UK CPI Preview (Aug 20): Services Inflation Fall Afresh r as Headline Stabilises?

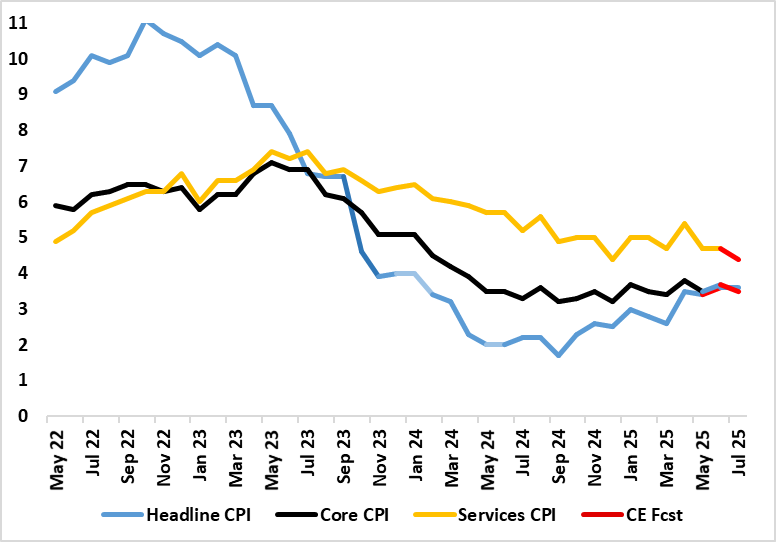

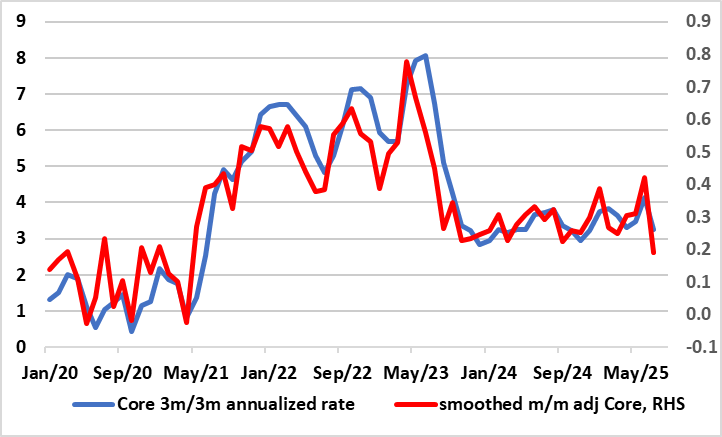

After the upside (and broad) June CPI surprise, we see CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation (Figure 1) and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% seen last time around. In fact, to what extent base effects may be helping shore up the headline CPI is unclear. But we see softer price pressures across the underlying board when it comes to short-term adjusted data (Figure 2), albeit these numbers possibly being affected by what may be somewhat altered calendar price swings.

Figure 1: July Inflation to See Softer Core and Services?

Source: ONS, Continuum Economics

Food price inflation which picked up to a 16-mth high of 4.5% may be a growing concern for the BoE both for its impact of spending power and on inflation. The question is whether this may be a poor UK harvest or shops passing on recent NIC hikes.

But real economy and labor market weakness, allied to fiscal concerns may soon be even bigger worries for the BoE. Admittedly, the slight increase in the headline rate into June 2025 reflected upward contributions from seven (of the 12) divisions, partially offset by downward contributions from three divisions. The largest upward contribution came from transport, particularly motor fuels. There were also upward effects from air fares, rail fares, and maintenance and repair of personal transport equipment.

Clothing and footwear prices rose by 0.5% y/y, compared with a fall of 0.3% in the 12 months to May. The 12-month rate has fluctuated between positive and negative during 2025 and has turned positive again following two consecutive negative readings – but we still think this weakness is consistent with a hesitant consumer and questions whether higher taxes are indeed, being passed on by shops. This is underscored by the further fall in restaurant/hotels inflation, this often seen as a harbinger of underlying inflation and very much driven by wages, in turn suggesting n a slowing in the latter.

Overall, the data does underscores some price resilience as far as UK inflation is concerned. But we still see the headline rate coming down to around 3% but probably not until year end and maybe with some further (temporary) pick-up in the interim.

Figure 2: Clear Adjusted Core Inflation Drop Continues?

Source: ONS, Continuum Economics

But for the BoE, we think it is a little pessimistic in suggesting CPI inflation to increase slightly further to peak at 4.0% in September, even though it is then expected to fall back thereafter towards the 2% target. But the MPC worry (and an overstated one from our perspective give our labor market assessment), is the risk that this temporary increase in inflation could put additional upward pressure on the wage and price-setting process. This is why that in cutting rates again this month, the MPC still judged that the upside risks around medium-term inflationary pressures have moved slightly higher since May.

This is despite a margin of slack is judged to have emerged in the economy, something we think is occurring faster and more sizeable than the BoE is willing to admit – at least at this juncture. Moreover, downside domestic and geopolitical risks around economic activity remain, although trade policy uncertainty has diminished somewhat.