UK GDP Review: Moving Sideways – At Best

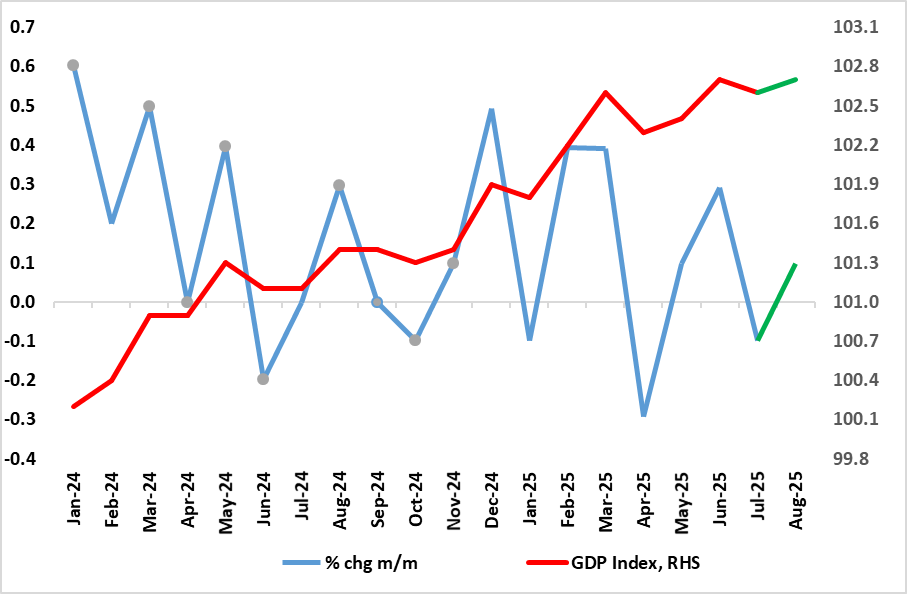

Although the revisions up to July GDP data now confirm a small m/m fall for that month), this was unwound in the August numbers with a 0.1% rise (Figure 1). This put the less volatile three-month rate at 0.3% but we think this overstates what is very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data (Figure 2), especially once construction weakness is incorporated. Indeed, GDP has hardly moved since March. Admittedly, solid GDP outcomes early in the year suggest that UK GDP growth in 2025 will be around 1.25% - the highest in the G& according to the IMF this masks what is very much a weak(er) picture in per capita terms, this being a politically important amid current immigration issues. Indeed, the IMF see a cumulative growth of 0.9% for 2025 and 2026, the weakness in the DM would save for a similar soggy outlook for Germany. The data seems to be taking second place to labor market concerns, at last for some MPC member and we still think this may trigger a further rate cut by end-year!

Figure 1: Solid GDP Growth Ebbing?

Source: ONS, CE

Even so, at this juncture, the still-solid June outcome of 0.3% has created a solid backdrop for the last quarter GDP but we think that the BoE’s 0.3% Q3 forecast may be too high, possibly half being more likely.

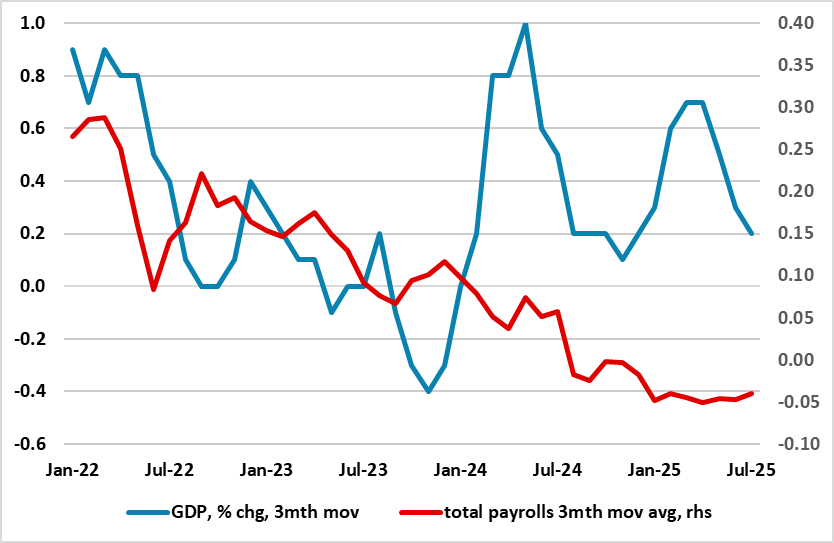

To what extent better weather has helped prevent a more discernible further in the month’s GDP is unclear. But gauging the economy is all the more difficult given both conflicting signals and the extent to which the public sector has supported growth and employment of late. The question is whether this latter factor will go in to reverse, sooner but probably later. As for conflicting signals this is best highlighted by recent headline regarding service sector surveys but also where GDP data have diverged from jobs numbers (Figure 2).

Figure 2: GDP Diverging from Weak(er) Labour Market

Source: ONS, CBI, CE

As for August backdrop details, it does seem as if the housing market downturn has now filtered through into transactions, while industry data suggests a clear fall in vehicle production (which will only worsen in September given the problems JLR has faced). But services were again bolstered by health spending rather than the private sector. Moreover, consumer-facing services output decreased by 0.6% in the three months to August 2025, compared with the three months to May 2025

The weather in August was mixed but warm and dry, this possibly explaining the further gain in retail sales in the month. Given the near flat outcome we see for the whole of H2 we see that GDP growth this year may be around 1.2% (previous estimate sub-1%) but where more ominous signs suggest a) that the underlying economy has been growing far less appreciably and b) where downside risks still persist into next year, this highlighted by growing signs of an ailing housing market and clearer hints of an impending fiscal tightening alongside clear(er) drops in private sector employment.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.