Brazil: Quarterly Inflation Report Shows BCB Worries

The Brazilian Central Bank's latest report highlights stronger-than-expected economic growth of 1.4% in Q2 and a positive output gap, raising inflation risks. While non-core inflation decreased, core measures like services inflation remain sticky. Credit growth continues to be robust, but fiscal policy has worsened due to flood-related aid. Inflation risks are now tilted upward, with concerns over unanchored expectations and a weaker currency. As a result, the likelihood of the BCB hiking 50bps in their next meeting increases.

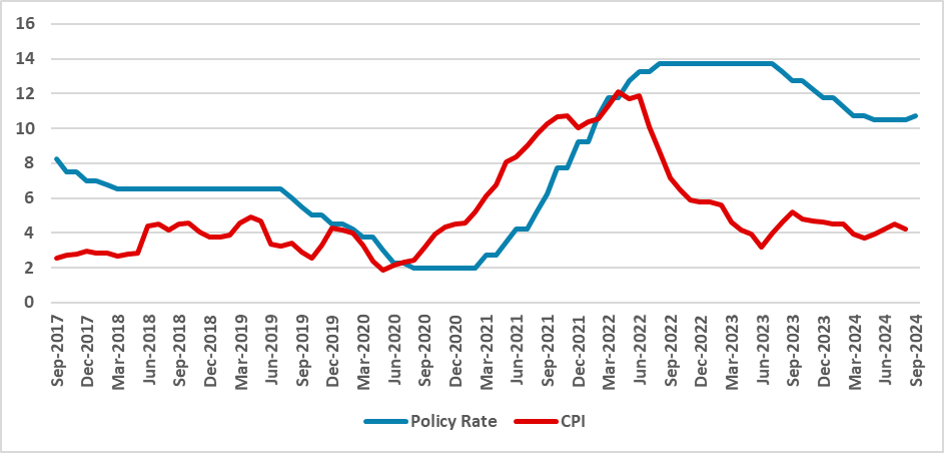

Figure 1: Brazil CPI and Policy Rate (%)

Source: BCB and IBGE

The Brazilian Central Bank analyst team has released their quarterly inflation report, highlighting the BCB's technical view on inflation. Below, we summarize the biggest takeaways from this report.

The strength of economic activity surprised the BCB and most analysts, showing robust 1.4% (q/q) growth in the second quarter. The impact of the floods in the southern region of the country has had only a marginal effect on growth. The BCB now expects the Brazilian economy to grow by 3.2% in 2024, similar to our forecast of 3.1%. However, the BCB hasn’t detailed their assumptions behind this surprise. In line with July's activity numbers, the BCB expects the third quarter to be weaker compared to the first half of the year.

The estimation of the output gap, which was in neutral territory three months ago, has shifted to positive territory due to the positive surprises in growth. This major change increases inflationary risks, as the economy is now operating above its capacity.

Despite inflation numbers behaving more or less as expected by the BCB, the qualitative aspects have changed. While non-core CPI decreased, mostly due to a drop in food inflation, some core measures are showing more persistence than previously expected. There were rises in Industrial CPI and Regulated CPI, while Services CPI continued to register high figures.

Credit figures continue to show robustness, with non-earmarked credit registering 10% nominal growth, likely in response to the past decreases in the policy rate and strong demand. Despite this rise, the delinquency rate remained stable at around 7%, despite the high levels of household indebtedness.

Due to the aid package for the floods, the fiscal result will be worse than previously expected. The BCB emphasized the subsequent revisions to government projections for the 2024 deficit, currently expected to be around 0.5% of GDP. Despite the neutral tone adopted by the BCB technical team, we believe that the lack of credibility in fiscal policy is impacting inflation expectations, which are currently unanchored, thereby increasing the cost of disinflation.

The BCB’s balance of risks for inflation is now skewed to the upside. Two new inflationary risks were added: (i) a longer period of unanchored expectations, and (ii) the resilience of services inflation in response to a higher output gap. Another upside risk relates to a prolonged period of a depreciated exchange rate, which appears to have stabilized at levels above 5.2 BRL/USD.

Inflationary risks have clearly increased according to the BCB’s technical team, which influenced the board to raise the policy rate. It seems that rather than focusing on headline CPI figures, the BCB is more concerned with what is happening to services inflation and expectations, and they are worried that stronger economic activity could start generating price pressures. As we do not see inflation expectations fading and services inflation remaining sticky, we now see a significant increase in the likelihood of the BCB hiking rates by 50bps rather than our previous forecast of 25bps.