Bank of England

View:

December 19, 2025

Western Europe Outlook: Underlying Price Pressures Ebbing

December 19, 2025 9:34 AM UTC

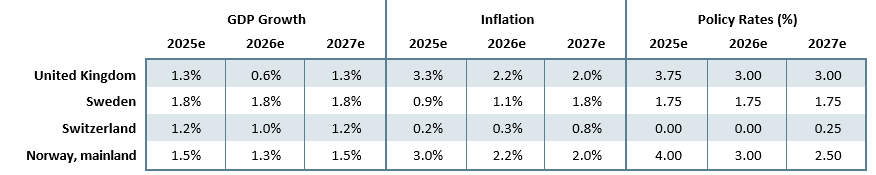

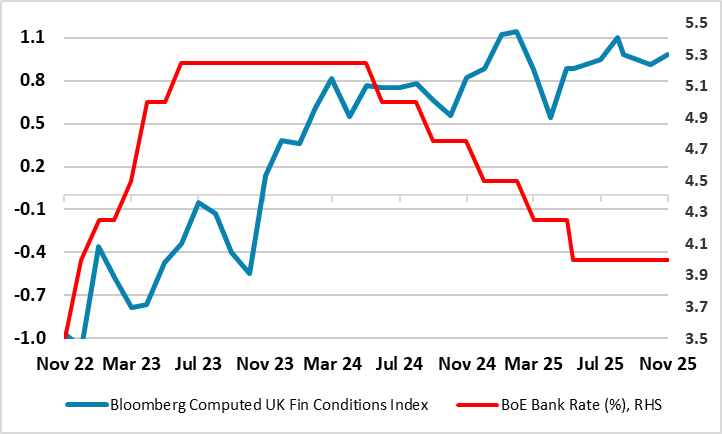

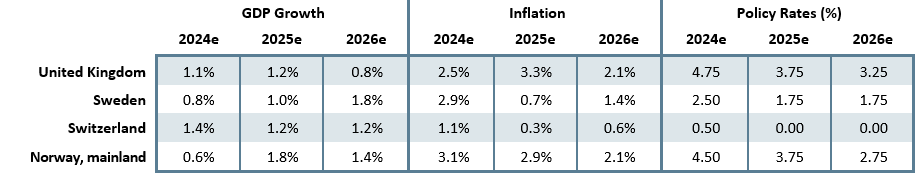

· In the UK, we have upgraded 2025 GDP growth by 0.1 ppt to 1.3%, but pared back that for next year by a two notches to a very sub-par 0.6%. We think the weak(er) labor market will accentuate somewhat refreshed disinflation allowing the BoE to ease further in 2026 by around 75 bp to 3.0

December 18, 2025

BoE Review (Dec 18): Splits More Entrenched?

