UK CPI Review: Down from Likely Peak?

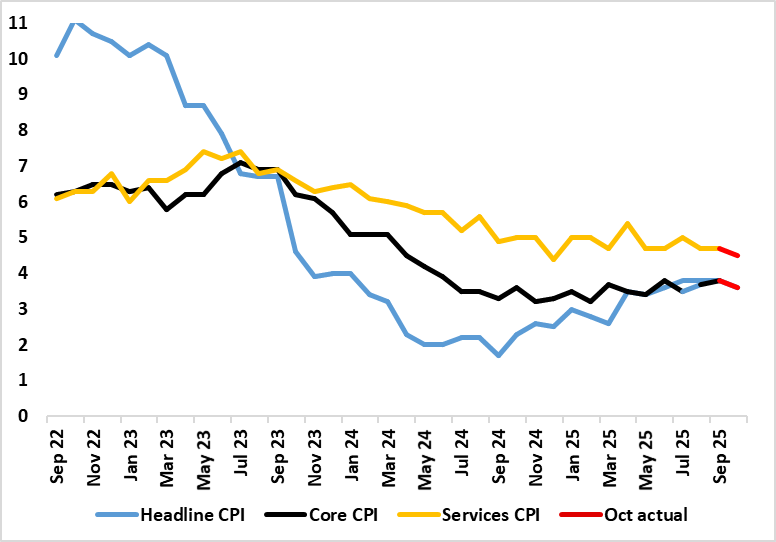

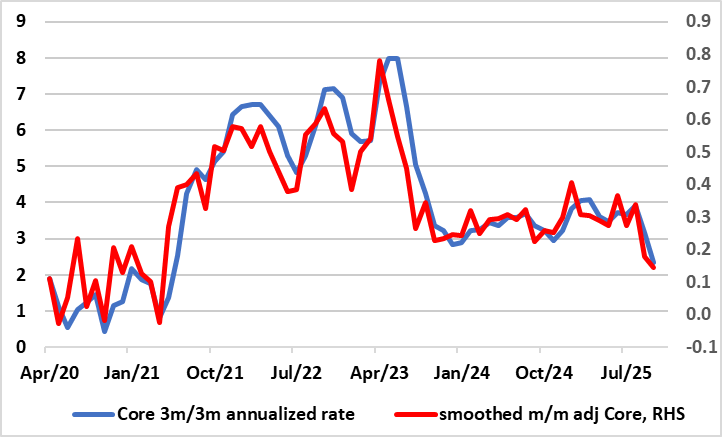

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base effects, with the core rate seen dropping 0.1 ppt to a six-month low of 3.4% (Figure 1). Other base effects meant food inflation rose afresh after a clear and belated fall in September. After some further aberrant factors, services inflation (helped by airfares), dropped 0.2 ppt to a 10-mth low of 4.5% in October, partly explaining the anticipated fall in the core rate. Notably, in adjusted terms of late (Figure 2), a clear fall may be occurring as far as underlying inflation is concerned, this also evident in regard to services.

Figure 1: Headline and Core Fall Further

Source: ONS, Continuum Economics

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable base effect through 2026, with maybe moves in the opposite direction given suggestions of lower VAT on energy in the looming budget. This is one reason why shorter-term, but adjusted m/m data, are useful as they to not encompass price rises that took place months before and are unlikely to be repeated – Figure 2 shows a more reassuring picture for core inflation in this regard. In fact, the BoE also now employ some use of such short-term adjusted data, showing services price pressures having dropped sharply of late.

Figure 2: Short-Term Core Inflation Softening?

Source: ONS, Continuum Economics

In this context, headline inflation does not reflect underlying inflationary dynamics but where over half of the 12 CPI components failed to fall further in October. This may harden the views of MPC hawks worried by alleged price resilience, albeit where slightly faster food inflation is both more a result of base effects and less likely to feed into wage demands. However, while the CPI data therefore has a mixed interpretation even with lower core numbers other data will be more important in re-shaping BoE thinking.

Notably, the labour market is loosening, and both more broadly and faster than the BoE may be accepting at least the hawks. Against this latter backdrop it is not surprising that forward looking surveys suggest softer pressures from wages, with pay settlements likely to falling towards levels compatible with the 2% CPI inflation target according to both BoE survey data and its updated forecast for private sector regular pay (seen down to almost 3% by mid-2026, something we think is too pessimistic).

On this basis, we suggest that the underlying disinflationary process towards target is not only intact but being overlooked, justifying more than a continued “gradual and careful” withdrawal of monetary policy restriction as did four members of the MPC this month. We see 100 bp of rate cuts ahead, including an increasingly likely move in December, this outlook into 2026 helped by a fall in the headline rate to possibly just under 3% in Q1 next year.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.