UK: BoE Offers Financial Boost?

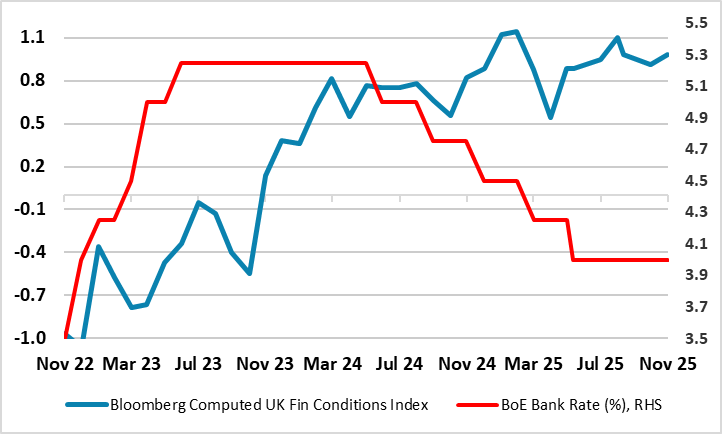

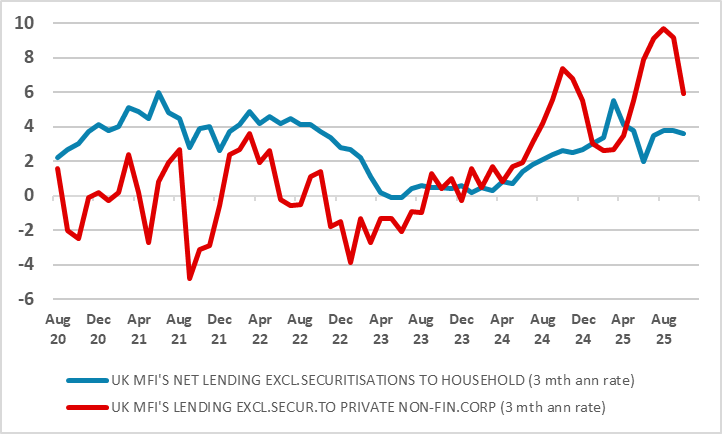

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual private sector credit growth and may even be a reaction to evidence that despite reduction is Bank Rate, financial condition have not loosened – the opposite (Figure 1) while credit growth has slowed (Figure 2). This decision is very much separate to the BoE’s monetary policy decisions, but will be a factor when the MPC updates its projections in February but has little bearing on its likely rate cut decision expected later this month.

Figure 1: Financial Conditions Impervious to Lower Bank Rate?

Source; BoE, Bloomberg

Some perspective first. Banks account for around 85% of lending to UK households and just under half of lending to UK corporates. They also play an increasingly significant role in supporting market-based finance, including through the provision of lending and other services to various types of non-bank financial institutions

The FPC has revisited its assessment of the appropriate capital requirements for the banking system from the perspective of the costs and benefits to growth. This assessment weighs the macroeconomic costs of capital, which stem from the impact of higher capital pushing up on borrowing costs, against the benefits of capital, which come about because higher bank capital reduces the likelihood and costs of financial crises. The Committee has taken into account the experience of the 10 years since it first assessed the appropriate overall level of capital. The Committee judges that the appropriate benchmark for the system-wide level of Tier 1 capital requirements is now 1 percentage point lower at around 13% of RWAs – equivalent to a Common Equity Tier 1 (CET1) ratio of around 11%.

Figure 2: Private Sector Credit Growth Slowing

Source: BoE

Given the reduction in the FPC’s benchmark, the FPC is very much of the view that banks should have greater certainty and confidence in using their capital resources to lend to UK households and businesses. It does seem a reaction to any swing in financial conditions; it is of the view that credit conditions have been consistent with the macroeconomic outlook, with no evidence that banks are constraining credit supply to defend capital positions. But recent data have shown some slowing in credit growth with household lending just about zero in real terms (Figure 2). Notably, financial condition do seem to be moving in opposite direction to conventional policy (Figure 1). Regardless, this is an easing capital requirements for banks for the first time in a decade, also being the latest attempt to loosen regulations designed to protect the UK economy in the wake of the 2008 financial crisis.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.