UK CPI Review: A Final and Lower Than Expected Peak?

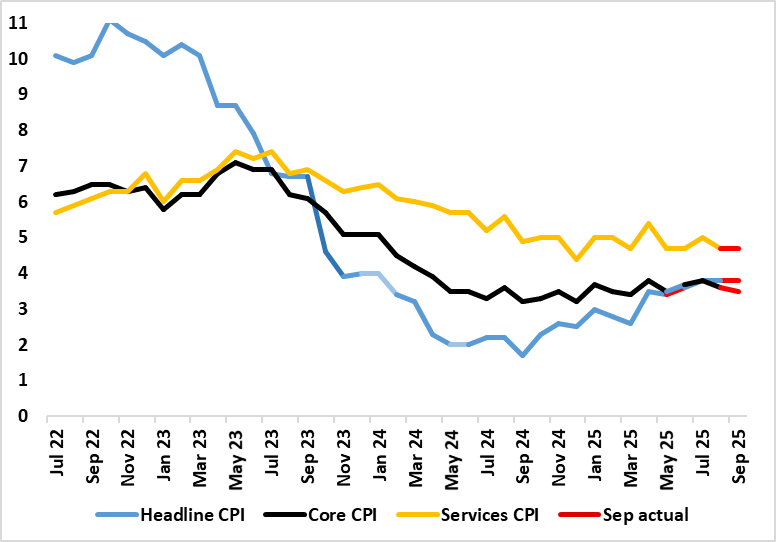

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel costs, the headline stayed there in the August figure, and did so again in September in what was a lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. This September data saw the core rate drop 0.1 ppt to a four-month low of 3.5% (Figure 1), tempered by a belated fall in food inflation. After some further aberrant factors, services inflation in September stayed at 4.7% bolstered again by airfares. Notably, in adjusted terms of late (Figure 2), the recent rise in headline inflation driven more by goods but where pay deals ahead look to be much lower (Figure 3).

Figure 1: Headline and Core Nudge Lower

Source: ONS, Continuum Economics

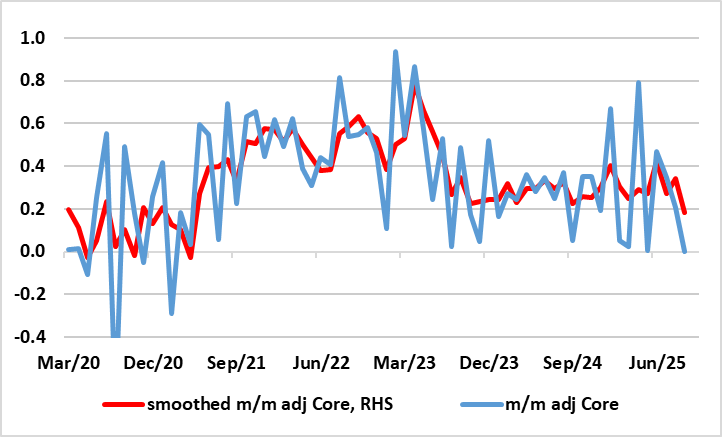

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable bae effect through 2026. This is one reason why shorter-term but adjusted m/m data are useful as they to not encompass price rises that took place months before and are unlikely to be repeated – Figure 2 shows a more reassuring picture for core inflation in this regard.

Figure 2: Short-Term Core Inflation Softening?

Source: ONS, Continuum Economics

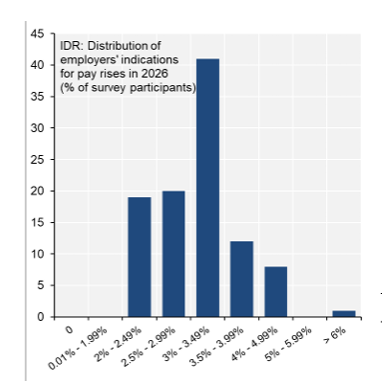

In this context, headline inflation does not reflect underlying inflationary dynamics and where over half of the 12 CPI components fell in September. Moreover, the labour market is loosening, and both more broadly and faster than the BoE may be accepting at least the hawks. Indeed, Chief Economist Pill used a speech last week to acknowledge mixed messages, albeit choosing to highlight the one business survey data suggesting employment resilience without highlighting that the all other survey numbers suggest the very opposite, not least BoE survey data it compiles and computes itself. Against this latter backdrop it is not surprising that forward looking surveys suggest softer pressures from wages, with pay settlements likely to falling towards levels compatible with the 2% CPI inflation target (Figure 3) according to BoE survey data. On this basis, we suggest that the underlying disinflationary process towards target is not only intact but being overlooked, justifying more than a continued “gradual and careful” withdrawal of monetary policy restriction and where forthcoming Budget measures may act to dampen CPI inflation mainly via a possible reduction in VAT on household bills. (that could knock almost 0.2 ppt of the headline rate. We still see 75 bp of rate cuts ahead, including an increasingly likely move in December but where a November move may be unlikely as the MPC awaits fiscal news due later in the month.

Figure 3: Firms Anticipate Much Softer Pay Awards Ahead

Source: BoE

The headline inflation numbers for the last three months are still the highest since January last year but below BoE thinking. The notable but stable services inflation was also largely in line with BoE thinking, but reflected several special factors (airfares). The latest numbers saw a further rise in restaurants inflation possibly a result of tax-induced labor costs feeding through, but if even so, the inflation rise in the last 2-3 months is far from broad as it reflected upward contributions from less than six (of 12) divisions, partially offset by downward contributions from six divisions, but where some BoE hawks will nevertheless deduce signs of inflation persistence. But lower food inflation will reassure even the hawks, as they see it being very much a driver of inflation expectations.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.