UK: BoE Inflation Expectations Worries Overdone

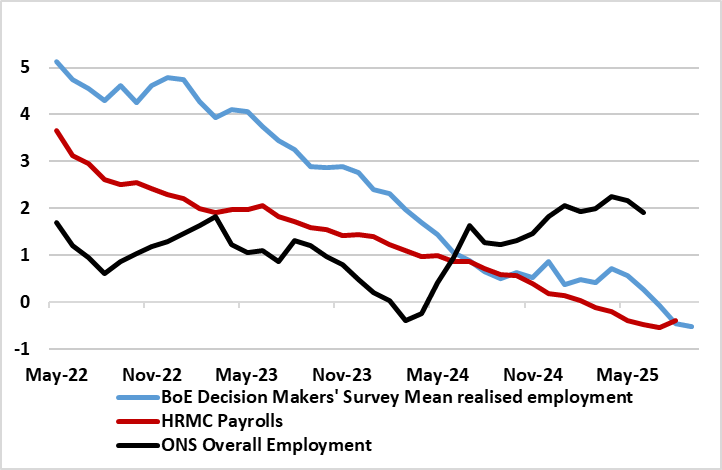

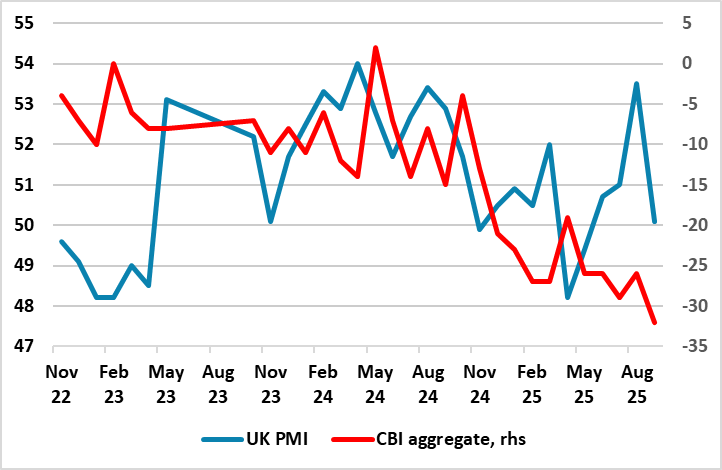

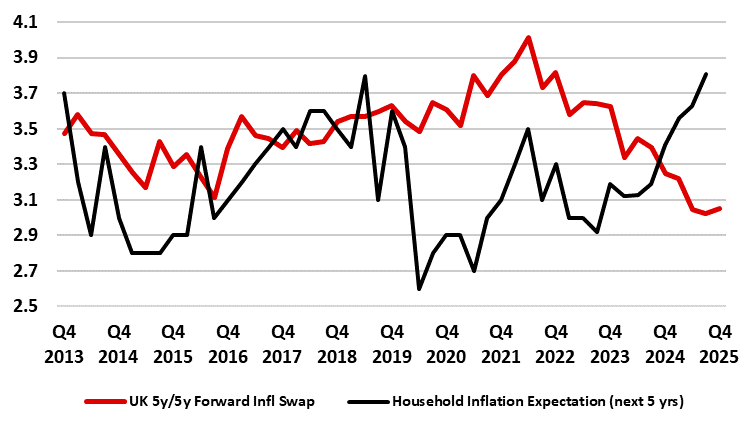

UK monetary policy is relatively loose, according to BoE MPC member Mann. But if the policy stance is so loose (something we refute), why is the real economy at best labouring, if not stalling. In this regard, the BoE have had conflicting data in terms of whether the labor market is loosening while business surveys have shown divergences. But these seem to be converging to suggest both clear weakness in regard to employment (Figure 1) and soft(er) business surveys (figure 2). The question we would pose is whether the current inflation overshoot can be explained by loose policy or whether it reflects a range of factors (fiscal shifts, supply shocks and rate hikes). Moreover, we would argue that current high inflation and costs pressures are in themselves adding to these strains on the real economy and that while some measures of inflation expectation have risen (while others have fallen – Figure 3) the weak labor market is likely to prevent any ensuing added wage pressure.

Figure 1: Range of Data Suggest Falling Employment

Source; HMRC, BoE - % chg y/y

UK inflation has risen well above levels seen in the US and EZ, prompting markets to see little prospect of another BoE rate cut before the end of the year. However, some MPC officials, such as Deputy Governors Ramsden and Breeden, still believe that an easing in underlying price pressures is on track. We think this is more likely to be the case. In particular, we are seeing gathering evidence of a weak labor market that both suggest (far) more slack than the BoE hawks would accept. But also where survey data, including the BoE’s own Decision Makers’ Survey results add to signs from official data that employment is haemorrhaging clearly, this as much a result of companies being reluctant to recruit as much as laying off staff. But if companies are acting in this way, why and how would they grant increased wage demands apparently precipitated by households having rising inflation expectations – NB; the latter are being driven by higher food and energy costs which given their non-discretionary nature can only add to already squeezed spending power.

Figure 2: Business Surveys Converging on the Downside?

Source; Markit, CBI

Overall, inflation is not being driven up by apparently loose policy and where the likes of fast rising consumer credit growth more likely reflects distress spending by hard-pressed households. Regardless, if policy is loose why is the economy so weak or is it simply that to suggest there is a clear and stable relationship between a particular real economy backdrop and inflation and a certain policy rate is an over-simplification of policy-making. Instead we continue to suggest that UK financial conditions remain clearly restrictive and this is why market based measures of inflation expectations are telling a different story to those compiled from household surveys.

Figure 3: Inflation Expectations Diverging (%)

Source; Bloomberg, BoE