BoE Preview (Sep 18): Guilty on Gilts?

That the BoE will keep Bank Rate at 4% after this month’s MPC meeting is all but certain. Indeed, the MPC majority has hinted that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s complacency regarding what we think is a rapidly deteriorating labor market (Figure 1) that warrants the further circa-75 bp of rate cuts we have pencilled in by mid-2026. But the other and perhaps more overt rational for no change in Bank Rate is that this month’s meeting is more to do with unconventional policy with the BoE carrying out its (now) annual update of its planned gilt rundown and sales as it continues to shrink its balance sheet. Along with the consensus, we see the annual rundown of gilts being slowed from GBP100bln pa to GBP75bln, but where the MPC may suggest both that it may shift the maturity of some gilt sales and also alter the rationale behind the decision too!

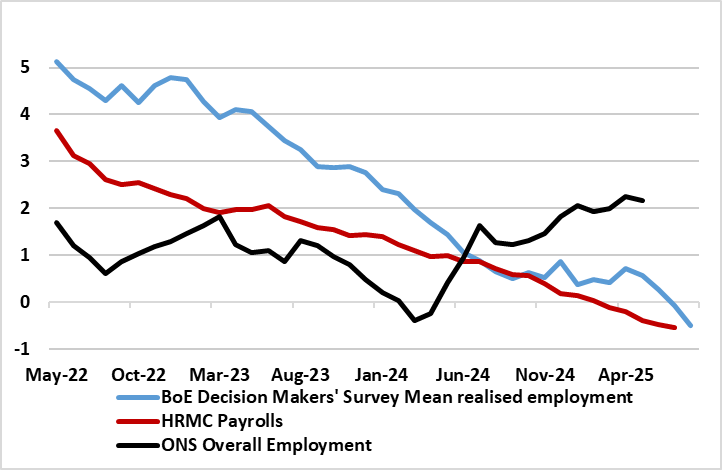

Figure 1: Employment Contracting Not Moving Sideways

Source: BoE, ONS, CE, % chg y/y

Last month, the widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relatively disparately. This partly reflects the alternative scenario building that now lies at the heart of policy thinking and which effectively demotes the baseline inflation projection’s importance. This very much complicates the policy outlook. Admittedly, familiar policy guidance (policy to be framed carefully as well as gradually) was offered but this surely masks similar divides that led to the dissents. More notably, the policy outlook is clouded even more than normal as the updated and somewhat higher CPI forecast it offered last month cannot encompass several likely downside risks, most notably a likely fiscal tightening that will impact over the next 1-3 years. Thus, the message from those BoE updated August projections, may be far from authoritative, if not outright misleading but what we consider to be (still) too optimistic on growth with the BoE very much underplaying what we think is fast emerging weakness and slack in the labor market.

Labor Market Slackening

Indeed, we feel that the BoE is not fully embracing just how weak the UK jobs backdrop is currently nor the extent to which it has worsened of late. According to the August Monetary Policy Report, the BoE very much judges that underlying employment growth, has been around zero since the end of last year as opposed to the clear gains in official jobs numbers. Instead, we see employment is contracting, this being very much evident from range of indicators (Figure 1), even those complied by the BoE itself. Moreover, we feel that when considering the labor market, the BoE is too focused on the implications for overall inflation via what may be happening to wages rather than also taking account the damage that falling jobs have on demand via decreased spending power and a hit to confidence. This is the rationale behind our continued call of a further circa-75 bp of rate cuts we have pencilled in by mid-2026, but where we also note that the MPC is likely to break from its regular three-month gaps between rate cuts as the otherwise possible November decision may be postponed as the BoE awaits vital fiscal updates due in the Nov 26 Budget.

Let’s Be Unconventional

However, it is the unconventional side of BoE policy making that needs addressing at this juncture. Since February 2022, the MPC has been reducing the stock of assets held in its Asset Purchase Facility (APF) for monetary policy purposes, a process known as quantitative tightening (QT). From the BoE perspective, QT is rationalised as by reducing the size of its balance sheet this increases the headroom and flexibility available to the Bank to use its balance sheet in the future if needed. The key principles under which QT should be conducted are threefold. First, the MPC uses Bank Rate as its active policy tool when adjusting the stance of monetary policy. Second, sales have been conducted so as not to disrupt the functioning of financial markets, and only in appropriate market conditions. And finally, sales have been conducted in a relatively gradual and predictable manner over a period of time. But a further factor may start to influence BoE thinking, namely that by as soon as mid-2026, it will have shrunk its balance sheet so that the supply of reserves will have fallen back to match commercial banks demand.

