BoE Review: Guillotine for Gilts?

That the BoE kept Bank Rate at 4% after this month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MPC majority, was that the MPC adhered to its (conventional) policy guidance, still suggesting that a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate and that policy is not on a pre-set path, but will instead respond to the accumulation of evidence. Otherwise the MPC made its annual adjustment to the QT program, cutting back the overall pans from GBP 100 bln to GBP 70 bln for the year to next October, although this actually means that active sales will rise by GBP 8 bln. The conventional policy outlook remains uncertain given both divergences if current data and great uncertainty about the outlook especially fiscally. But we see still a further circa-75 bp of rate cuts into H1 next year.

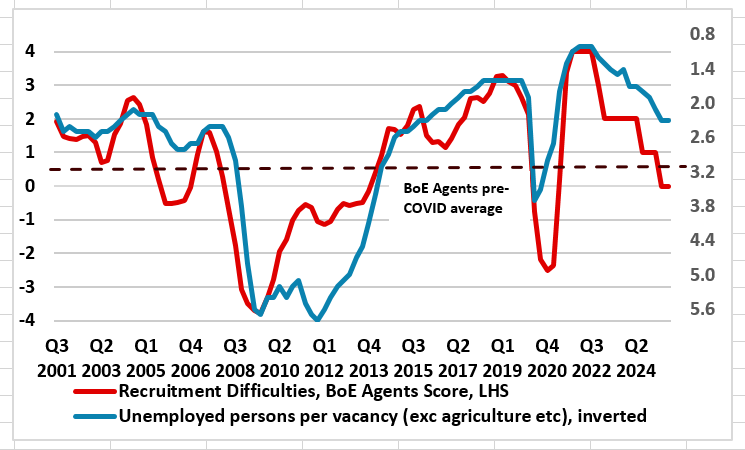

Figure 1: Labor Market Looser than Pre-Pandemic

Source: BoE, CE

The BoE is keen to stress that the restrictiveness of monetary policy has fallen as Bank Rate has been reduced. However, the timing and pace of future reductions in the restrictiveness of policy will depend on the extent to which underlying disinflationary pressures continue to ease. But recently, the MPC majority has hinted that the recent regular pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns, this reflecting the MPC majority’s complacency regarding what we think is a rapidly (not gradually) deteriorating labor market that warrants the further circa-75 bp of rate cuts we have pencilled in into H1 next year. The BoE view is that the ratio of vacancies to unemployment had continued to fall below Bank staff’s estimate of its equilibrium level. But its own (agents) survey data suggest that this has occurred faster and more clearly that (far from authoritative) ONS official labor market data (Figure 1), this also backed up by BoE survey data regarding employment that chime with the clear y/y falls seen in now fully accredited HMRC payroll figures,

In addition, we note that recent CPI resilience has come more from food and energy than services. This is important as a) it is not indicative of demand and b) with both such goods being non-discretionary they are likely to cramp spending power even more, especially on more discretionary spending, this including a wide range of services.

Otherwise, perhaps more the overt rational for no change in Bank Rate is that this month’s meeting is more to do with unconventional policy with the BoE carrying out its (now) annual update of its planned gilt sales as it continues to shrink its balance sheet. Indeed, it was keen to stress the separation of conventional and unconventional policies to a degree where there would be a high bar for amending the planned reduction in the stock of purchased gilts outside the scheduled annual review. That was in order to remain consistent with the principles that Bank Rate should be the active policy tool when adjusting the stance of monetary policy, and that gilt sales undertaken through QT should be predictable. In judging whether that bar was met, the FPC would also have a role through its assessment of financial stability.

What occurred and largely in line with the consensus, the BoE will now shrink is balance sheet by GBP 70 billion in the 12 months starting in October, down from GBP 100 billion a year. The question is the extent to which this reduction comes after long-term borrowing costs recently jumped to the highest in almost 30 years. Partly as a counter, the BoE will now sell fewer longer-dated gilts than other maturities, ie about 20% of the GBP 21 billion bonds on offer will have maturities above 20 years, with the remainder split, evenly between short- and medium-term debt.