UK Budget Review: Deferring the Fiscal Pain?

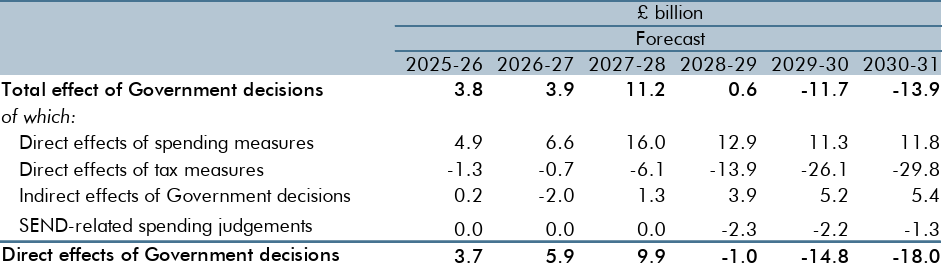

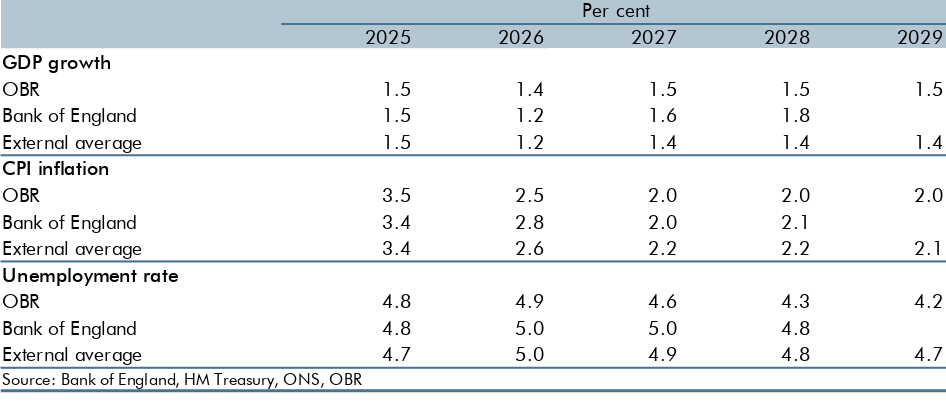

The Budget looks something of a fudge, with no fiscal tightening until 2028 suggesting policy changes very much back-loaded (Figure 1) and puzzlingly timed to take effect in what may be the lead-up to the next general election. The immediate the result is actually a modest boost to GDP growth in the near-term. This provides no added pressure on the BoE to ease over and beyond the alleged damage to sentiment that the protracted and still uncertain fiscal picture allied to an already seemingly weaker demand outlook. Markets may take some solace from the fact that, despite the lack of front-loading, the eventual fiscal tightening still creates added fiscal headroom of over twice that previously in place. But, while welcome, this is still historically small and partly dependent on assumed additional tax rises. Moreover, with what still seem optimistic OBR economic forecasts (Figure 2), the government debt ratio may continue to rise, as the OBR estimates it still does on the more familiar measure excluding the impact of the BoE.

Figure 1: New Fiscal Measures see Tightening only from 2028!

Source: OBR Nov 2025

Notably, across the five years of the Office for Budget Responsibility’s (OBR) forecast, sees only a relatively small net reduction in government borrowing of 0.04 %of GDP (GBP 2.0 billion) on average per year. This represents the second consecutive fiscal event involving a small overall policy tightening following four successive events of policy loosening prior to that – but this being much smaller than a year ago. However, of some note to the likes of the BoE, the OBR confirms that 'Policy measures in this Budget increase borrowing in the near term, mainly through increases to spending, and then reduce borrowing in the medium term primarily through increases to taxation (Figure 1). This means that, relative to March, the fiscal consolidation starts from a higher borrowing level and is more back loaded, with measures pushing a greater share of the consolidation later in the forecast, to 2028-29 and 2029-30’. In fact, the measures are seen temporarily to raise aggregate demand and the OBR's central estimate of the real GDP level by 0.1 ppt in 2026-27. Admittedly, the OBR economic forecasts look optimistic both in terns if size and form(Figure 2), especially to us, but the high-profile revision to productivity had less fiscal impact than was one thought – hence why the Chancellor seemingly changed her mind about raising incomes taxes.

Indeed, that assumed productivity downgrade of 0.3 ppt per year (to 1%) was as expected but caused less damage to the fiscal picture than was originally assumed/feared. Indeed, the overall impact is that growth in the nominal economy has not been downgraded by as much as productivity, and the composition of nominal GDP growth is more tax rich than in March – this including an upgrade to average earnings worth some 1.5- 2.0 ppt over the next two years.

Figure 2: OBR Still Too Optimistic

Regardless, the eventual fiscal tightening increases the margin against the Government’s fiscal mandate to balance the current budget. Indeed, it has more than doubled and, at GBP 22 bln, is now around three-quarters of the average margin that previous Chancellors have left against their fiscal mandate since 2010. However, it is only around two-fifths of the median four-year-ahead difference between forecast and outturn, which is over GBP 50 billion and is actually smaller given that it assumes a rise in fuel duty sometime ahead that will contribute some GBP 4 bln to the fiscal headroom or 0.1% of GDP.

As far as debt is assumed, with the Government running a primary deficit of GBP 46 billion in 2025-26, the primary balance is currently some GBP 100 billion away from a debt-stabilising level. The primary balance is projected to moves into a surplus towards the end of the forecast, and increases to nearly match the debt stabilising primary balance in 2030-31. This allows the formal fiscal mandate, for the current budget to be in surplus, to be met by a margin of 0.3% of GDP (£9.9 billion) in 2029-30. The probability of the target being met is assessed as 54 per cent. The supplementary target, for public sector net financial liabilities to be falling as a percentage of GDP, is met by a margin of 0.4 per cent of GDP (GBP 15.1 billion) in 2029-30. The probability of the target being met is assessed as 51 per cent based on historic forecast errors. However, this ignores the fact that the more familiar measure of debt (ie Public sector net debt excluding Bank of England) continues to rise throughout he forecast horizon. Indeed, PSND ex BoE is seen rising in every year of the forecast from 89.9 per cent of GDP in 2024-25 to 95.0 per cent of GDP in 2029-30. Compared to the restated October forecast, net debt excluding the Bank of England is lower this year and higher in every year thereafter, and by 0.9 % of GDP in 2029-30.

Otherwise, the Chancellor has announced plans to change the legislative framework to reduce the requirement on the OBR to assess the fiscal rules to once per year rather than twice a year (as at present), while still requiring the OBR to produce two economic and fiscal forecasts per year. This, according to the likes of the IMF, should reduce what has been rampant and volatile fiscal speculation about policy ahead. We think it may very well do the opposite as markets will have less credible baseline numbers to rely on. Regardless, the OBR will continue to produce and publish two full five-year economic and fiscal forecasts per year, containing estimates for all the main economic and fiscal aggregates including those that feature in the Government’s fiscal rules.