December 18, 2025 12:41 PM UTC

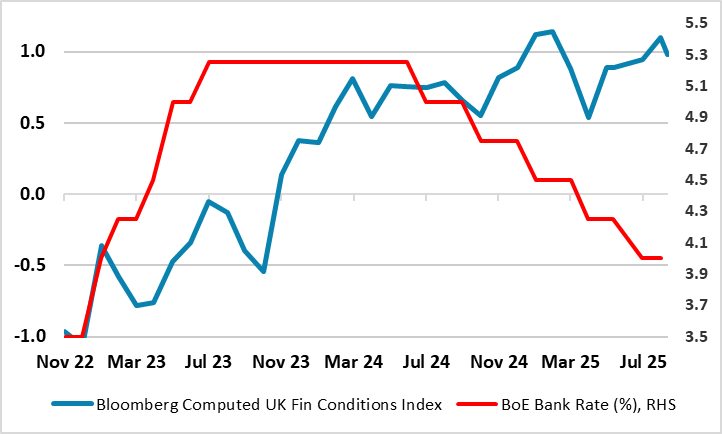

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

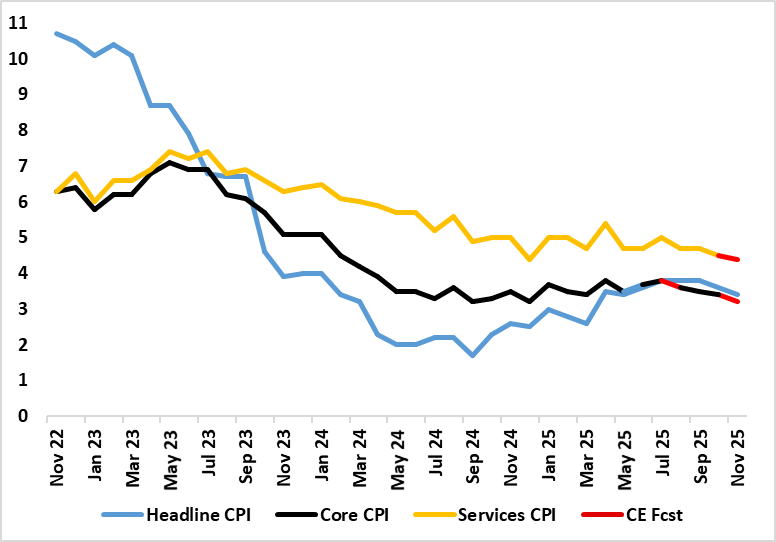

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

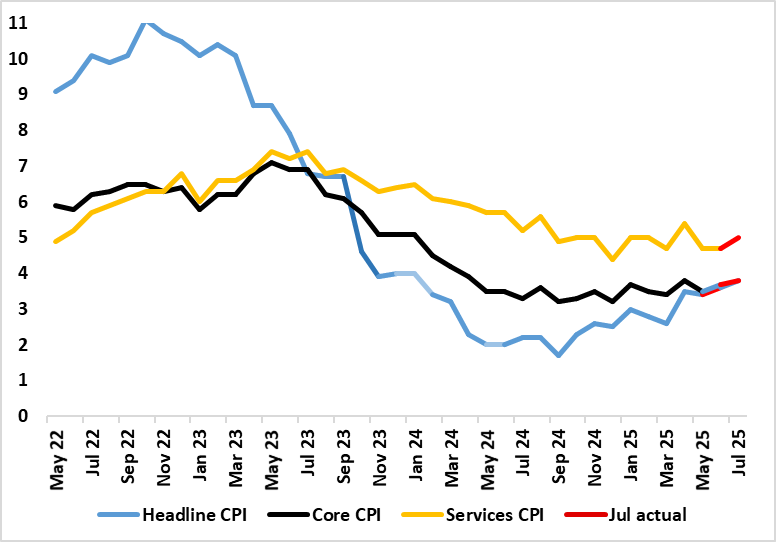

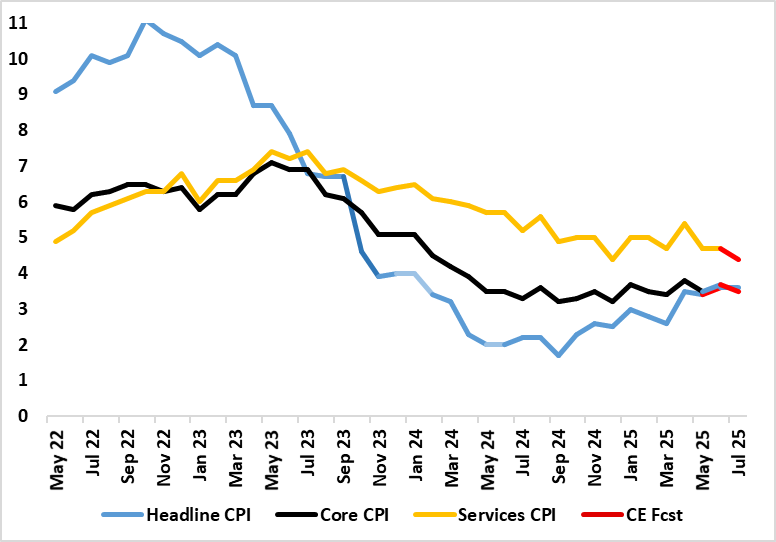

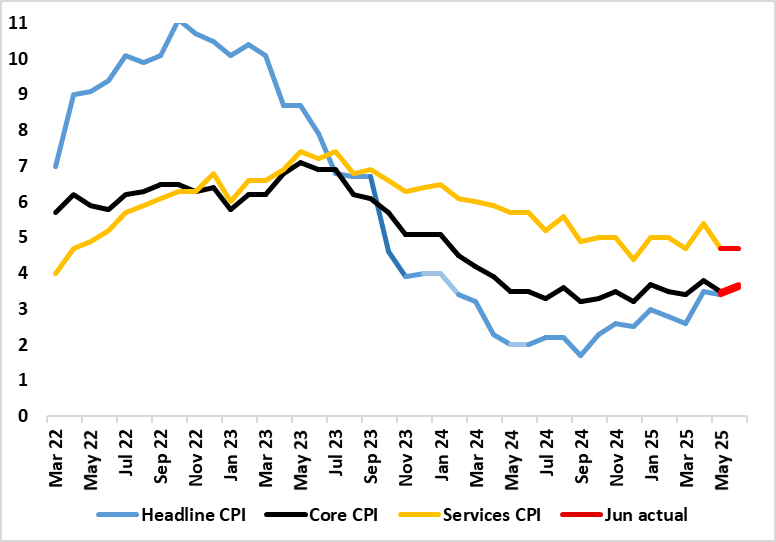

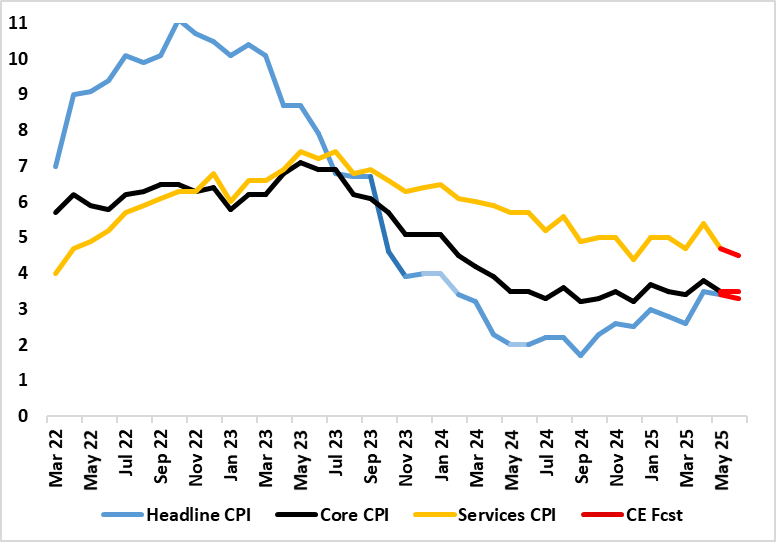

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

