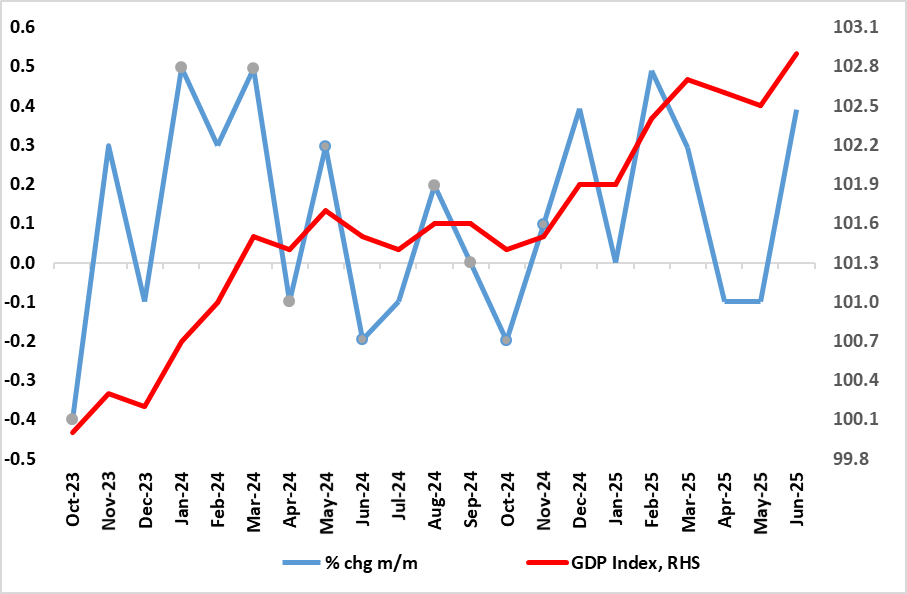

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1). The result was that the economy grew by 0.3% q/q in Q2 also higher than expected. Admittedly, this rise was based almost solely around a fresh rise in government spending and equally a further build in inventories as well as net trade that failed to turn negative after the distorted Q1 jump. This means that GDP growth this year may be around 1.1% (previous estimate sub-1%) but where more ominous signs not least fiscal policy and international trade worries continue to weigh on economic activity suggest a) that the underlying economy has been growing far less appreciably and b) where downside risks still persist for H2 and into next year, this highlighted by fresh news today of an ailing housing market.

Figure 1: GDP Growing Solidly?

Source: ONS, CE

As will many others, we are surprised by the June and Q2 outcomes, even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two successive declines in the previous months, hardly alters what is at best a feeble real activity backdrop that may actually be weaker than the near flat underlying picture seen by the BoE. The GDP data are also volatile.

This frailty is very much is evident in a host of alternative insights into the economy whether they be monthly fiscal patterns, falling employment and weak business survey data. To some extent, this divergence by this data from the GDP may reflect the fact the jobs and survey data cover mostly the private sector whereas the GDP rise was based around government spending. Indeed, it is likely that the current government’s first budget and ensuing fiscal boost is coming though having contributed to over a third of the 1.2% y/y rise seen in Q2. In addition, to what degree the further rise in inventories reflects at least a partly involuntary build is unclear. Also the construction 'strength' in Q2 may be more good weather driven than underlying, especially given the much softer messages for the sector from survey numbers and now today the RICS housing market update. Regardless, while the Q2 outcome is also well above the 0.1% BoE projection, the MPC is likely to focus more on the array of alternative indictors in assessing the real economy, albeit with the hawks possibly concluding that the stronger than expected GDP backdrop helps explain at least some of the CPI rises and persistence of late!