UK Gilts: Fiscal, Politics and BOE

· 2yr Gilt yields have scope to fall through 2026, as we see growth and inflation slowing more than the BOE and this will likely see the MPC changing view and cutting policy rates to 3.25% in H1 2026. Though a pause could then be seen, we see one final BOE cut then being delivered to 3.0%. 10-2yr yield curve steepening will likely be evident in 2026, as the supply pressures (QT and extra borrowing beyond the budget deficit) will only lessen from September 2026 with a further slowing of BOE QT. Additionally, ongoing UK political flux, and the concerns that internal Labour politics could mean a rework of the UK fiscal rules, will likely mean that 10yr gilt yields find it difficult to fall below 4% consistently in H2 2026 and 2027.

The 2026/27 Gilt market outlook depends on fiscal policy credibility, supply, politics and the BOE. What is the outlook?

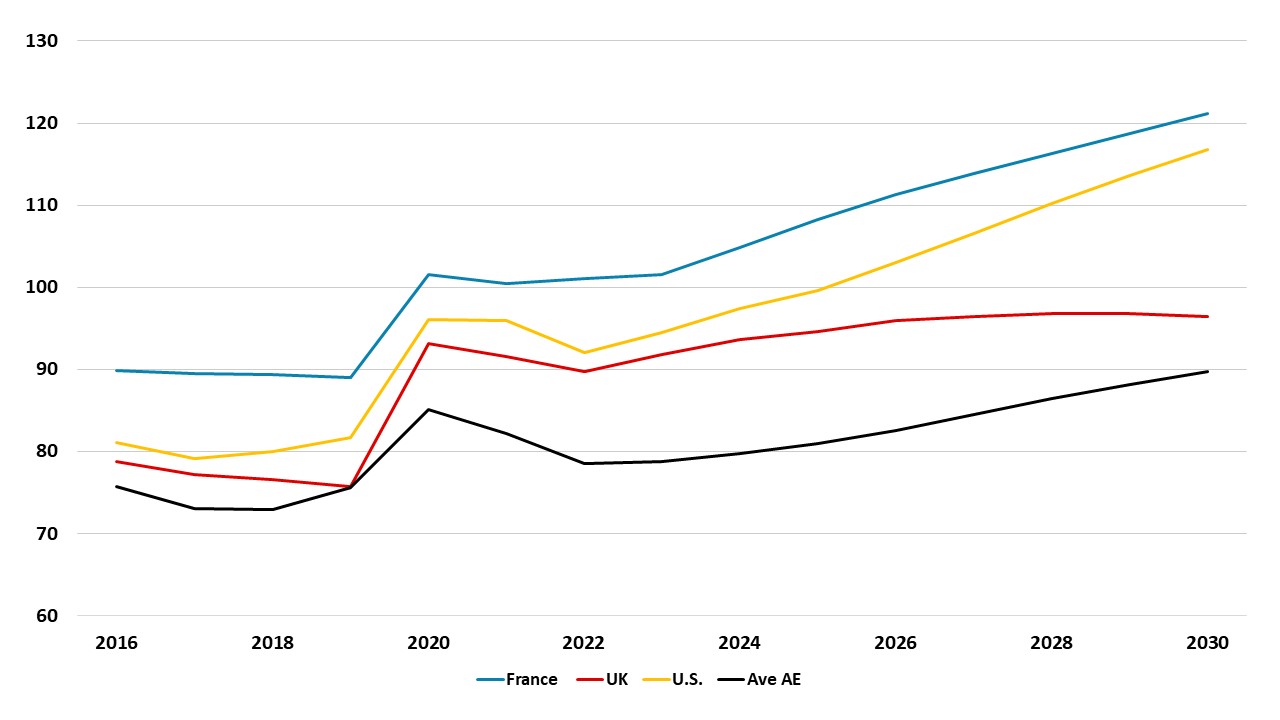

Figure 1: UK, France, U.S. Net General Government Debt/GDP (%)

Source: Oct 25 IMF Fiscal Monitor

The November 26 budget is crucial to confidence in the UK fiscal trajectory, though hints suggest that Chancellor Reeves is committed to raising taxes and meeting the fiscal rules. This is important given the political U turns by the Labour government on tax and spending measures after pressure from the electorate and Labour MP’s. In a wider context, the UK fiscal deterioration in recent years is a concern, but the debt situation is actually worse in other countries looking at net general government debt/GDP trends (Figure 1).

The main problem facing the Gilt market is supply, which is not just a function of the budget deficit trend. Supply facing the Gilt market is driven by three forces (Figure 2): government public sector borrowing (PSNB); financial and other transactions (PSNB v CGNCR ex Network Rail difference) and BOE QT.

