UK Labor Market: Is the BoE too Complacent?

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully embracing just how weak the UK jobs backdrop is currently but the extent to which it has worsened. Indeed, we see employment is contracting, this being very much evident from range of indicators (Figure 1). Moreover, we feel that when considering the labor market, the BoE is too focused on the implications for overall inflation via what may be happening to wages rather than also taking account the damage that falling jobs have on demand via decreased spending power and a hit to confidence. Overall, we feel that the gradual loosening in the labour market that the BoE pointed in its assessment this month understates the degree of slack (Figure 2) that we envisage will continue to rein in wage growth and weigh on spending.

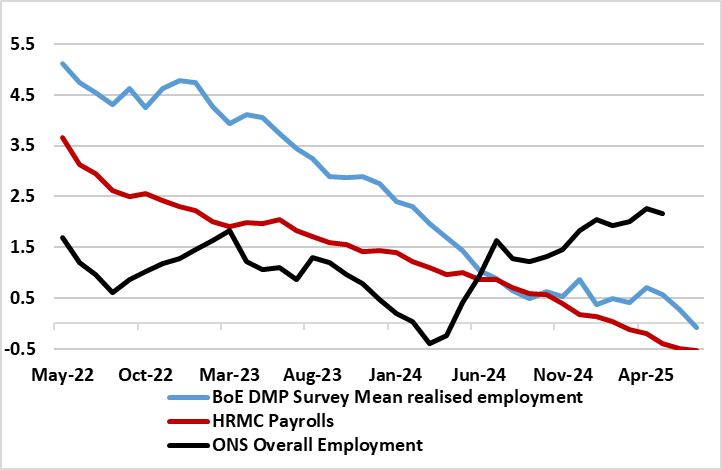

Figure 1: Employment Contracting Not Moving Sideways

Source: BoE, ONS, CE, all % chg y/y

Gauging the dynamics if the UK labor market is made more difficult at present by the problems associated with the official compiled numbers from the ONS. Although there has been some improvement, response rates are too low to make the data anything likely authoritative, especially with the headline official produced employment numbers suggesting jobs growth of over 2% in the year to May. This is not a problem unique to the UK and, as elsewhere, the result has been resorting to an examination of a host of alternative labor market indicators. The question is how to aggregate them to get and broad and more authoritative insight, where there is a certain degree of dispersion among these various measures.

According to the latest Monetary Policy Report, the BoE very much judges that underlying employment growth, has been around zero since the end of last year. This is seemingly based around based signals from a range of measures but where we suggest these measures in aggregation are pointing to a much weaker jobs picture, both in terms of a weaker recent trend and also extent of weakness.

Notably, in contrast to official ONS compiled employment data, HMRC payroll data (even given recent upward revisions) have been particularly weak, falling by 0.5% y/y in the three months to July, with this looking all the more plausible as around half of this fall represents fewer jobs in the retail and hospitality sectors, both of which are quite labour intensive and are therefore exposed to the recent rise in labour costs from National Insurance Charge increases. This is all the more notable as the HMRC data has just received accredited official statistics status by the Office for Statistics Regulation. Regardless, other, as-timely indicators of employment growth, such as the REC permanent staff placements index, are below historical averages as well as highlighting falling recruitment while the composite PMI numbers suggest private sector employment decreased with the rate of job losses the fastest since February, this also evident in the construction PMI survey. Admittedly, the BoE Agents survey points to Employment intentions remaining mildly negative but a far more worrying picture emerges from the BoE’s other survey, namely its survey of Decision Makers Panel (DMP. Indeed, this pointed to a y/y employment drop of 0.6% in July, while the 3-mth average corroborates a picture of increasing job losses as flagged by the HMRC payroll numbers. (Figure 1).

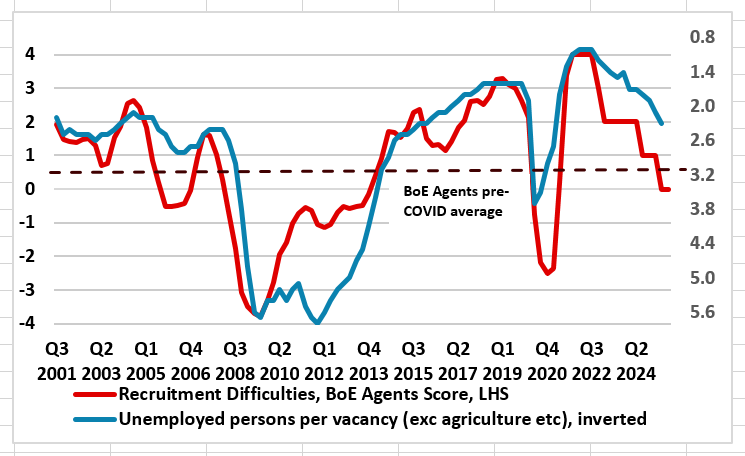

Figure 2: BoE Numbers Suggest Increasing and Above Average Labor Market Slack

Source; ONS, BoE Agents, CE

It does seem as if the BoE is still reluctant to dispense with the message from official labor market data, even when its own survey alternatives are offering different messages. This is very much the case in regard to employment as discussed above but also in terms of assessing labor market slack which to us suggests that the UK labor market that is now not so much less tight but decidedly loose. Indeed, we would assert that the official data is still underplaying the extent of emerging labor market slack in contrast to the BoE’s own survey data (again from the Agents Makers survey) which is consistent with increasing spare capacity, now well above pre-COVID levels (Figure 2). This is both a symptom of recent underling demand weakness and a cause of the latter. But with tariff-related uncertainty and fiscal tightening looming for the UK (likely to reverse what has been a relatively buoyant public sector jobs backdrop), labor market weakness point to more subdues GDP growth ahead.