UK CPI Preview (Dec 17): Down Further from Likely Peak?

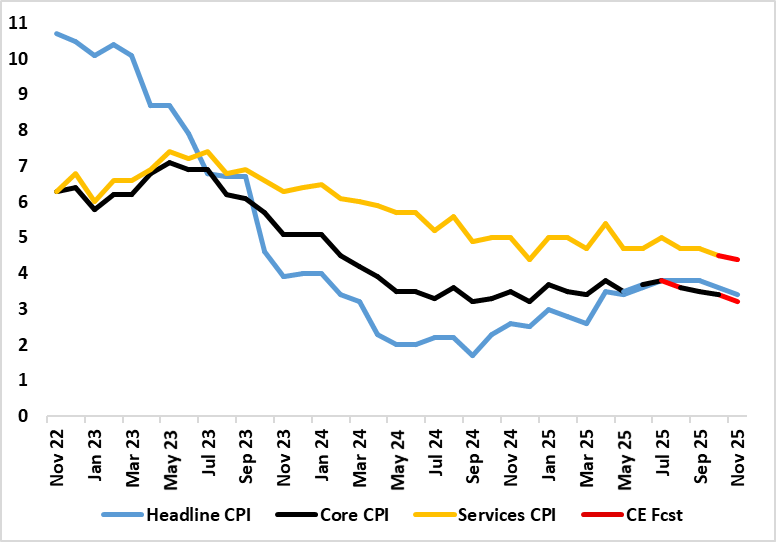

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt but to an 11-month low of 3.2% (Figure 1). Other base effects meant food inflation rose afresh last time around but this may reverse in November. After some further aberrant factors, services inflation (helped by airfares), dropped 0.2 ppt to a 10-mth low of 4.5% in October, but we see only a notch further fall thereby only partly explaining the anticipated fall in the core rate. Notably, in adjusted terms of late (Figure 2), a clear fall to rates consistent with target already seems to be occurring as far as underlying inflation is concerned, this also evident in regard to services.

Figure 1: Headline and Core to Fall Further

Source: ONS, Continuum Economics

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable base effect through 2026. Indeed, the recent budget, though the likes of rail fare freezes, is adding to downward pressure. In fact, the overall impact of the budget may knock 0.5 ppt from headline CPI inflation by Q2 next year, although as this may create unfavourable base effect for the following year it may not impress the MPC, certainly the hawks.

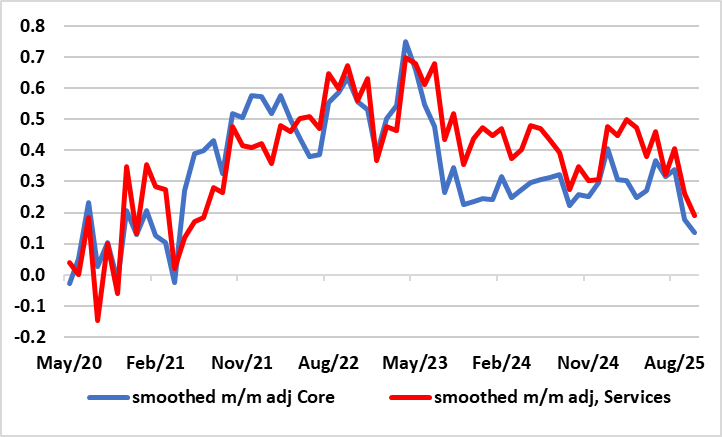

However, amid what clearer signs of a looser labor market and softer wage pressures, existing CPI data already show signs of a clear and broad slowing too, when using adjusted m/m numbers. This is one reason why shorter-term, but such adjusted m/m data, are useful ad becoming more widely used, as they do not encompass price rises that took place months before and are unlikely to be repeated. In this regard, Figure 2 shows a much more reassuring picture for core inflation in this regard, actually showing that smoothed (ie 3-mth mov avg) rates for both services and the core are already consistent with the 2% target. In fact, the BoE also now employ some use of such short-term adjusted data, showing services price pressures having dropped sharply of late.

Figure 2: Short-Term Core Inflation Already Softening to Target?

Source: ONS, Continuum Economics

In this context, headline inflation does not reflect underlying inflationary dynamics but where over half of the 12 CPI components failed to fall further in October. We see a slightly better picture in the November numbers with our 3.4% headline projection matching that if the BoE – NB the BoE will get the CPI data several days before the official release, rather than just one day ahead of its next decision on Dec 18!

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.