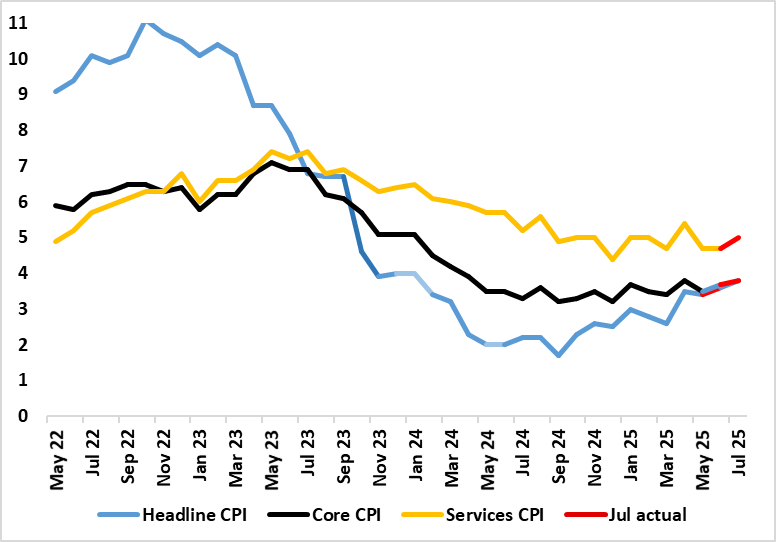

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in line with BoE thinking, and seemingly reflected several special factors (airfares and hotels) as does the notch rise in the core rate but that does not mean it mean it will not trouble the MPC even further, not least the hawkish contingent. Even so, the inflation rise is far from broad as it reflected upward contributions from four (of 12) divisions, partially offset by downward contributions from six divisions. With the headline rate likely to rise toward 4% by the time of the key November MPC decision, a further BoE rate cut at that juncture will need clearer real activity weakness – which we do envisage!

Figure 1: July Inflation Boosted by Services?

Source: ONS, Continuum Economics

The 0.1 ppt increase in the headline rate reflected upward contributions from four of the 12 CPI divisions, partially offset by downward contributions from six divisions. The largest upward contribution came from transport, particularly air fares. This was partially offset by a large downward contribution from housing and household services including a clear slowing in rental inflation, was influenced by an unusual timing of school summer holidays. The rise in the annual rate also reflected a large upward effect from motor fuels and also hotels, the latter also possibly influenced by unusual factors.

Food price inflation which picked up to an 18-mth high of 4.9% may be a growing concern for the BoE both for its impact of spending power and on inflation expectations and wage demands. The question is whether this may be a poor UK harvest or shops passing on recent NIC hikes.

But real economy and labor market weakness, allied to fiscal concerns, may soon be as big worries for the BoE.