Figure 2: UK Supply: Budget Deficit/Off Balance Sheet and QT (GBP Blns)

2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | 2029-30 | |

| Public Sector Borrowing | 137.3 | 117.7 | 97.2 | 80.2 | 77.4 | 74.0 |

| PSNB v CGNCR (ex Network Rail) difference | 35.2 | 25.0 | 32.0 | 57.4 | 60.0 | 35.2 |

| BOE QT | 100.0 | 85.0 | 70.0 | 70.0 | 70.0 | 70.0 |

| Total extra supply | 272.6 | 227.7 | 199.1 | 207.5 | 207.4 | 179.2 |

| % of GDP | 9.5 | 7.6 | 6.4 | 6.4 | 6.2 | 5.2 |

Source: OBR March 2025 /Continuum Economics

Even if the government were able in the November budget to keep close to the PSNB seen in March’s budget, the other two supply drivers would still be large. The CGNCR in the period is on average £40.8 billion higher than PSNB, largely reflecting sales and redemptions losses on the APF (£18.4 billion on average) and net outlays on student loans (£10.5 billion) (OBR March 2025 Tables 6.2/6.4/6.5). The BOE QT has slowed from £100bln pa to £70bln from September 2025 and we look for a further slowing to around £50bln from September 2026 to avoid tight financial conditions too much – QT is restrictive. We think this will likely be followed in September 2027 by a move to stop active gilt sales. Thus the supply picture will likely get better in H2 2026 and into 2027, at least relative to that projected in Figure 2.

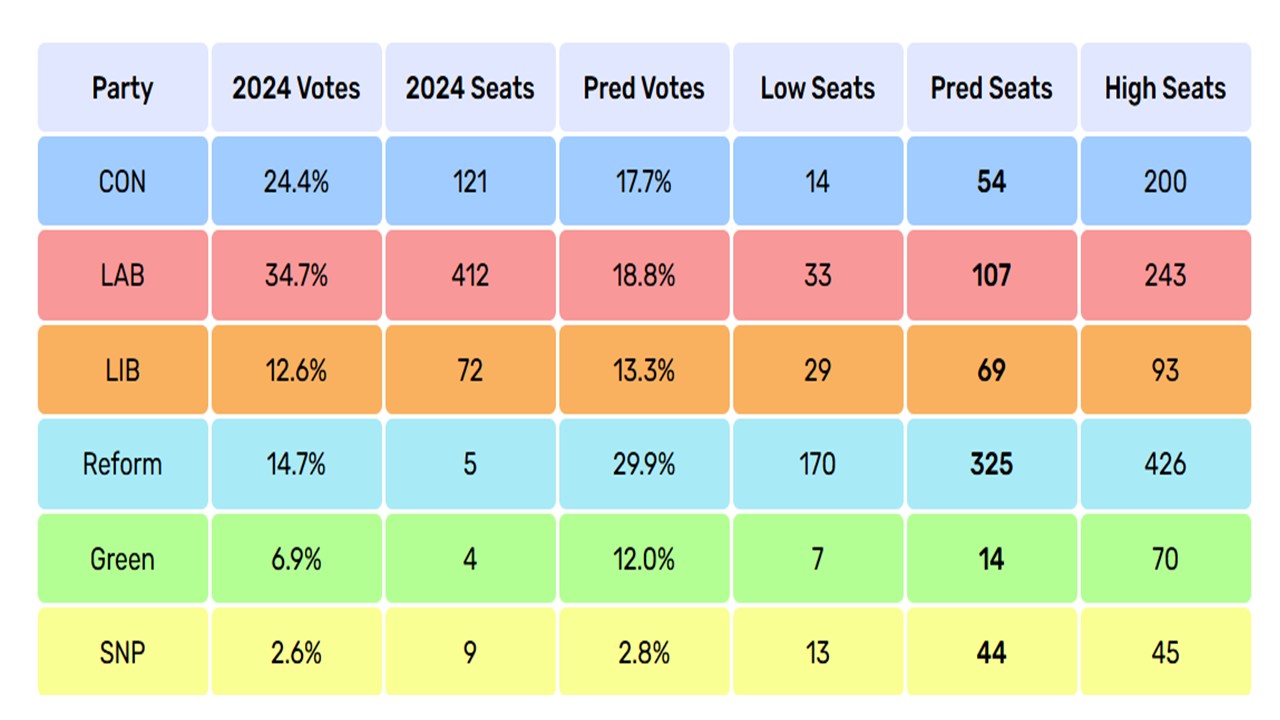

Talk of a UK fiscal crisis in 2027 is unlikely to be driven by supply pressures. However, politics is a swing factor for gilts in 2027 ahead of a 2029 general election. A 2029 UK election outcome is too difficult to call at this juncture (Figure 3), as parties support can shift noticeably in the run-up to an election e.g. 1980-82 and 1990-92. However, if Labour does not see a poll recovery in 2026/2027 then pressure will grow to soften the fiscal rules. This could see leadership pressure on PM Stamer, but ultimately would be designed to replace Chancellor Reeves. This is an event risk for 2026/27 for the gilt market, though this would likely be a softening of the rules rather than a major fiscal easing (the 2022 Truss crisis restricts UK fiscal policy).

