UK: BoE Financial Arm Warns of (Increasing) Risks But Ignores Tighter Financial Conditions

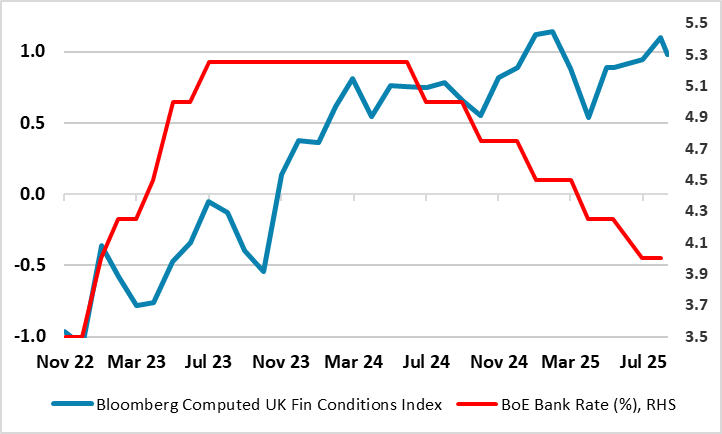

According to the BoE Financial Policy Committee (FPC) meeting this month, risks associated with geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt markets remain elevated. In fact, the FPC was very clear of the increasing risk of a sharp market correction which could have a material impact on the UK as an open economy and global financial centre. The BoE here is very much and justifiably pointing to global factors, not least uncertainty as the source of these risks. However, we would argue that amid a monetary stance that assesses policy purely within the confines of (short-term) interest rates, the MPC and the BoE as a whole are both ignoring and contributing to what are tightening UK financial conditions that have arisen in spite of recent Bank Rate cuts (Figure 1) and which both accentuate such risks and underscore their domestic nature too.

Figure 1: Lower Bank Rate But Tighter Financial Conditions

Source; Bloomberg, BoE, CE

The FPC meeting earlier this month was clearer about the array of risks facing the UK. It noted that despite persistent material uncertainty around the global macroeconomic outlook, risky asset valuations have increased and credit spreads have compressed and that on a number of measures, equity market valuations appear stretched, particularly for technology companies focused on Artificial Intelligence. This, according to the FPC, when combined with increasing concentration within market indices, leaves equity markets particularly exposed should expectations around the impact of AI become less optimistic.

Indeed, term premia in sovereign bond markets have increased in many advanced economies, driven in part by expectations of higher debt issuance, this being something we regard as partly responsible for the tightening in financial conditions that has occurred in the UK and through W Europe despite a narrowing in spreads and what are very elevated equity prices. Indeed, any gauge of financial conditions such as that compiled by Bloomberg suggests that not only have financial conditions failed to fall since the onset of BoE conventional easing over year ago, but that they have instead risen (Figure 1). To us, this tightening in financial conditions is the prime reason for out below-consensus real economy and inflation outlook and why we cling to a view of further BoE easing to the tune of some 75 bp by mid-2026.

A focus on financial, conditions is something prioritised by the likes of the ECB but seemingly played done by the BoE. Instead, the BoE assesses the monetary stance by identifying a point at which the level of Bank Rate neither stimulates nor depresses the level of activity. If the real policy rate is above this neutral level, then monetary policy is considered to be weighing on demand or being restrictive. Admittedly, the BoE concedes that this neutral level, or ‘equilibrium real interest rate’, should not be used as a guide for where the policy rate will settle in the long run and that other factors, over and above developments in Bank Rate, can influence the stance of policy if they lead to a shift in the equilibrium real rate. To what extent this latter concession allows for financial condition swings (eg exchange rate, spreads, equity prices bond yields etc) that we consider so important is unclear.

But apart from this relative omission of financial conditions is assessing the policy stance we are wary about how one moves from an assessment of and equilibrium real interest rate into an actual nominal policy rate – the difference is of course expected inflation, but the use of the (usual 2%) target would surely only be appropriate if policy was already at neutral, otherwise inflation would not be at target.

Regardless, the FPC warns does include some acknowledgment of domestic factors, not least the UK facing higher costs of living and the continued adjustment to higher borrowing costs. But the main FPC worry is that uncertainty around the global risk environment increases the risk that markets have not fully priced in possible adverse outcomes, and a sudden correction could occur should any of these risks crystallise. A sharp correction could interact with vulnerabilities in the system of market-based finance, adversely affecting the cost and availability of finance for households and businesses. As an open economy with a global financial centre, the risk of spill-overs to the UK financial system from such global shocks is material.