UK Budget Outlook (Nov 26): The Fiscal Blame Game – Yet Again!

If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates on Nov 26 is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be less sizeable than markets and even the Chancellor was hinting even a week or two ago – it will be interesting to see what new assumptions are made about the size and impact of immigration legislation! The rationale behind this fiscal reassessment (which seemingly allows the government to avoid breaking its electoral tax promises) will be as important as the form and timing of the budget consolidation measures themselves. What the estimated economic impact will be is also keenly awaited, not least as a harsher fiscal picture for the next 2-3 years should make the BoE less divided over the size and speed of Bank Rate cuts.

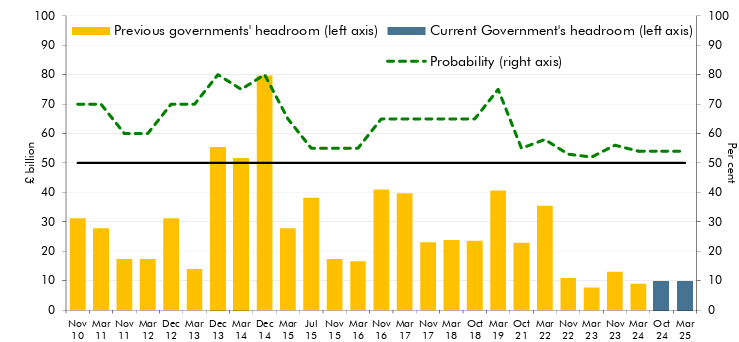

Figure 1: Current Fiscal Headroom Historically Tiny

Source: OBR (March 2025), Probability of hitting the fiscal target & successive headroom forecasts

They say that the art of good politics is successfully blaming others for one’s own problems whatever the cause. A willingness to ‘pass the buck’ has very clearly been a key feature of recent UK government rhetoric. Chancellor Reeves has sought to pin the blame for the UK’s fragile public finances on the previous (Conservative) administration, even though her party went along with the effective tax cuts that were squeezed in at the end if its tenure. But there are actually several factors behind the so-called UK budgetary black hole estimated at well over hole £30bn until recently?

Economic and Fiscal Forecasts

Although hardly a surprise and well flagged by ourselves seven months ago, is the seeming confirmation that the Office for Budget Responsibility (OBR), the independent fiscal watchdog, will lower its outlook for trend productivity growth, by around 0.3 ppt (from the current 5-year outlook of 1.3%). If so, this would be enough on most calculation to push up borrowing at the end of the running five-year outlook by GBR 20bn. Current numbers are not helping either with the OBR signalling a budget overshoot of over GBR 7 bln even given a likely better 2025 real GDP outcome. But the OBR may rein in what we think are very optimistic 2026 and 2027 GDP projections of just under 2% each. There may be offsets, with the OBR possibly revising up its (relatively soft) wage/earnings numbers, and in turn better nominal growth. However, this may lead to offsetting added debt servicing costs due to a higher presumed inflation path than the on-target picture currently envisaged by the OBR.

Policy Choices

Regardless, an important driver of the deterioration of the public finances will be policy choices by Labour, some already made. These include not only the government’s U-turn on welfare reforms, together with its decision to abandon planned cuts to winter fuel payments, and now the likely removal of the two-child benefit cap. There is also a possible cut to household VAT on energy bills or scrapping the environmental levy added to bills. All of these amount to well over GBP 10 bln. And none of these encompass the extent and timing of the planned increase in defense spending from the current 2.3% of GDP to 5% by 2035, although as far as fiscal rules are concerned much can be glossed over as such spending will be largely classed as capital investment.

But there is also the very topical issue of immigration. In the March forecast, the OBR already expected net migration to fall sharply from about 728,000 in the year but to reach 340,000 at the forecast horizon. Since then, the government has announced a further clampdown on immigration, all likely aimed to cut net migration by well over 100,000 a year. However, it has been suggested that any fall in annual net migration of 100,000 could add about GBP 7 bn a year to the deficit by the end of the forecast period. Indeed, according to the ONS's low migration variant scenario, where net inflows to the UK settle at 120,000, the impact on GDP could be material, with growth likely to be 0.2 ppt lower on average than otherwise.

The Fiscal Headroom

It also seems as if there will be larger fiscal headroom with which the Chancellor meets her self-imposed fiscal rules. Currently this is around GBP 10bn, a historically low margin (Figure 1). As this is effectively being actually half that as this pre-supposes a fresh rise in fuel duties, it would seem that any fiscal headroom less than GBP 20 bln may (again) lack credibility. Indeed, even at this latter level, the fiscal headroom would still be no more that 0.5% of GDP.

Fiscal Reforms

It has been suggested that even against a backdrop where hefty budget consolidation measures seem inevitable this would be suitable time to make what may suggest are much need fiscal reforms. The Institute for Fiscal Studies (IFS) have pointed to some pro-growth tax reforms, such as potential changes to road pricing that aim to reduce growth-sapping congestion in towns and on motorways, as well as shifting to a more uniform carbon-pricing regime. Stamp duty (land tax) has also long been criticised by economists as a barrier to labour mobility, although a move to a different model, such as a recurring tax on property value, would carry heavy political costs. The IFS has set out how it would simplify the tax system by treating different categories of income in a similar way, alongside reforms that reduce disincentives to savings and investment.

Chancellor Rachel Reeves has handed a key role to Torsten Bell, the current pensions minister. Until recently, he ran the left-leaning Resolution Foundation think-tank, which has advocated several big tax changes in recent years. This included an aim to ensure people on higher incomes were taxed equally, whether their income came from employment, self-employment, capital gains or rent. One specific proposal was to extend national insurance to rental income, so that landlords would pay the same tax on rental income as tenants pay on their earnings.

There is also clear momentum behind a complete overhaul of the council tax regime, and reducing stamp duty — seen as exacerbating the UK’s problems with housing affordability. There is also speculation that the government could reduce the size of the tax-free lump sum that retirees can withdraw from their pension after the age of 55.

Overall, the size of the fiscal hole now seems smaller than was speculated upon until a week ago. This means that dramatic fiscal moves including increases in income tax rates was on the cards despite this being contrary to pre-election promises are now no longer likely. But a further extension of tax thresholds freezes is likely, this likely to go under the radar screen as far as most households are concerned. But the budget headlines, whether Chancellor Reeves delivers major reforms (unlikely) or an array of modest measures (more likely) is unlikely to foster any bounce in current fragile and weak consumer and business sentiment. This is not least as the fiscal bullet is likely to bite somewhere, the question being the extent to which we think this will encourage as more dovish shift in what is a clearly divided BoE.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.