BoE Review (Dec 18): Splits More Entrenched?

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some of the hawks are unwilling to accept that recent data means disinflation may have intensified with Chief Economist Pill actually questioning whether further cuts should occur. But overall, the majority do seem to back additional cuts but where they will be gradual and likely to remain ‘close calls’ in future. Admittedly, persistent sizeable dissents through 2026 may complicate policy making. But we think those dissents will be tempered as the MPC vast majority recognises the already ample signs of a weaker demand and a looser labor market backdrop. So far, this is purely evident to only two MPC members (Dhingra and Taylor) but even they not acknowledging clear signs of both price and wage pressures having subsided markedly. Thus we retain our below-consensus projection of Bank Rate falling to 3.0% by end-2026.

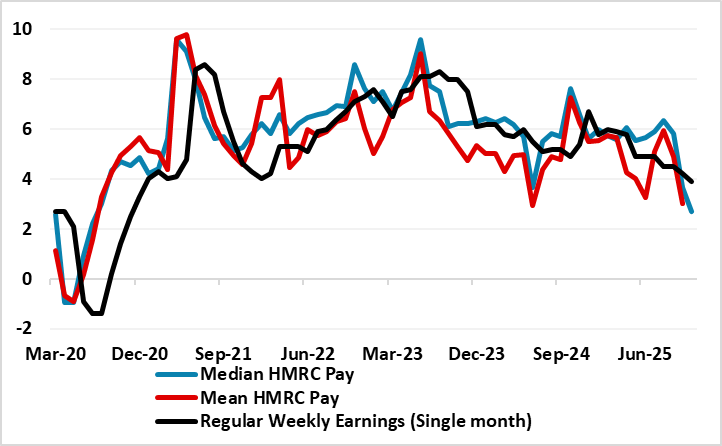

Figure 1: Much Weaker Wage Pressures?

Source: ONS, HMRC, CE, % chg y/y

As with the November MPC verdict, a further 5:4 split was not unexpected. What seems clear is that the effective swing voter was Governor Bailey who remains of the view that further easing is likely. However, at face value, this further close December vote suggests that the two camps within the MPC may remain entrenched in their thinking; even the dovish camp is divided with only two pointing to downside risks to activity and inflation. Effectively, this means that Governor Bailey will be the key, swing voter. If so, this may be something he will find both testing and problematic if he has to wrestle with what could be two intransigent and possibly vocal halves of the MPC.

This is a clear possibility but we instead think that dissents will dissipate into and through 2026. In contrast to the alleged array of forward looking indicators that BoE hawks suggest persistent cost pressures, is not any expectation of softer price and wage pressures but a continuation of the clear softening that is now emerging. This is especially so looking as recent adjusted m/m data. Recent such data suggest that core and services CPI numbers may already be running at rates consistent with the 2% target while wage (earnings) data may have slowed even more markedly and even more clearly in His Majesty’s Revenue & Customs (HMRC) sourced data, actually down to rates consistent with the inflation target (Figure 2).

To what degree this reflects what seems to be increasing demand weakness amid clearer signs of labor market loosing, and employment declines is unclear – BoE-compiled survey data suggest private payrolls may have fallen by almost 2% y/y of late, with the hawks ignoring their own survey results! Regardless we think BoE policy is partly to blame. Supporting this view, recent data have shown some slowing in credit growth with household lending just about zero in real terms. Notably, financial conditions seem to be tightening, thereby moving in the opposite direction to conventional policy.

Against this backdrop extrapolated through 2026, we see Bank Rate falling to 3.0%. This may be below consensus thinking but is far from being inconsistent with BoE analysis - this now among a series of rules the BoE is formally embracing. Indeed, according to the path suggested by a forward-looking Taylor rule, and which suggest that if the demand weakness scenario plays out. Bank Rate would fall to almost 3%. While some on the BoE may argue this would take policy below so-called neutral (something we disagree with), amid what may be formidable fiscal tightening two years hence, why can’t the BoE become expansive?

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.