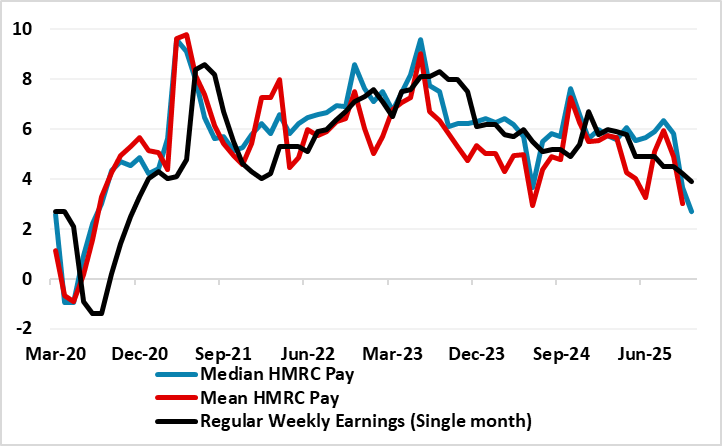

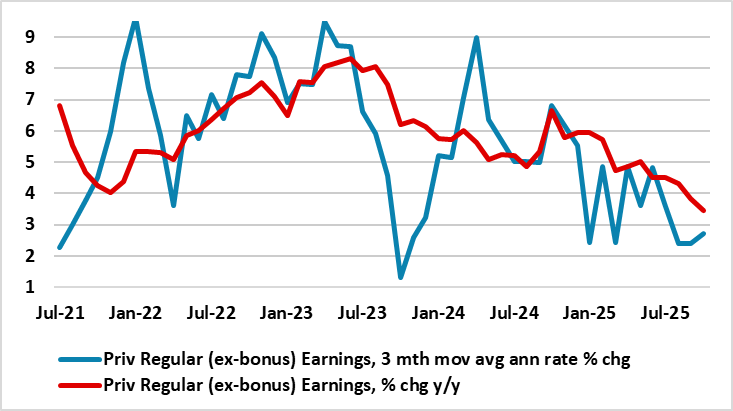

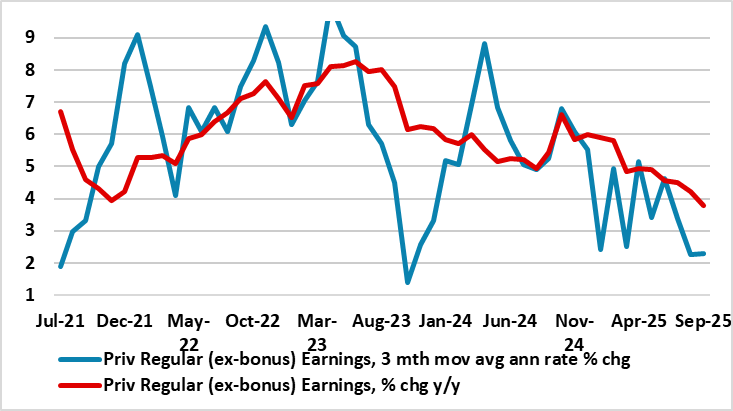

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

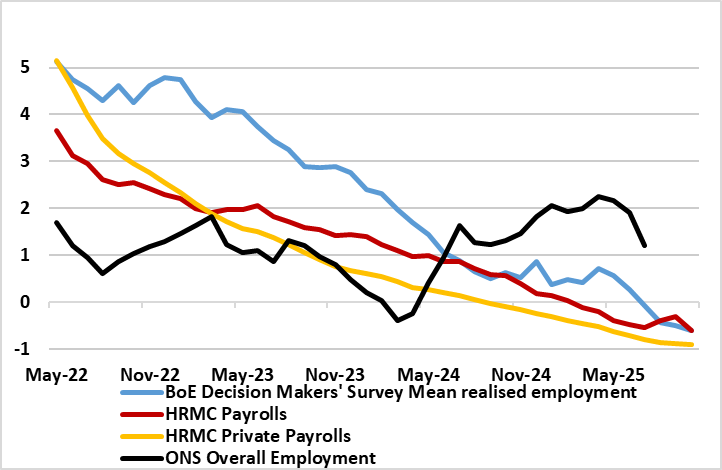

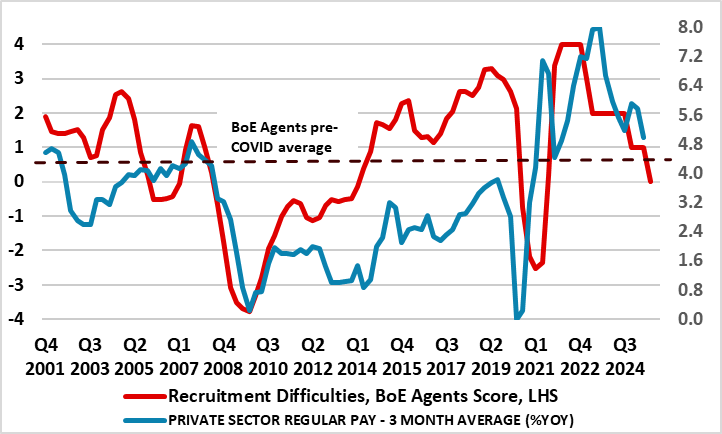

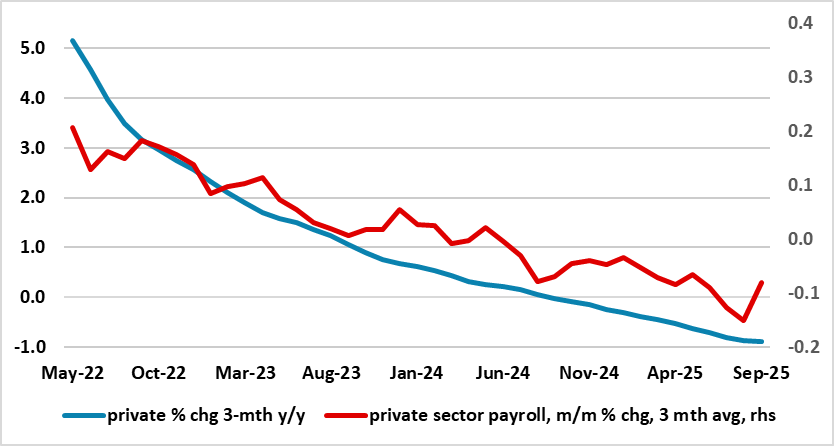

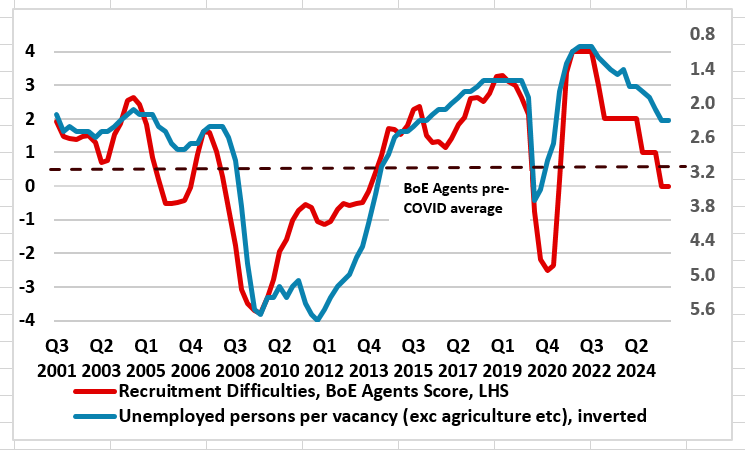

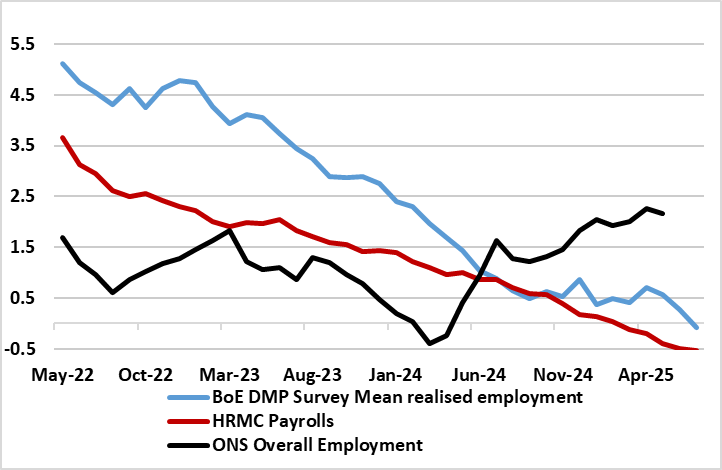

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 12, 2025

