DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to make forecasts for the policy rate trajectory and terminal policy rate. We feel that the ECB and BOE will deliver more easing than guided by policymakers and discounted in markets, as a reassessment occurs into 2026 of the disinflation process – market expectations for the Fed are about right, though we look for a Q1 pause (here). For the BOJ, we see two 25bps hikes coming quicker than BOJ forward guidance or current expectations.

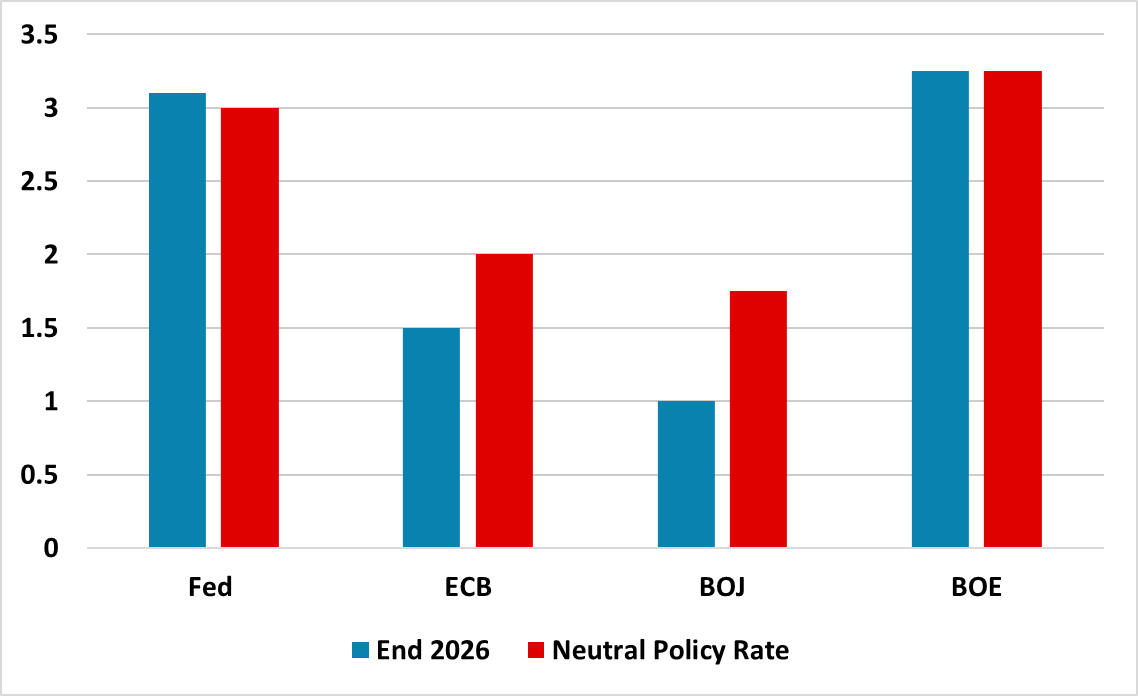

Figure 1: Central Neutral Policy Rate Estimates (%)

Source: Various Central Banks/Continuum Economics (note estimates of neutral rates vary among policymakers, especially for BOJ/BOE).

Neutral policy rate estimates are a broad brush guide to household/companies of the long-term landing zone for policy rates, but wider financial conditions need to be reviewed by economists and central banks for the terminal policy rate in this cycle. The FOMC median neutral policy rate estimate is published ever quarter and is currently 3.0%; the ECB guided to a 2% neutral policy rate estimate and the BOJ estimates it is between 1.0-2.5% (here). The BOE are however reluctant to provide any overall guidance and MPC members opinions of a central estimate vary from around 2.75-3.75%, so in Figure 1 we use the market MaPs median of 3.25% (here).

In reality, DM central banks’ decision making on the correct level of restrictiveness; accommodation or terminal policy rate is based on a wider assessment of economic and financial conditions. One example is the ECB reaction function as outlined by ECB Lane in Feb 2025 (here). Any policy decision would have to incorporate at least nine factors: (i) the still-important rolling off of super-cheap debt that was taken out in the “low for long” era that is now being re-financed at higher rates; (ii) in the other direction, the transmission of the easing since the peak of the hiking cycle; (iii) the impact of the anticipation of future rate cuts on current financing conditions; (iv) the evolving contribution of quasi-exogenous influences on financing conditions (such as global upward pressure on term premia); (v) the dynamics of bond and equity risk premia; (vi) the evolution of credit standards in bank lending; (vii) the different timelines for market-based and bank-based transmission; (viii) the responsiveness of consumption and investment to shifting monetary conditions; and (ix) the responsiveness of price setting to shifting monetary conditions. Households and companies have neither the expertise or time to make this assessment, while traders and fund managers need the support of economists to interpret development in all of these areas or to review latest central bank assessments of their policy reaction function.

