BoE Preview (Nov 6): Easing Door Opening Afresh?

That the BoE kept Bank Rate at 4% after last month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MC majority, was that the MPC adhered to its (conventional) policy guidance, still suggesting that a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate and that policy is not on a pre-set path, but will instead respond to the accumulation of evidence. And given slightly better inflation data and more worrying labor market numbers the door is opening for a fresh rate cut, albeit with it likely that any move at the Nov 6 verdict, (while far from improbable) would be too soon, as the MPC may very well want both more data (amid some conflicting signs and the fiscal details from the Nov 24 Budget to gauge just how restrictive the fiscal picture may become. But amid what will be more (easing) dissents this time around, we see still a further circa-75 bp of rate cuts into H1 next year and remain of the view that the next move will come in December.

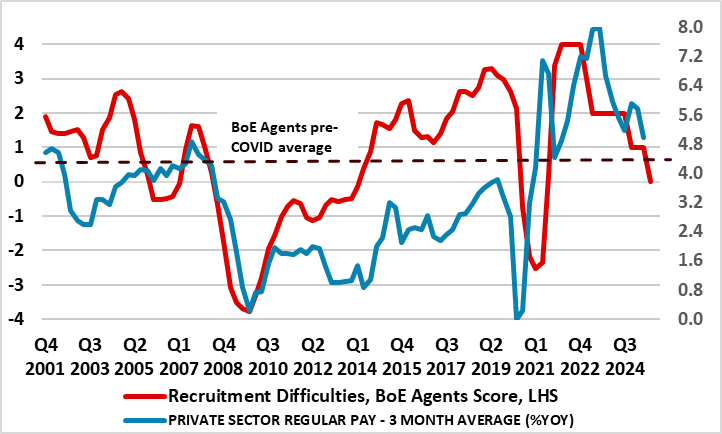

Figure 1: Labor Market Slack Helping Soften Wage Pressures

Source: BoE, CE, % chg y/y

The BoE is keen to stress that the restrictiveness of monetary policy has fallen as Bank Rate has been reduced. However, until most recently, the MPC majority has hinted that the recent regular pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns, this reflecting the MPC majority’s complacency regarding what we think is a rapidly (not gradually) deteriorating labor market that warrants the further circa-75 bp of rate cuts we have pencilled in into H1 next year. The BoE view is that the ratio of vacancies to unemployment had continued to fall below Bank staff’s estimate of its equilibrium level. But its own (agents) survey data suggest that this has occurred faster and more clearly that (far from authoritative) ONS official labor market data), this also backed up by BoE survey data regarding employment that chime with the clear y/y falls seen in now fully accredited HMRC payroll figures.

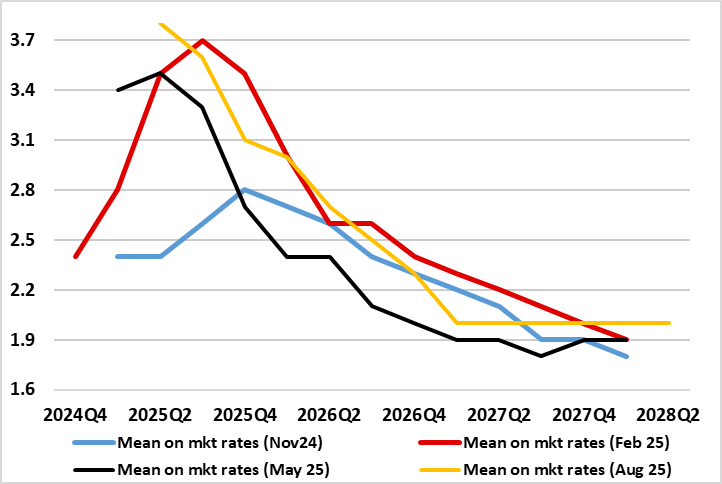

In fact, the MPC majority may now be getting more sensitive about the real economy and labor market backdrop, not least helped by what have been softer than expected CPI and wage numbers. The latter look all the more notable as they chime very much with the BoE’s own survey data regarding slack in the labor market and the likely impact of wage pressures (Figure 1). And of course the fiscal picture is getting potentially more onerous, with spending cuts and tax rises looming, both more sizeable and earlier than hitherto considered – the question here is whether eh MPC will wish to see details of the Nov 26 Budget and incorporate them into an updated outlook in December or instead anticipate and act sooner on the presumption that the existing on-target inflation projection (Figure 2) will be will be reduced back to those seen prior to August.

But the BoE’ other policy arm is also sounding more cautious. According to the recent BoE Financial Policy Committee (FPC), risks associated with geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt markets remain elevated. In fact, the FPC was very clear of the increasing risk of a sharp market correction which could have a material impact on the UK as an open economy and global financial centre. The BoE here is very much and justifiably pointing to global factors, not least uncertainty as the source of these risks. However, we would argue that amid a monetary stance that assesses policy purely within the confines of (short-term) interest rates, the MPC and the BoE as a whole are ignoring what are tightening UK financial conditions that have arisen in spite of recent Bank Rate cuts and which both accentuate such risks and underscore their domestic nature too.

Figure 2: Existing BoE CPI Inflation Projection Merely Hits and Stays at Target

Source; BoE - last four Monetary Policy Report projections