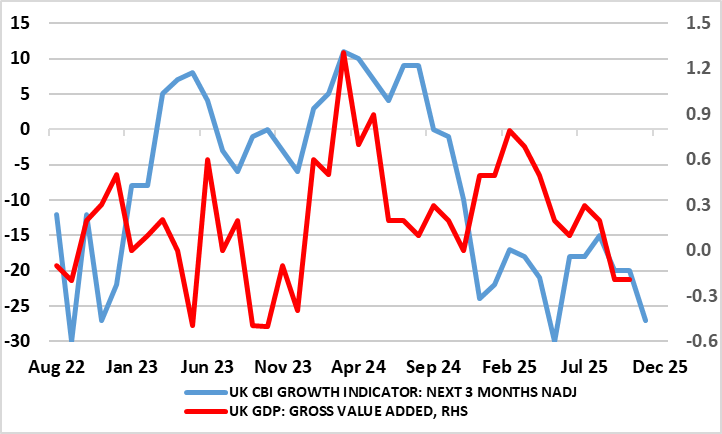

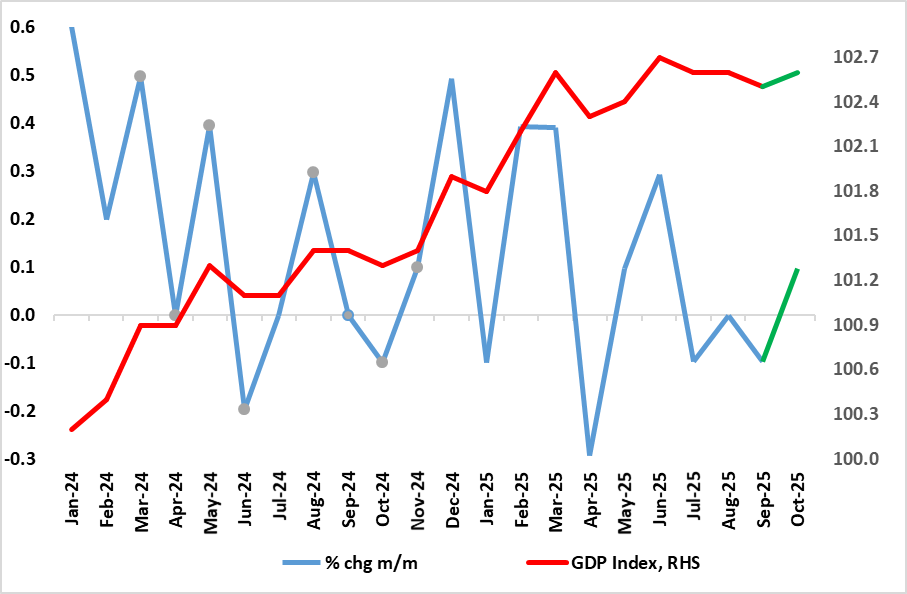

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

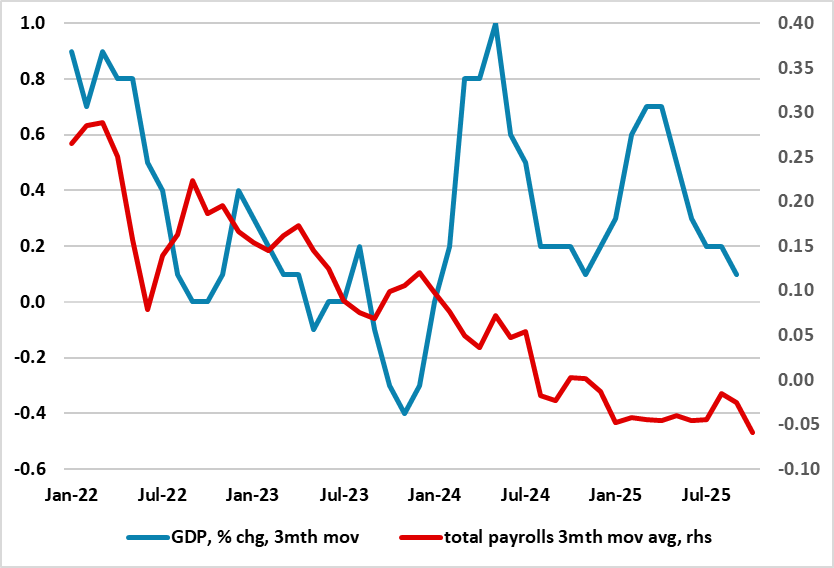

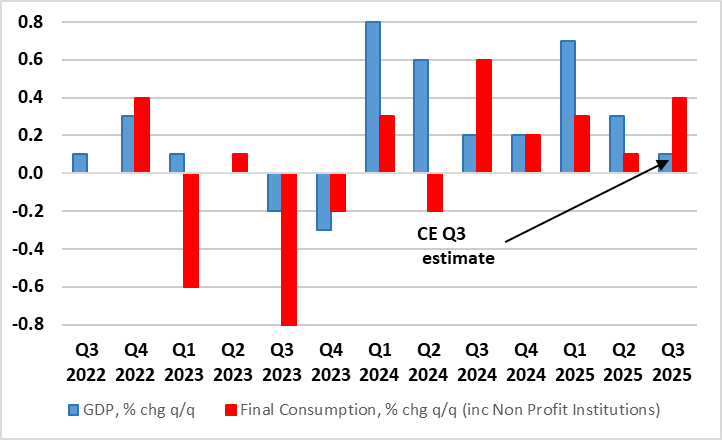

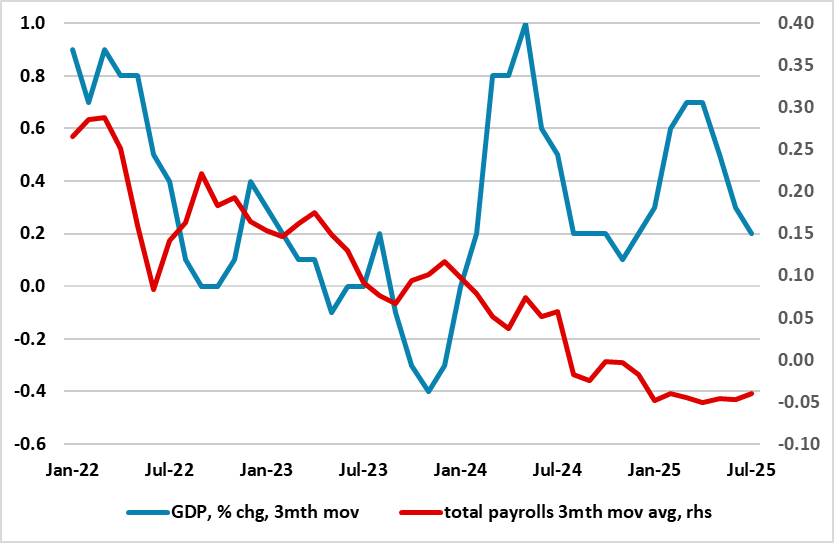

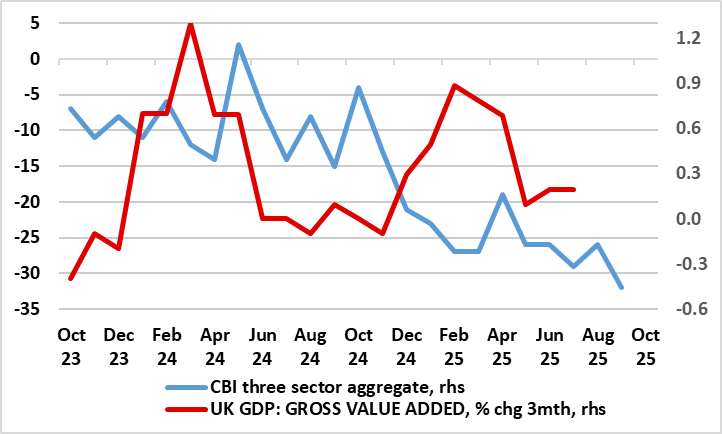

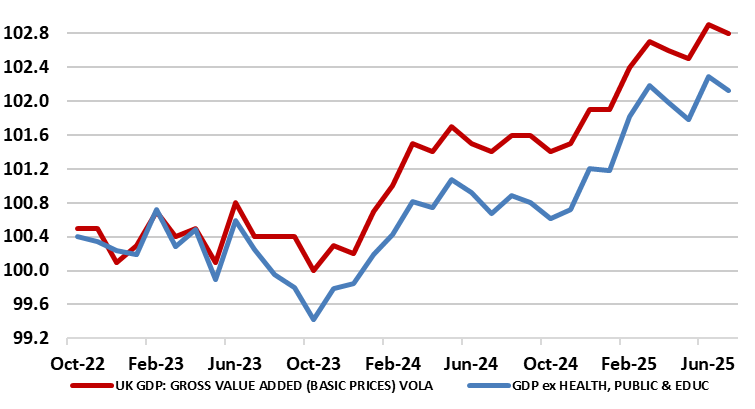

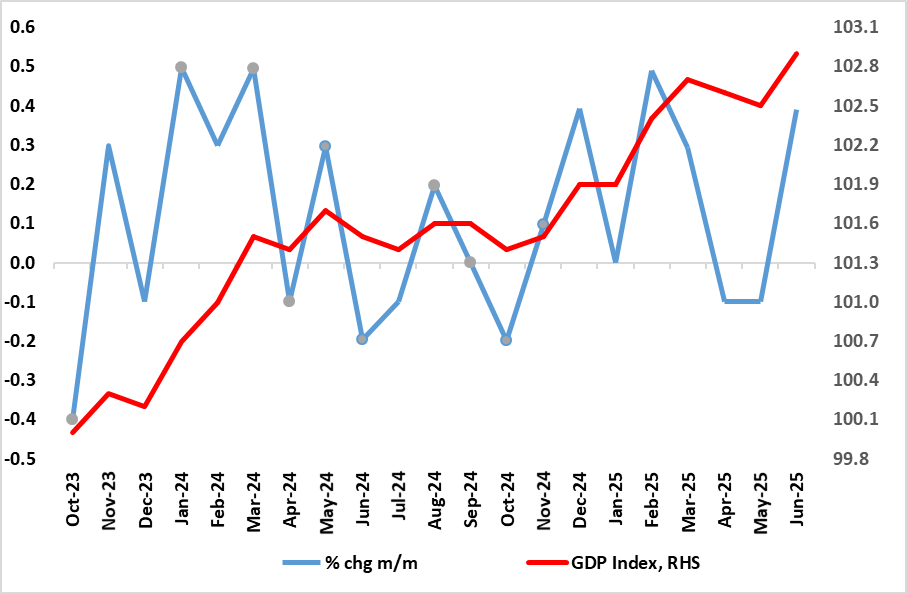

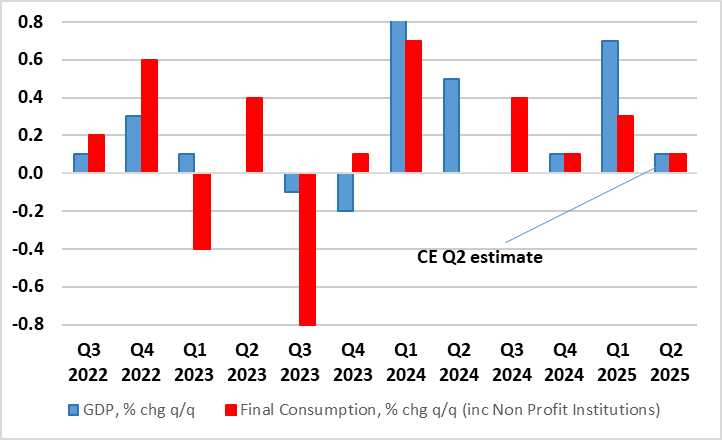

