UK GDP Preview (Nov 13): Cyber Crime Shock but Underlying Economy Listless

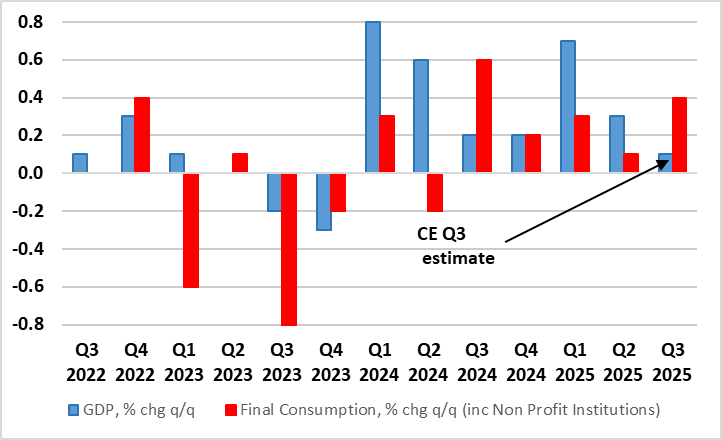

Notably, the level of UK GDP has hardly moved since March but we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September GDP dropping 0.2% m/m and with downside risks, albeit the latter partly alleviated by cooler weather boost utility production and already-published solid retail sales number. If so, this would mean Q3 GDP having slowed to 0.1% q/q (Figure 2) despite a perkier consumer performance. A recovery already looks on the cards for October GDP but as surveys still suggest, the economy is at best moving sideways.

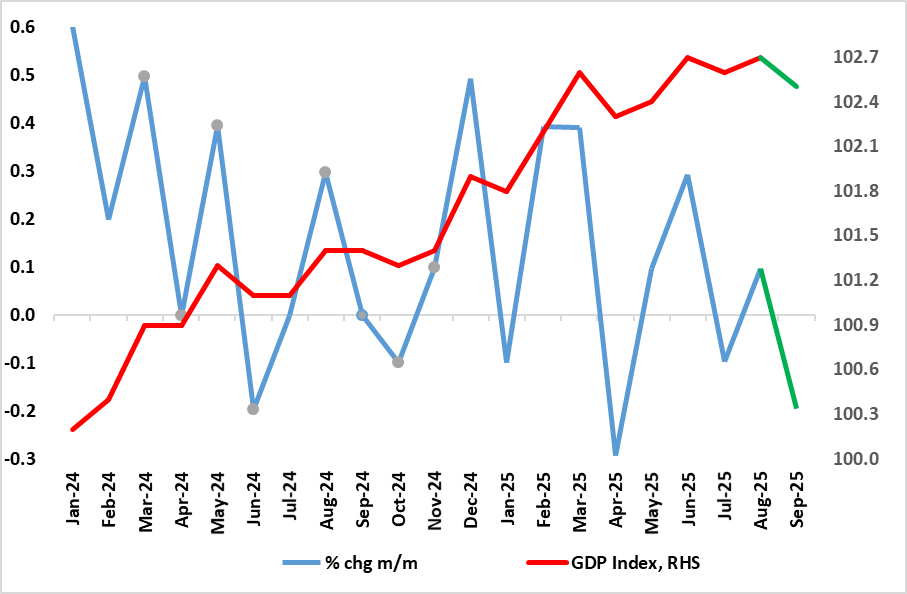

Figure 1: Solid GDP Growth Ebbing and Hit by Shock?

Source: ONS, CE

Although the revisions up to July GDP data now confirm a small m/m fall for that month), this was unwound in the August numbers with a 0.1% rise (Figure 1). This put the less volatile three-month rate at 0.3% but we think this overstates what is very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data (Figure 2), especially once construction weakness is incorporated. Indeed, GDP has hardly moved since March. Admittedly, solid GDP outcomes early in the year suggest that UK GDP growth in 2025 will be around 1.25% - the highest in the G7 according to the IMF but this masks what is very much a weak(er) picture in per capita terms, this being a politically important issue amid current immigration issues. Indeed, the IMF see a cumulative growth of 0.9% for 2025 and 2026, the weakness in the DM would save for a similar soggy outlook for Germany.

Even so, at this juncture, the still-solid June outcome of 0.3% has created a solid backdrop for the last quarter GDP but we think that the BoE’s 0.3% Q3 forecast may be too high, possibly less than half being more likely.

Figure 2: Consumer Recovery Still Fragile?

Source: ONS, CE

To what extent better weather has helped prevent a more discernible weakening of late GDP is unclear. But gauging the economy is all the more difficult given both conflicting signals and the extent to which the public sector has supported growth and employment of late. The question is whether this latter factor will go in to reverse, sooner but probably later. As for conflicting signals this is best highlighted by recent headline regarding service sector surveys but also where GDP data have diverged from jobs numbers and where it is unclear whether the recent run of solid retail sales data are indicative of a better consumer trend or instead are missing a weakening that surveys have hinted at.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.