Figure 3: 2029 Election – Too Far For Certainty

Source: Electoral Calculus (here)

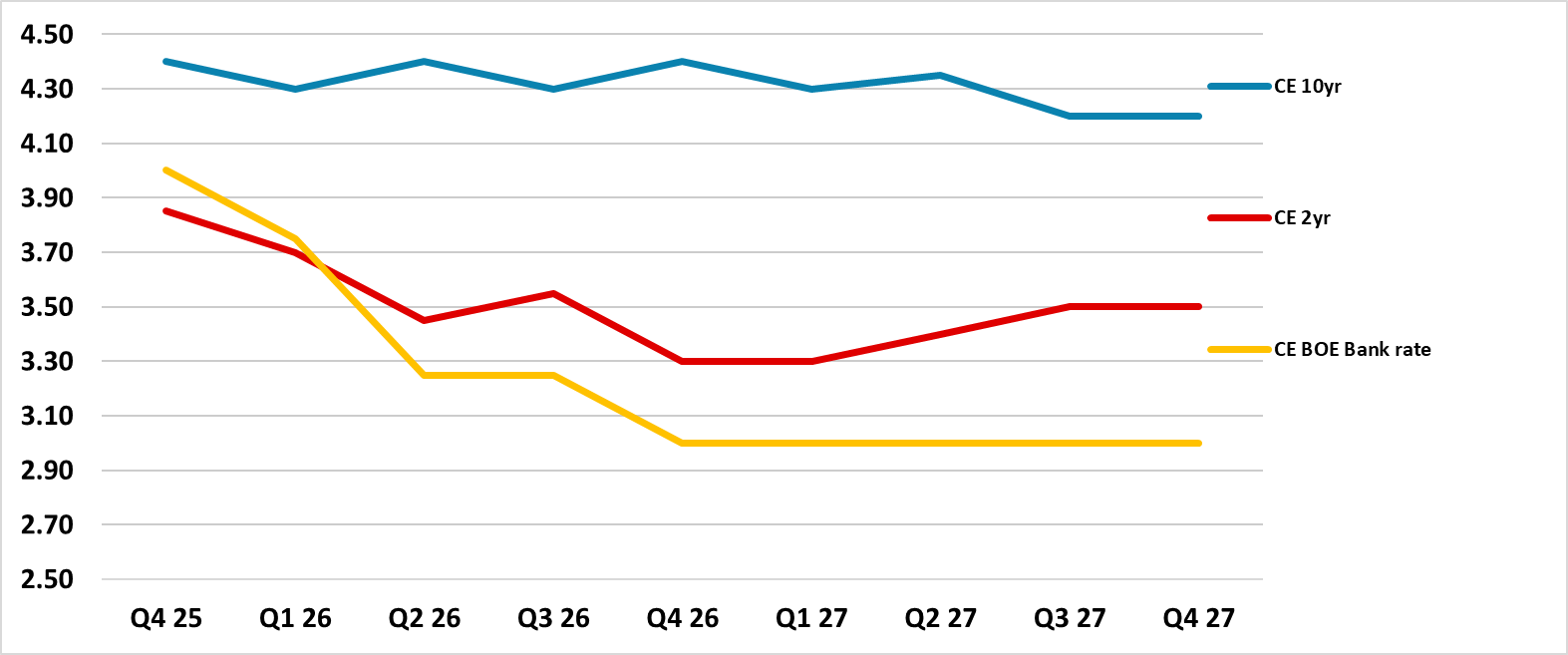

Finally, BOE policy matters for gilts. We feel that the UK labor market is weakening sufficiently (here) to increase confidence in the UK achieving 2% inflation. Some of the November fiscal tightening will also impact in the next 1-3yr, which will adversely impact UK growth and add to disinflation, especially if VAT on household energy is reduced. This will likely lead to a shift in MPC thinking and allow not only a 25bps cut in Dec 2025 but also two further cuts in H1 2026 down to 3.25%. Additionally, though MPC members have different views on where the neutral policy rate is (doves 2.5-3.0%, hawks 3.25-3.75%), we feel UK growth/inflation will be low enough to trigger the MPC majority to deliver a further 25bps cut to 3.0% after a pause by the BOE. We have penciled this in for Q4 2026 (Figure 4), though it could also come in H1 2027 – fyi a 50bps easing arrived in 2003, after the BOE had paused in 2002.