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 09, 2025

BoE Preview (Dec 18): How Big a Split?

December 9, 2025 11:29 AM UTC

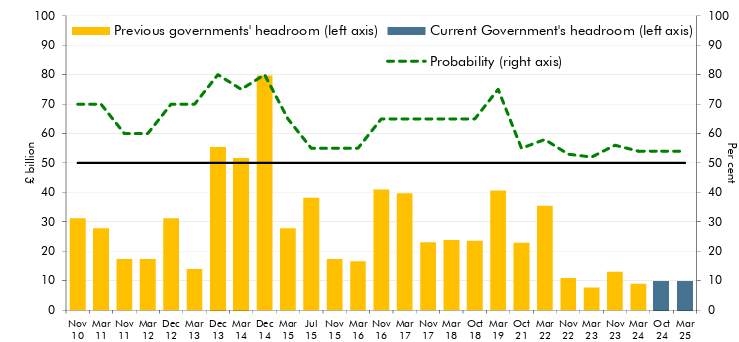

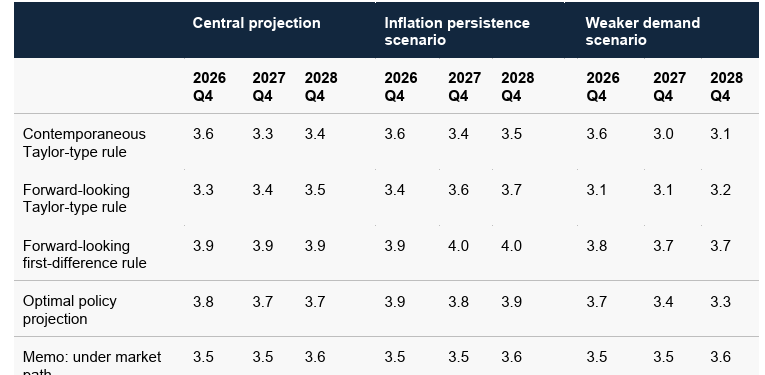

That the BoE will deliver a fifth 25 bp rate cut (to 3.75%) on Dec 18 is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides.

December 08, 2025

UK CPI Preview (Dec 17): Down Further from Likely Peak?

