UK CPI Preview (Nov 19): Falling Back Broadly From Likely Peak?

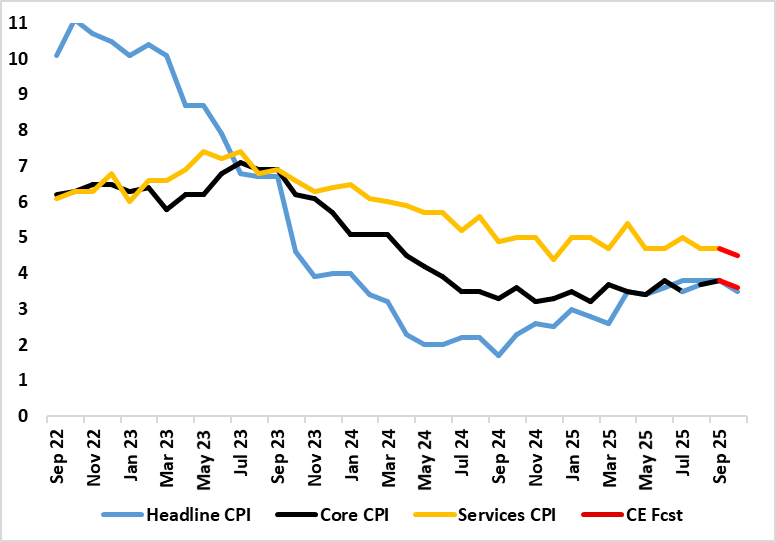

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July and stayed there for the two following months, with the September outcome having been lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. Indeed, we see that the October figure will drop a notch more than BoE thinking, to 3.5%, helped by favourable energy base effects, with the core rate seen dropping 0.1 ppt to a ten-month low of 3.3% (Figure 1). Other base effects may mean food inflation being stable after a clear and belated fall in September. After some further aberrant factors, services inflation in September stayed at 4.7% bolstered again by airfares, but should unwind in October, partly explaining the anticipated fall in the core rate. Notably, in adjusted terms of late (Figure 2), a clear fall may be occurring as far as underlying inflation is concerned, this also evident in regard to services (Figure 3).

Figure 1: Headline and Core to Fall Further

Source: ONS, Continuum Economics

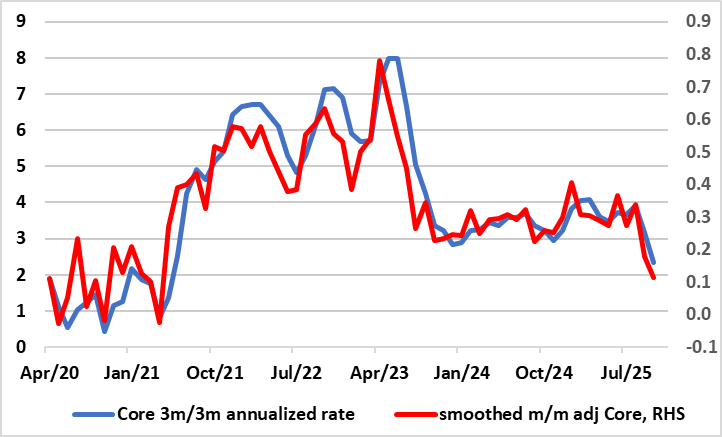

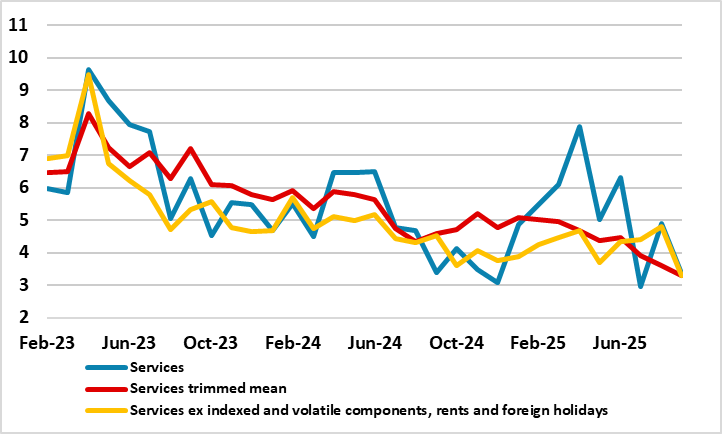

Changes in taxes and administered prices have raised headline inflation this year but are unlikely to be repeated next thereby creating favourable base effect through 2026, with maybe moves in the opposite direction given suggestions of lower VAT on energy. This is one reason why shorter-term but adjusted m/m data are useful as they to not encompass price rises that took place months before and are unlikely to be repeated – Figure 2 shows a more reassuring picture for core inflation in this regard. In fact, the BoE also now employ some use of such short-term adjusted data, showing services price pressures having dropped sharply of late (Figure 3).

Figure 2: Short-Term Core Inflation Softening?

Source: ONS, Continuum Economics

In this context, headline inflation does not reflect underlying inflationary dynamics and where over half of the 12 CPI components fell in September. Moreover, the labour market is loosening, and both more broadly and faster than the BoE may be accepting at least the hawks. Indeed, Chief Economist Pill used a recent to acknowledge mixed messages, albeit choosing to highlight the one business survey data suggesting employment resilience without highlighting that the all other survey numbers suggest the very opposite, not least BoE survey data it compiles and computes itself. Against this latter backdrop it is not surprising that forward looking surveys suggest softer pressures from wages, with pay settlements likely to falling towards levels compatible with the 2% CPI inflation target according to both BoE survey data and its updated forecast for private sector regular pay (seen down to almost 3% by mid-2026, something we think is too pessimistic).

On this basis, we suggest that the underlying disinflationary process towards target is not only intact but being overlooked, justifying more than a continued “gradual and careful” withdrawal of monetary policy restriction as did four members of the MPC this month. We still see 75 bp of rate cuts ahead, including an increasingly likely move in December, this helped by a fall in the headline rate to possibly just under 3% in Q1 next year.

Figure 3: Short-Term Services Inflation Softening According to BoE Analysis

Source: BoE - November Monetary Policy Report, 3-mth annualized rates

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.