UK CPI Preview (Sep 17): Goods Inflation the Recent Problem, Not Services?

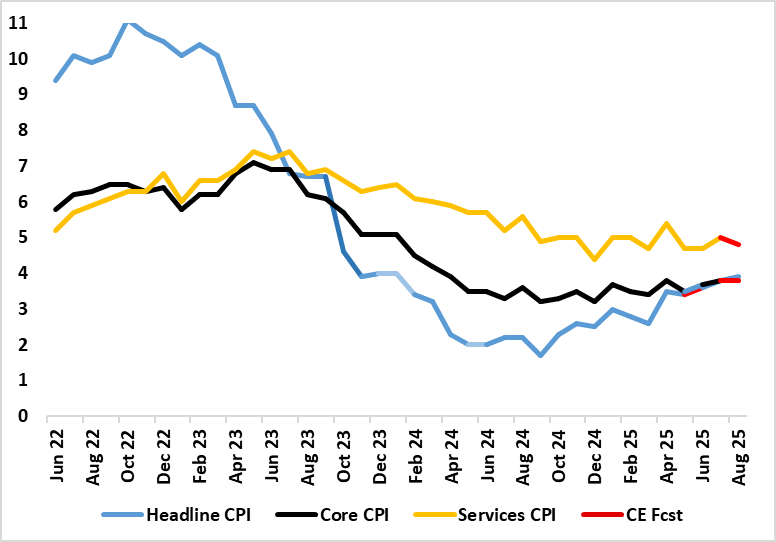

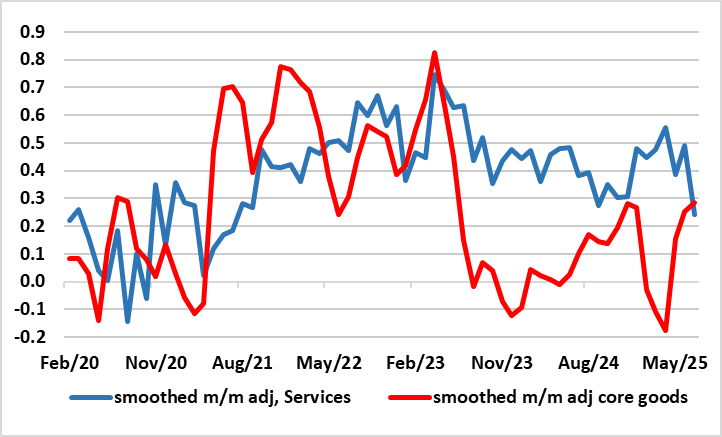

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Partly due to rounding and fuel (and possibly food) costs, we see the headline rising a notch to 3.9% in the August figure, this foreshadowing a similar rise this month to what we (and the BoE think) will be the inflation peak in September of 4.0%. The core rate is seen staying at 3.8%. After some aberrant factors that affected it last time around, services inflation is seen easing, the rise in August still masking a clear slowing in services inflation in adjusted terms of late (Figure 2), with the recent rise in headline inflation driven more by goods.

Figure 1: Headline to Nudge Higher Still, Core Stable?

Source: ONS, Continuum Economics

The July CPI headline was the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in line with BoE thinking, but seemingly reflected several special factors (airfares and hotels) as does the notch rise in the core rate but that does not mean it will not trouble the MPC even further, not least the hawkish contingent. Even so, the inflation rise is far from broad as it reflected upward contributions from four (of 12) divisions, partially offset by downward contributions from six divisions.

Figure 2: Inflation Boosted by Goods, Not Services?

Source: ONS, Continuum Economics

In fact, while all the media and policy attention has been apparently stubborn services inflation, the latter has been easing, this more discernible in m/m adjusted terms, with the recent rise in headline inflation driven more by goods. Notably, while relatively broad, goods inflation has been pushed higher largely by food and energy, neither of which seem to be demand driven. Clearly, higher food inflation is a worry to the BoE as will the energy rise, the latter partly driven by the UK’s peculiar method of estimation. But it can be argued that both food and energy being both non-discretionary are adding to already strained consumer finances which we feel will continue to weigh on the real economy picture into 2026. But the main downside factor for the economy is the ailing labor market, data for which appear on Sep 16; they may show still high wage numbers but with the (now officially accredited) HMRC showing continued job losses!se in June. stronger than expected GDP backdrop helps explain at least some of the CPI rises and persistence of late!