December 8, 2025 9:43 AM UTC

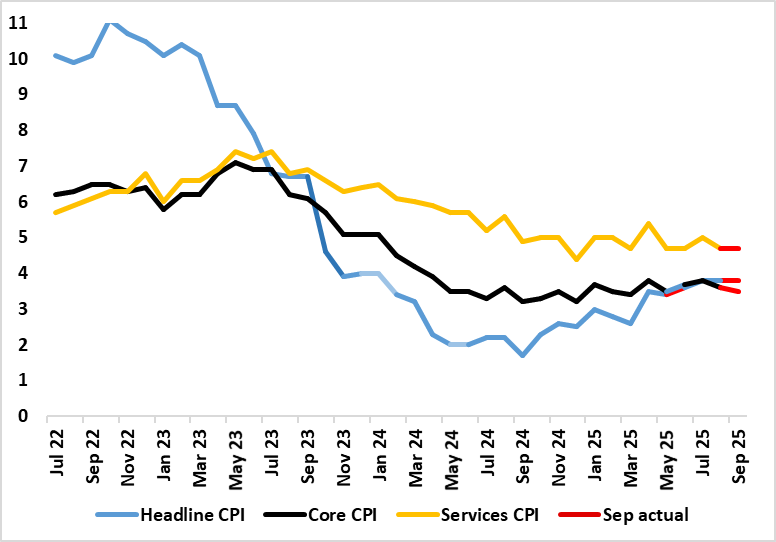

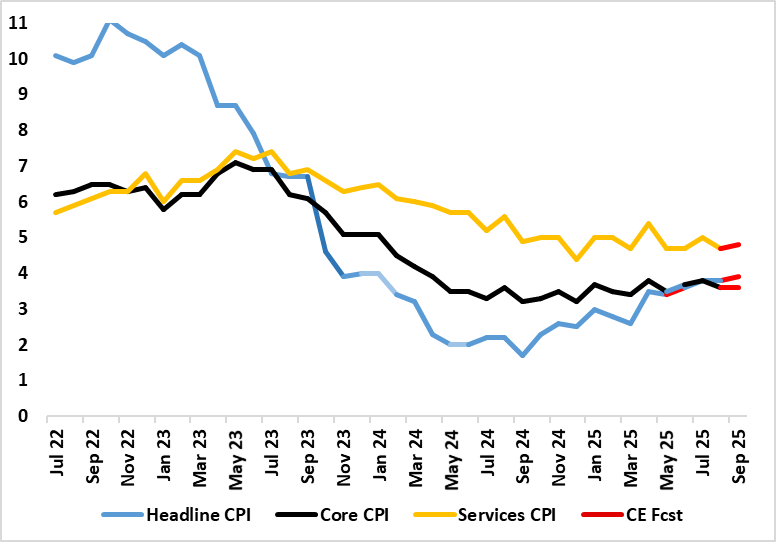

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt b

December 04, 2025

UK GDP Preview (Dec 12): Underlying Economy Fragile and Listless

December 4, 2025 9:55 AM UTC

As we have underlined, GDP has hardly moved since March and this is un likely to change with the October GDP release. Indeed, it has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporari

December 02, 2025

UK: BoE Offers Financial Boost?

December 2, 2025 8:05 AM UTC

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual p

November 26, 2025

UK Budget Review: Deferring the Fiscal Pain?

November 26, 2025 2:01 PM UTC

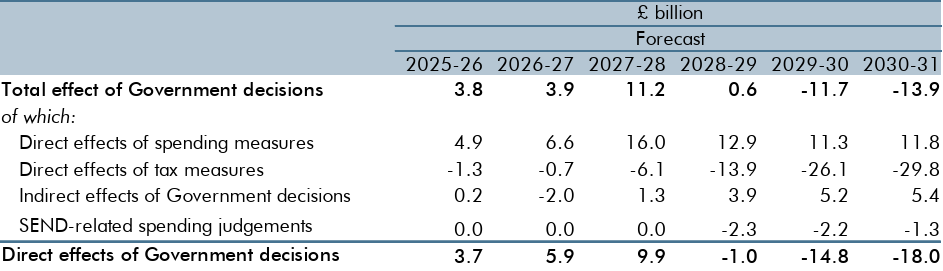

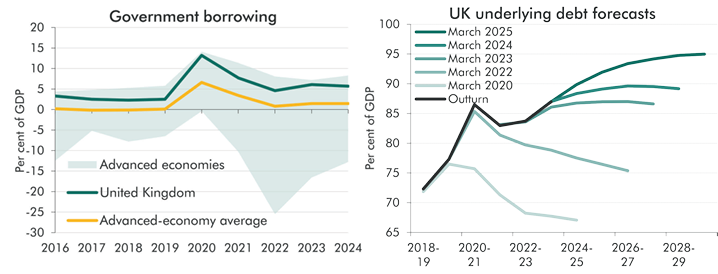

The Budget looks something of a fudge, with no fiscal tightening until 2028 suggesting policy changes very much back-loaded (Figure 1) and puzzlingly timed to take effect in what may be the lead-up to the next general election. The immediate the result is actually a modest boost to GDP growth in t

November 19, 2025

UK CPI Review: Down from Likely Peak?

November 19, 2025 7:50 AM UTC

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base eff

November 18, 2025

UK Budget Outlook (Nov 26): The Fiscal Blame Game – Yet Again!

November 18, 2025 3:09 PM UTC

If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates on Nov 26 is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be

November 13, 2025

UK GDP Review: Underlying Economy Listless - At Best

November 13, 2025 8:10 AM UTC

As we have underlined, GDP has hardly moved since March and, again, the latest update undershot consensus thinking. Indeed, GDP has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as these September numbers were hit (temporar

November 12, 2025

UK Gilts: Fiscal, Politics and BOE

November 12, 2025 9:55 AM UTC

· 2yr Gilt yields have scope to fall through 2026, as we see growth and inflation slowing more than the BOE and this will likely see the MPC changing view and cutting policy rates to 3.25% in H1 2026. Though a pause could then be seen, we see one final BOE cut then being delivered to

November 11, 2025

UK Labor Market: Continued Private Sector Job Losses Weighing Even More Clearly on Wages

November 11, 2025 8:01 AM UTC

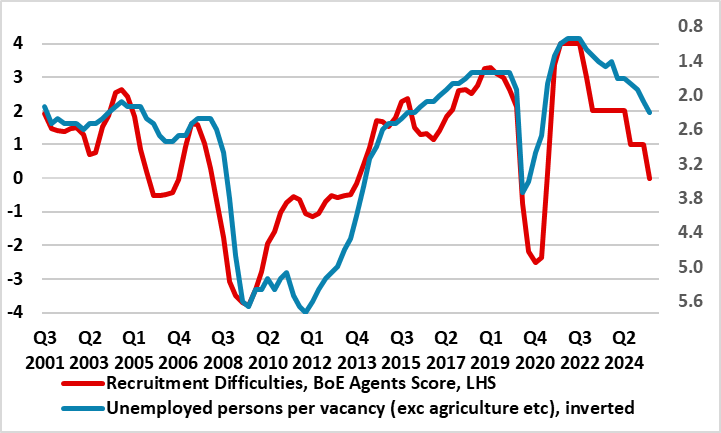

Previous signs that the labor market is haemorrhaging jobs less clearly have evaporated, with fresh and deeper falls in the more authoritative payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1). Regardless, the latest l

November 10, 2025

UK CPI Preview (Nov 19): Falling Back Broadly From Likely Peak?