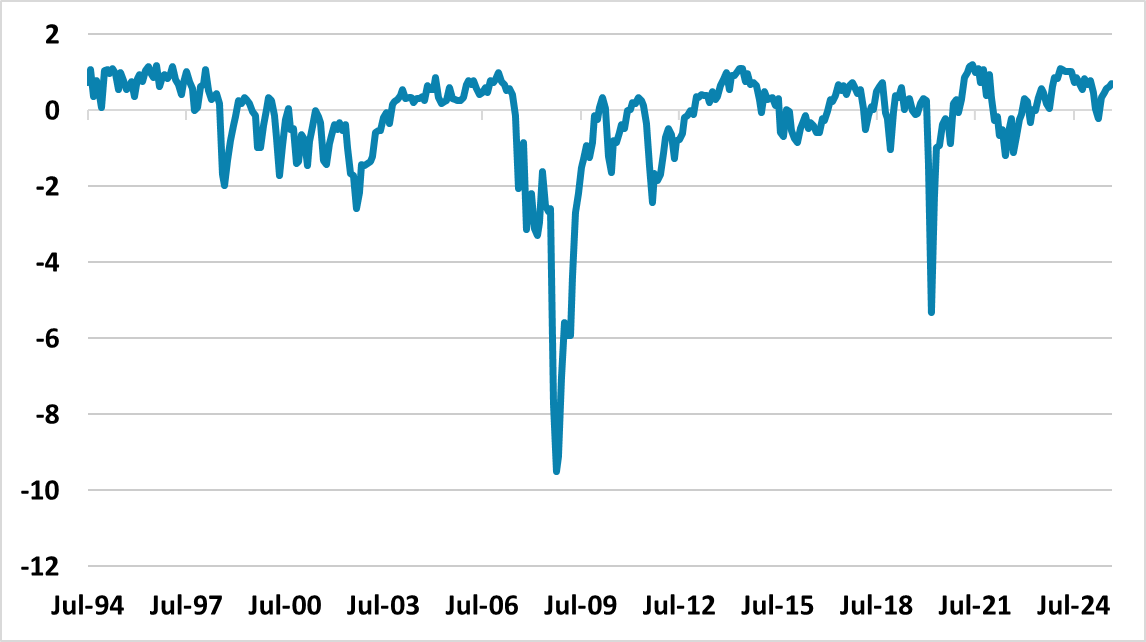

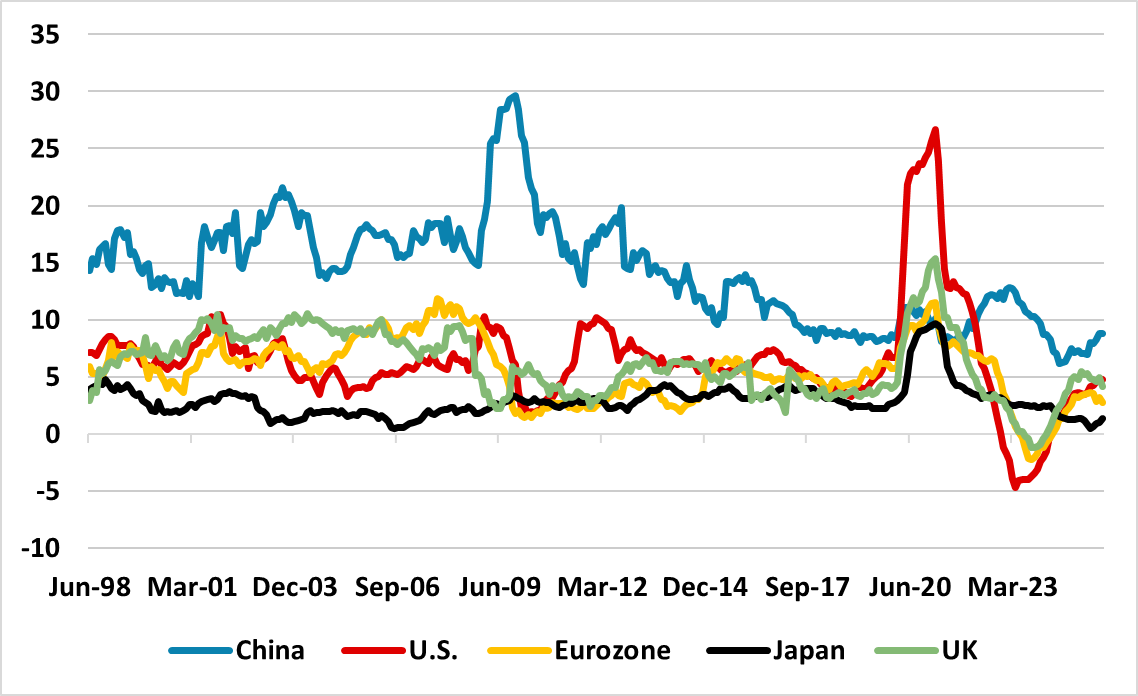

This is why forward guidance has helped to guide multi month policy rate expectations, as it provides a short cut for big picture guidance on policy rates. The U.S. money market is now discounting a move toward the median FOMC neutral policy rate of 3.0% by end 2026 (Figure 1). However, the use of forward guidance can dampen interest rate expectations as the policy cycle become more mature. For example though we look for a 3.00-3.25% Fed Funds rate by end 2026 (here), the alternative scenario of a hard landing for the economy would likely see the Fed easing to 2.00-2.50% terminal policy rate. FOMC members estimates of the neutral long-term policy rate also varied between 2.60-3.90% at the September FOMC meeting and low immigration could mean that the neutral policy rate drifts a little higher in 2027-28. Some clients ask us whether one single measure can help provide a guide to future policy prospects such as financial conditions index. However, U.S. financial conditions (Figure 2) are currently lax due to the overvalued equity market, which could tighten again with an April style fall in the equity market. Money supply is useful (Figure 3), but our overall approach remains a comprehensive review of current economic and financial conditions and our view of how they will evolve in the next 3-24 months.

Figure 2: Bloomberg U.S. Financial Conditions Index (%)

Source: Bloomberg/Continuum Economics

Figure 3: M2 Still Sluggish In Most Countries (%)

Source: Datastream/Continuum Economics

The problem of forward guidance and neutral policy rate estimates dampening policy rate expectations is clear for the ECB. The ECB short-term forward guidance still has an easing bias, but high level communications leave households and corporates with the impression that easing is pretty much finished. However, going back to ECB Lane’s nine points leaves us inclined that wider economic and financial conditions are being adversely impacted currently and in the next six months and this is partly a result of the QT program whose economic impact has been accepted by some Council members (here). The monetary transmission mechanism is not