Figure 4: 10, 2yr Gilt Yield and BOE Rate Forecasts (%)

Source: Continuum Economics

In terms of 2yr, our BOE easing view is more aggressive than the money and bond markets and this will likely lead to a decline in 2yr yields in 2026 (Figure 4). However, 2yr gilt yields will likely push to a positive premium versus the BOE policy rate, both as this traditionally occurs in a mature easing cycle and as a 3.0-3.25% policy rate would likely be seen by the majority of the market as neutral rates. At the end of the 1994, 1996, 1999 and 2001 easing cycles 2yr gilt yields pushed to 100bps over the BOE policy rate. A positive 25bps premium between 2yr and BOE policy rate would be more normal now in a steady policy environment, which is what we pencil in for H2 2026. However, fears of 2028 BOE tightening will likely be evident by H2 2027 and this can mean a wider spread between the 2yr and policy rate of 50bps.

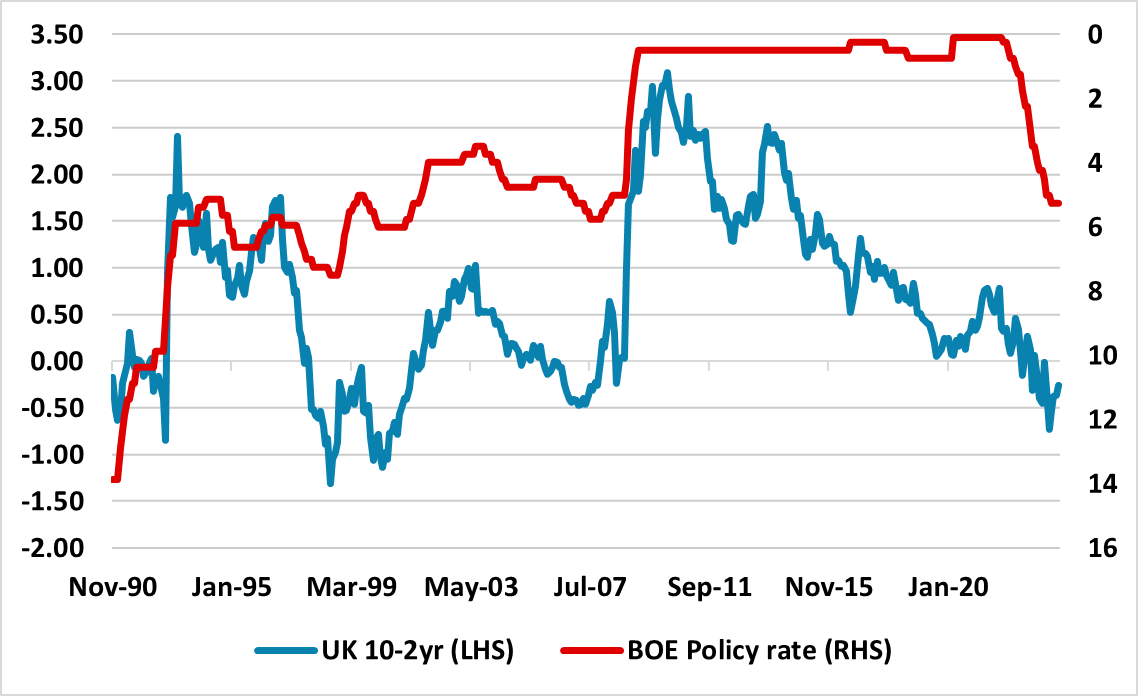

Figure 5: 10-2yr Gilt Curve and Inverted BOE Policy Rate (%)

Source: Continuum Economics

10yr gilt yields face a choppy environment in 2026. While more BOE easing than market expectations can help sentiment at the long-end, the supply pressure will remain large before the September 2026 BOE QT decision (Figure 2). Additionally, the 10-2yr Gilt curve is shallow and most of the BOE easing will likely benefit the short-end more and we see the 10-2yr Gilt curve steepening to 100bps in 2026. This yield curve steepening process should stop in 2027 and a marginal decline in 10yr yields could be seen, helped by further slowing of BOE QT and a sense that the UK can get inflation back sustainably to 2%. Even so, ongoing UK political flux and the concerns that internal Labour politics could mean a rework of the UK fiscal rules will likely mean that 10yr gilt yields find it difficult to fall below 4% consistently.