November 10, 2025 10:49 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July and stayed there for the two following months, with the September outcome having been lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. Indeed, we see

November 06, 2025

BoE Review: Fiscal Elephant in the Room Ignored – For Now!

November 6, 2025 1:47 PM UTC

A tight vote was always likely for the November MPC verdict, but the 5:4 split was closer than expected, but almost a repeat of the August decision when rates were cut to the current 4%. What seems clear is that the effective swing voter was Governor Bailey but who coloured his decision with a cle

November 03, 2025

UK GDP Preview (Nov 13): Cyber Crime Shock but Underlying Economy Listless

November 3, 2025 4:01 PM UTC

Notably, the level of UK GDP has hardly moved since March but we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September G

October 29, 2025

BoE Preview (Nov 6): Easing Door Opening Afresh?

October 29, 2025 4:43 PM UTC

That the BoE kept Bank Rate at 4% after last month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MC majority, was that the MPC adhered to its (conventional) policy guidance, still

October 28, 2025

UK Food Inflation; Not Just a Domestic Issue, Despite Industry Claims

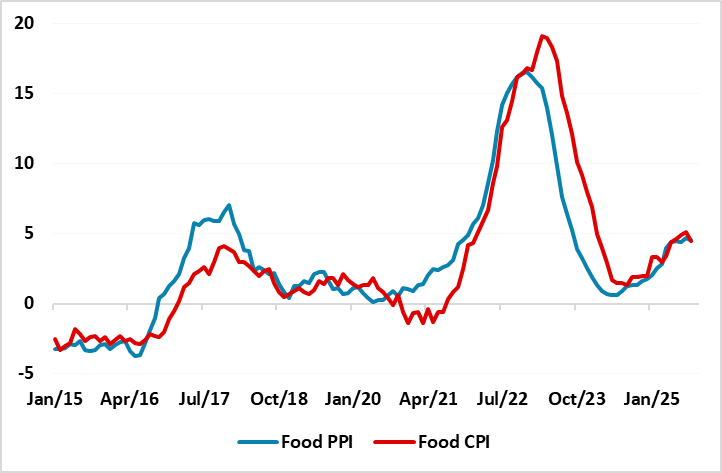

October 28, 2025 8:45 AM UTC

Food price inflation is becoming an increasing issue for both policy makers and households as well as companies that are generating and selling the produce. Particularly in the UK, rising food price inflation is helping shore up well-above target CPI inflation and thereby deterring the BoE from what

October 22, 2025

UK CPI Review: A Final and Lower Than Expected Peak?

October 22, 2025 7:05 AM UTC

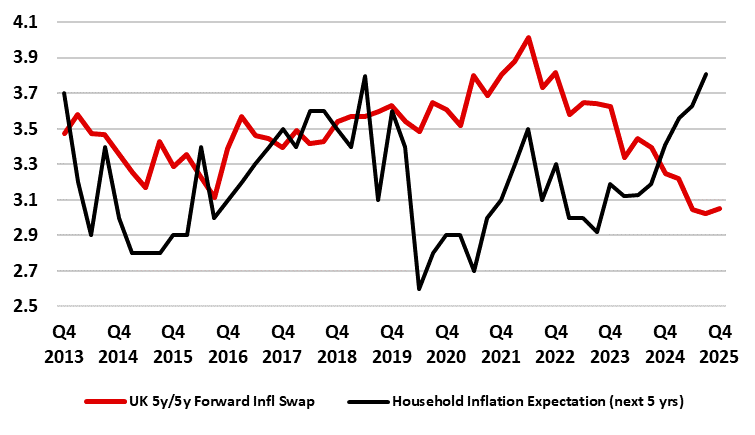

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel costs, the headline stayed there in the August figure, and did so again in September in what was a lo

October 16, 2025

UK GDP Review: Moving Sideways – At Best

October 16, 2025 6:39 AM UTC

Although the revisions up to July GDP data now confirm a small m/m fall for that month), this was unwound in the August numbers with a 0.1% rise (Figure 1). This put the less volatile three-month rate at 0.3% but we think this overstates what is very feeble momentum, which may actually be nearer zer

October 14, 2025

UK CPI Preview (Oct 22): A Final Peak?

October 14, 2025 2:07 PM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel (and food) costs, the headline stayed there in the August figure, this foreshadowing a likely rise th

UK Labor Market: Continued Private Sector Job Losses Weighing More Clearly on Wages

October 14, 2025 9:22 AM UTC

There may be signs that the labor market is haemorrhaging jobs less clearly, if not actually indications that the more authoritative payrolls have stopped falling, albeit this largely due to increasing jobs within the health sector. Indeed, private sector payrolls are still falling, down almost a

October 08, 2025

UK: BoE Financial Arm Warns of (Increasing) Risks But Ignores Tighter Financial Conditions

October 8, 2025 1:58 PM UTC

According to the BoE Financial Policy Committee (FPC) meeting this month, risks associated with geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt markets remain elevated. In fact, the FPC was very clear of the increasing risk of a sharp ma

October 07, 2025

UK GDP Preview (Oct 16): Conflicting Signs To Veer Toward Weakness

October 7, 2025 1:37 PM UTC

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). We see this being repeated in the August numbers with a 0.1% drop (Figure 1). This would leave the less volatile three-month rate a

October 03, 2025

UK: BoE Inflation Expectations Worries Overdone

October 3, 2025 10:22 AM UTC

UK monetary policy is relatively loose, according to BoE MPC member Mann. But if the policy stance is so loose (something we refute), why is the real economy at best labouring, if not stalling. In this regard, the BoE have had conflicting data in terms of whether the labor market is loosening wh

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

September 23, 2025

Western Europe Outlook: Policy Divergences

September 23, 2025 9:54 AM UTC

· In the UK, we have upgraded 2025 growth by 0.2 ppt back to 1.0%, but pared back that for next year by a notch to a sub-par 0.8%. We think this will refresh somewhat stalled disinflation allowing the BoE to ease further into H1 by around 75 bp.

· Sweden has seen a clear e

DM Rates Outlook: Steepening Yield Curve The Old Normal?

