strong devaluation of the ARS made inflation skyrocketing in December and January. Monthly inflation fell to 4.1% in May from the 25.4% in December. However, this drop came with a strong contraction in the economic activity, with economic activity shrinking by 3.0% in the first quarter of the year.

The government initially failed to pass a large decree to move the economy to a more friendly markets and some capital controls are still in place with the government promising to take it out as soon as economic condition allows. In recent weeks the Chamber of Deputies approved partially the project which is now in discussions in the Senate. We are expecting the economy of Argentina to contract by 4.0% in 2024 as a consequence of Milei policies. Inflation will likely fall to an average of 4.0% monthly as inertia will continue to be strong, and on our calculation will end 2024 at 224% (Y/Y average).

In terms of monetary policy, the BCAR is actually focusing on cleaning the its balance sheet, moving people from its bonds towards the National Treasury bonds, in local currency. Therefore, it has been lowering its policy rate, the BADLAR to 40% from 100% in December 2023. We are expecting a further decrease towards 30% in the next months, and we expect it to be stable at this rate until 2025 at least. In 2025, some economic recovery from the contraction will likely be seen although due to the magnitude of the damage, this recovery will likely not return Argentina to the previous level of GDP. We are forecasting the Argentine economy to grow only by 1.4% in 2025, while inflation will likely decelerate to 61% (Y/Y average).

The deal with the IMF will likely continue and the relationship of the Argentine government with IMF is good at the moment. We are forecasting that a new negotiation of the current deal will likely occur with Argentina seeking further disbursements and delaying the beginning of the re-payment of its USD 40 bln deal. We believe that by 2025, most of the capital controls will be taken out and we continue to see no room for dollarizing the economy as Javier Milei advocated during his campaign.