UK CPI Review: Down More Than Expected from Likely Peak?

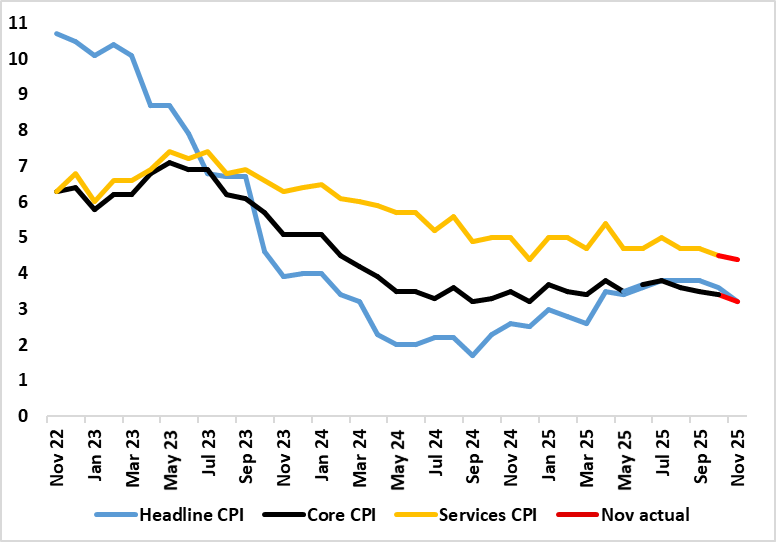

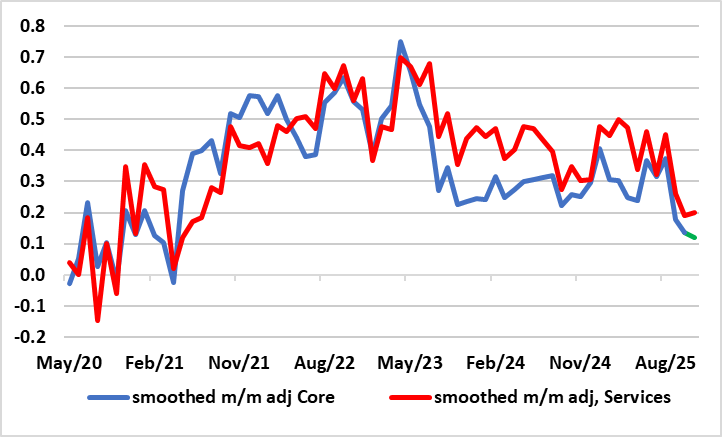

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 ppt to 3.6%, these November numbers showed twice as large a drop to 3.2%, an eight-month low. Much was food related but the core rate still fell 0.2 ppt but to an 11-month low of 3.2% (Figure 1). After some further aberrant factors, services inflation (helped by airfares), dropped 0.1 ppt to a 10-mth low. Notably, in adjusted terms of late (Figure 2), a clear fall to rates consistent with target already seems to be occurring as far as underlying inflation is concerned, this also evident in regard to services. The data, 0.2 ppt below its expectation, clears the way for the BoE to cut tomorrow, and may not only limit dissent against lower rates but persuade some doves to call for a larger move than the likely 25 bp move.

Figure 1: Headline and Core Further and Clearly So

Source: ONS, Continuum Economics

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable base effect through 2026. Indeed, the recent budget, though the likes of rail fare freezes, is adding to downward pressure. In fact, the overall impact of the budget may knock 0.5 ppt from headline CPI inflation by Q2 next year, although as this may create unfavourable base effect for the following year it may not impress the MPC, certainly the hawks.

However, amid what clearer signs of a looser labor market and softer wage pressures, existing CPI data already show signs of a clear and broad slowing too, and now not just when using adjusted m/m numbers. This is one reason why shorter-term, but such adjusted m/m data, are useful and becoming more widely used, as they do not encompass price rises that took place months before and are unlikely to be repeated. In this regard, Figure 2 shows a much more reassuring picture for core inflation in this regard, actually showing that smoothed (ie 3-mth mov avg) rates for both services and the core are already consistent with the 2% target. In fact, the BoE also now employ some use of such short-term adjusted data, showing services price pressures having dropped sharply of late.

Figure 2: Short-Term Core and Services Inflation Already Softening to Target?

Source: ONS, Continuum Economics

In this context, headline inflation does not reflect underlying inflationary dynamics but where nine of the 12 CPI components fell further in November, this also showing broader disinflation sign. NB; the BoE will have received the CPI data several days before today’s official release, something that may soften the thinking of at least some MPC hawks, they worried by alleged price resilience, albeit where slower food inflation is in their eyes less likely to feed into wage demands.

Notably, as Tuesday’s data showed, the labour market is loosening, and both more broadly and faster than the BoE may be accepting at least the hawks. Against this latter backdrop it is not surprising that forward looking surveys suggest softer pressures from wages, with pay settlements likely to falling towards levels compatible with the 2% CPI inflation target according to both BoE survey data and its updated forecast for private sector regular pay (seen down to almost 3% by mid-2026, something we think is too pessimistic).

On this basis, we suggest that the underlying disinflationary process towards target is not only intact but being overlooked, justifying more than a continued “gradual and careful” withdrawal of monetary policy restriction as did four members of the MPC this month. We see 100 bp of rate cuts ahead, including an increasingly likely move this month, this outlook into 2026 helped by a fall in the headline rate to possibly just under 3% in Q1 next year.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.