September 23, 2025 7:53 AM UTC

• We continue to forecast further yield curve steepening across the U.S./EZ and UK, driven by cumulative easing. For the U.S. this can see a modest further decline in 2yr yields, but the prospect is for a move to a premium of 2yr to Fed Funds (unless a hard landing is seen). 10yr yields

September 18, 2025

BoE Review: Guillotine for Gilts?

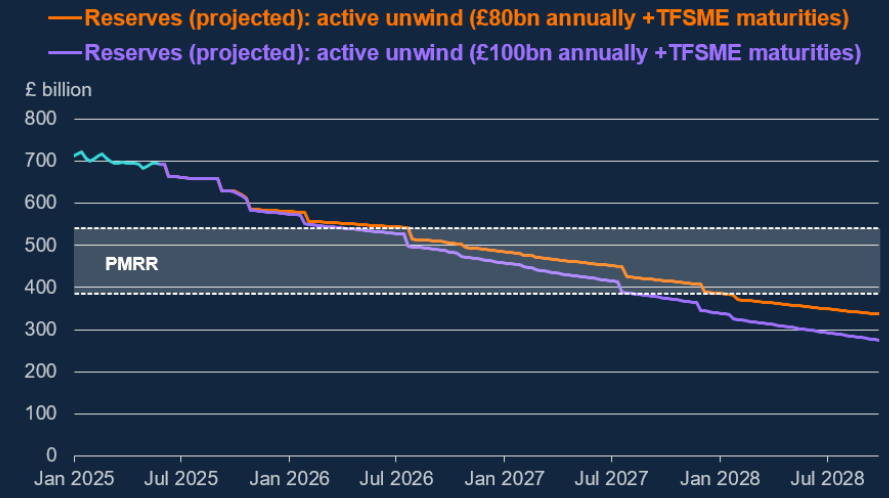

September 18, 2025 11:53 AM UTC

That the BoE kept Bank Rate at 4% after this month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MPC majority, was that the MPC adhered to its (conventional) policy guidance, stil

September 17, 2025

UK CPI Review: A Pause Before a Peak?

September 17, 2025 6:29 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel (and food) costs, the headline stayed there in the August figure, this foreshadowing a likely rise th

September 12, 2025

UK GDP Review: Conflicting Signs

September 12, 2025 6:52 AM UTC

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). The three-month rate slowed a notch to 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer

September 10, 2025

UK CPI Preview (Sep 17): Goods Inflation the Recent Problem, Not Services?

September 10, 2025 9:05 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Partly due to rounding and fuel (and possibly food) costs, we see the headline rising a notch to 3.9% in the August figure, this foresh

September 09, 2025

BoE Preview (Sep 18): Guilty on Gilts?

September 9, 2025 3:54 PM UTC

That the BoE will keep Bank Rate at 4% after this month’s MPC meeting is all but certain. Indeed, the MPC majority has hinted that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s co

August 20, 2025

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

August 20, 2025 6:47 AM UTC

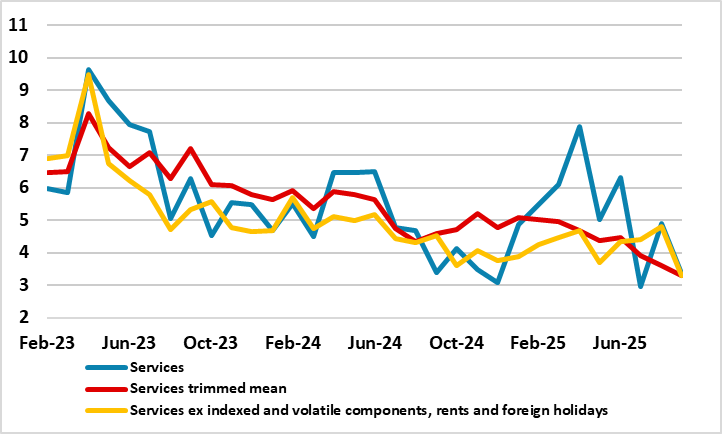

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in lin

August 19, 2025

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

August 14, 2025

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

August 14, 2025 7:02 AM UTC

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1).

August 11, 2025

UK CPI Preview (Aug 20): Services Inflation Fall Afresh r as Headline Stabilises?

August 11, 2025 2:24 PM UTC

After the upside (and broad) June CPI surprise, we see CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation (Figure 1) and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% s

August 07, 2025

BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

August 7, 2025 12:48 PM UTC

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relativel

August 06, 2025

UK GDP Preview (Aug 14): Small GDP Rises Hardly Worth Shouting About?

August 6, 2025 2:48 PM UTC

There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise (Figure 1), even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two suc

July 31, 2025

BoE Preview (Aug 7): Labour Market Softness to Trigger Further Cut, But Fiscal Risks Loom

July 31, 2025 7:14 AM UTC

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision. Likely to discuss its two alternative scenarios still,

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 17, 2025

UK Labor Market – No Lack of Slack

July 17, 2025 6:58 AM UTC

Even the BoE has acknowledged that the UK economy is developing slack in its labor market that we suggest is now not so much less tight but decidedly loose. Indeed, just days after BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evid

July 16, 2025

UK CPI Review: Services Inflation Fails to Fall Further as Headline Surprises on Upside?

July 16, 2025 6:42 AM UTC

Calendar effects have been accentuating swings in UK CPI data of late and these may have reoccurred in the June numbers partly explaining June numbers which surprised on the upside. Indeed, June saw the headline and core rise a further 0.2 ppt – the former to an 18-mth high of 3.6%. Moreover, se

July 14, 2025

UK BoE Hints of Faster Easing Backed up by Survey Data?

July 14, 2025 8:38 AM UTC

Somewhat ironically, just as BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evidence accumulates. In fact, as monthly survey compiled by Markit pointed to not only weaker pay pressures, falling job rolls (Figure 1) and a steep ris

July 11, 2025

UK GDP Review: Another Downside Surprise

July 11, 2025 6:28 AM UTC

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But that 0.3% m/m drop was almost repeated in the May numbers (Figure 1), where a further albeit smaller (ie 0.1%) fall occurred, but very much below consensus. Admittedly

July 09, 2025

UK CPI Preview (Jul 16): Services Inflation to Fall Further?

July 9, 2025 2:05 PM UTC

Calendar effects have been accentuating swings in UK CPI data of late. Indeed, the timing of Easter may have been a partial factor in the May CPI, where a distinct drop back in services and core rates failed to make the headline drop, which instead stayed at 3.4% in line with BoE thinking due to hig

UK: Risk Picture Rising and Broadening

July 9, 2025 12:35 PM UTC

The BoE’s latest message from its Financial Policy Committee notes that UK household and corporate borrowers remain resilient in aggregate while the UK banking system remains in a strong position even if economic, financial and business conditions became substantially worse than expected. But th