seeing full feedthrough of previous easing. In the September Eurozone outlook (here), we outlined the reason behind our view that this will eventually prompt the ECB to cut twice by 25bps in December and 2026 to get to a terminal policy rate of 1.50%. ECB short-term forward guidance will probably change the meeting before they actually cut.

BOJ forward guidance is still more problematic, with the past two years having seen the BOJ moving before its own forward guidance on ending QE and rate hikes. BOJ estimates of a neutral policy rate also vary from 1.00-2.50% (here), which BOJ Ueda admits is wide. We see the next 25bps hike arriving as soon as October followed by an additional 25bps hike to 1.00% in H1 2026, but then a pause into 2027 before economic conditions allow a further normalization of policy (here).

Finally, BOE Bailey is very reluctant to get involved in neutral policy rate estimates. MPC members central estimates also vary substantively from 2.75-3.75% (Norges bank economist estimates were even wider at 2.25-3.75% (here p11)). In some ways this is good, as the BOE can then make a deeper assessment of wider economic and financial conditions along similar parameters as outlined by ECB Lane for the ECB. However, BOE forward guidance is mixed sometime only spreading to the next meeting, despite subtle hints from Bailey that the easing cycle has not finished and will remain gradual and cautious. Household and corporates may not get the subtle guidance or be able to build up an independent view for the BOE from deep data analysis, which leaves them relying on money market expectations – which currently has a terminal policy rate of 3.75%. Our interpretation of current data and also forecasts for the future prompt us to project more disinflation than the BOE, due to the weak UK labor market (e.g. HMRC data). The BOE also currently feels that still large QT is policy neutral, which we disagree with given the impact on gilt yields and lending rates. Combined with the prospect that some of November 26 budget further fiscal tightening will hit in the next 3 years leave us inclined that the MPC views will reset in 2026 and drive decisions to a 3.25% BOE policy rate (Western Europe outlook here).