UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

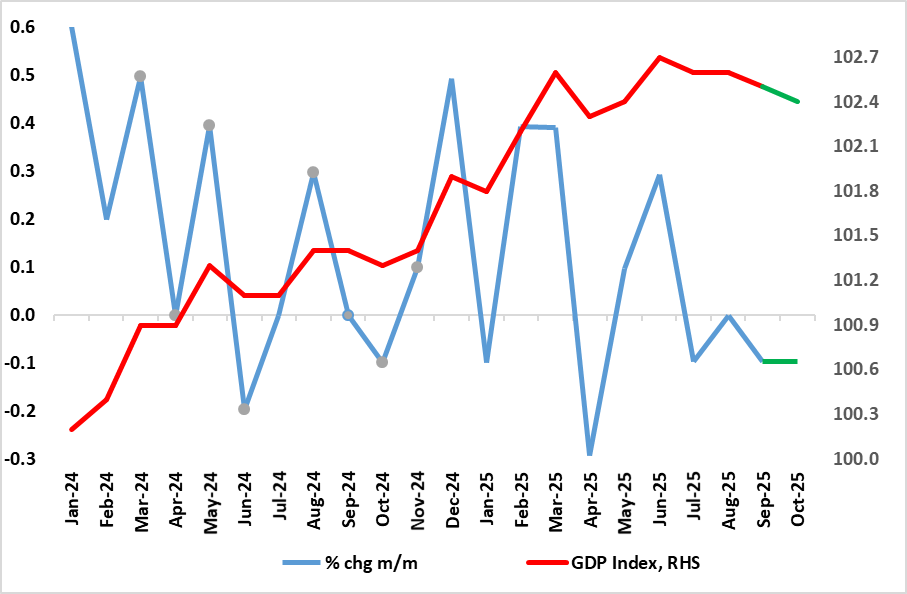

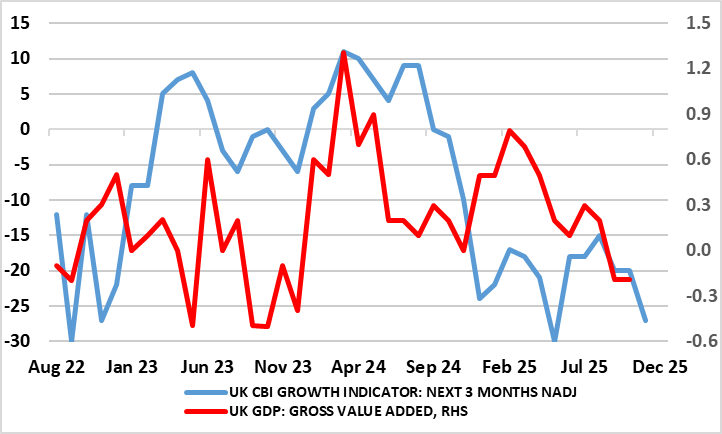

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.1% m/m drop in October came in spite of a recovery from a cyber-attack at JLR vehicle manufacturing and by weather swings. But amid less friendly weather patterns and what have already been weak retail sales numbers as well as only a slow recovery on the vehicle side and even with modest rises for the rest of the quarter, this points to Q4 GDP possibly falling by 0.1% q/q) a projection well below the 0.3% forecast of the BoE. This weakness chimes nevertheless with what surveys still suggest (especially construction), namely the economy is at best moving sideways, and very probably contracting further (Figure 2).

Figure 1: Solid GDP Growth Turning Negative?

Source: ONS, CE

It is unclear how uncertainty affected activity in October. Businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies. If so, then this may damage November GDP numbers too. This increases the chance that Q4 may see a small fall in q/q terms for the first time in two years. This would be sharp contrast to the 0.3% BoE Q4 projection and this likelihood not only reinforces the probability of the Bio cutting rates later this month but also in limiting dissents. Moreover, were it not for the public sector, the October outcome would have been even worse, it being notable that private sector GDP actually fell for a fourth successive month!

Figure 2: Surveys Suggest Negative Picture to Persist?

Source: ONS, CE, CBI, Markit

Indeed, for some time, we have discerned very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data, especially once ever-clearer construction weakness is incorporated. Indeed, GDP has hardly moved since March. Admittedly, solid GDP outcomes early in the year suggest that UK GDP growth in 2025 will be around 1.3% - the highest in the G7 according to the IMF but this masks what is very much a weak(er) picture in per capita terms, this being a politically important issue amid current immigration issues. Indeed, the IMF see a cumulative per capita growth of 0.9% for 2025 and 2026, the weakest in the DM world save for a similar soggy outlook for Germany. Regardless, the 0.8% GDP projection we have penciled in for next year actually constitutes some modest pick-up in activity momentum and thus may actually be too optimistic, something that surveys would suggest given their weakness (Figure 2). In fact, GDP growth next year may now be as soft as 0.6%. This supports our long-standing view that the BoE will cut rates down to 3.0% by end 2026!