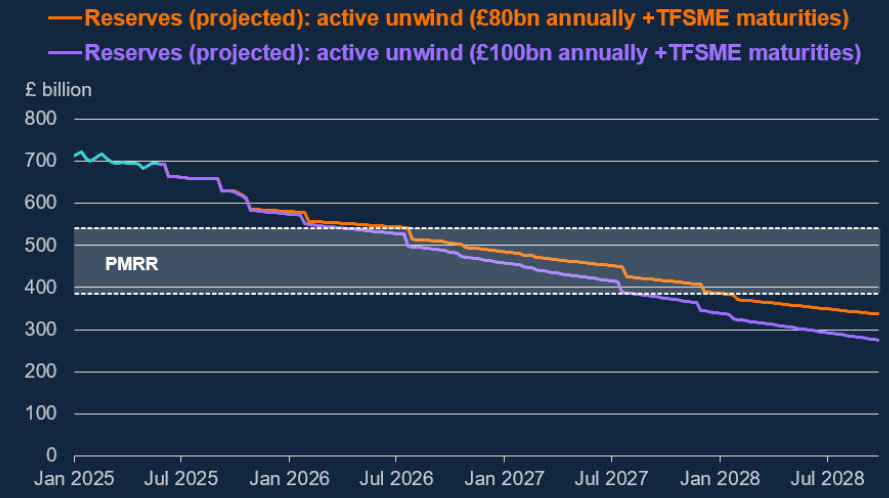

Admittedly, this demand for reserves is much larger than it was as both banks deposit bases and regulatory requirements have grown. It is proxied by a term the BoE refer to as the Preferred Minimum Range of Reserves (PMRR) which is an estimated range for the minimum level of reserves that satisfies commercial banks’ aggregate demand, both to settle their everyday transactions and to hold cash as a precaution against potential outflows in times of stress. Thus, when reserves supply exceeds the PMRR, reserves are ‘ample’. If reserves supply were to fall below the PMRR, however, reserves would become ‘scarce’. In this case, banks would be likely to respond by seeking to borrow reserves in money markets, bidding up the price in the process and thereby causing short-term interest rates to rise relative to Bank Rate.

Figure 2: BoE Reserves Could Meet Banks Demand by mid-2026

Source: BoE (TFSME-Term Funding Scheme)

Reserves- Demand vs Supply

The fact that if BoE reserves do fall into a range equating with demand next year (Figure 2), this does not mean that the BoE will or need stop gilt sales, as the BoE is and will continue to change the composition of its balance sheet, so that repos take greater prominence relative to gilt holdings – NB: a repo-led framework allows the bulk of interest rate risk to be managed in the private sector, rather than for the BoE to manage. But with the PMRR currently estimated in very wide range of between GBP 385 billion and GBP 540 billion and likely to be volatile, any such swings in reserve demand could cause a faster reduction in the balance sheet than the BoE wishes or a fresh rise against a backdrop of a preordained program of gilt sales. The question here is whether the BoE will tolerate such swings in its balance sheet; if not it may have to be more flexible about planed gilt sales.

Regardless, as we argued back in June, BoE QT is part of the reason behind both a steeper yield curve seen of late and what is far from solid private credit growth – at least until very recently. We think therefore that this month will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP100bln per annum to GBP75bln, the question being how open it will be in rationalizing any such decision. Indeed, the BoE’s previous position from 2021 that QT can operate in the background is now starting to be questioned, with MPC member Mann raising questions whether QT is causing tighter conditions at the long-end (here). We would argue that the MPC should go further at this meeting and stop outright gilt sales, as QT is boosting government bond yields and restraining lending. While this is possible, the odds are that the caution and divides within the MPC will mean only delivering the consensus, rather than being more proactive.