BoE Review: Fiscal Elephant in the Room Ignored – For Now!

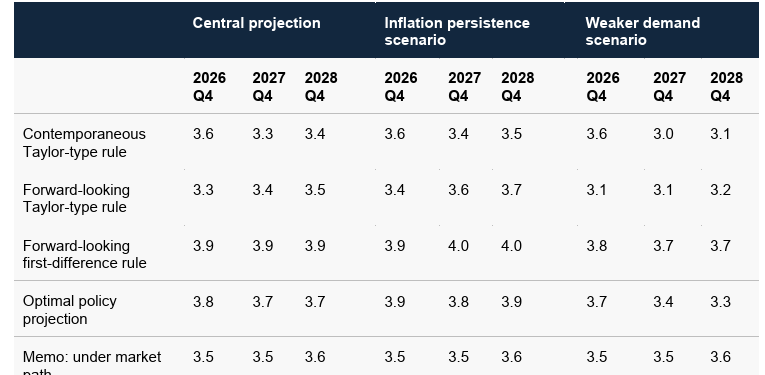

A tight vote was always likely for the November MPC verdict, but the 5:4 split was closer than expected, but almost a repeat of the August decision when rates were cut to the current 4%. What seems clear is that the effective swing voter was Governor Bailey but who coloured his decision with a clear pointer that he is likely to opt for a cut next month when more data will be available – an outlook we have had for some time. But this latest vote suggests that the two camps within the MPC may remain entrenched in their thinking for the time being, effectively meaning that Governor Bailey will remain the key, swing voter. In this regard, he seems willing to vote for up to three 25 bp cuts given his stressing that he sides with a policy outlook that sees Bank rate falling gradually further to around 3.3% by end-2026 (Figure 1). We largely adhere to this view but see the cuts coming sooner especially given the likely looming fiscal tightening which has yet to be factored into formal BoE thinking which still sees a virtual return of inflation to target.

Figure 1: BoE Presents Illustrative Paths for Bank Rate in the Central Projection and Alternative Scenarios

Source: BoE

Scenarios Now the Focus

Once again, the BoE presented three scenarios, with an inflation persistent view shaping the thinking of the MPC hawks while a downside risk alternative is what the dovish camp sided more with. In fact, they think that inflation risks have become more balanced as price persistence risks have diminished partly due to weaker demand both having occurred and expected. Notably, Governor Bailey seems to side with this scenario, he suggesting explicitly that the downside scenario seems more likely, this in his view possibly explaining elevated household savings and the Bank’s own survey intelligence on (elevated) uncertainty. But rather than cutting Bank Rate now, the Governor was explicit in suggesting he prefers to wait and see if the durability in disinflation is confirmed in upcoming economic developments this year but surely this also embodies a reaction to the likely sizeable fiscal tightening that the Nov 26 Budget is going to bring.

Would Fiscal Tightening Tone Down Even the Hawks?

Indeed, the question is whether this fiscal outlook could even temper what seems to be otherwise entrenched worries about inflation persistent worrying the hawks; after all, the central scenario still sees inflation falling to around 2% on current policies. Regardless, for the Governor, and surely the four-strong dovish contingent, he goes along with current market pricing which he suggests is close to the path suggested by a forward-looking Taylor rule, this being among a series of rules the BoE is now formally embracing and which suggest that if the demand weakness scenario plays out Bank Rate would fall to almost 3% (Figure 1). Such an outlook may mean that there be some votes next month in favor of a 50 bp cut!

BoE Sees Inflation Now on the Way Down

Overall, while unlikely to be clear consensus view, the BoE does seem to accept that CPI inflation has peaked. Regardless, it does seem as if underlying disinflation continues, supported by the still restrictive stance of monetary policy, in turn, underpinned by subdued economic growth and building slack in the labour market. From the BoE perspective, the restrictiveness of monetary policy has fallen as Bank Rate has been reduced, something we think is a simplification given what is a wide-ranging and complicated transmission mechanism. However, it does seem as if the BoE overall view is that as disinflation continues, Bank Rate is likely to continue on a gradual downward path. But amid what will be more dissents even into 2026, we see still a further circa-75 bp of rate cuts into H1 next year and remain of the view that the next move will come in December.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.