BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

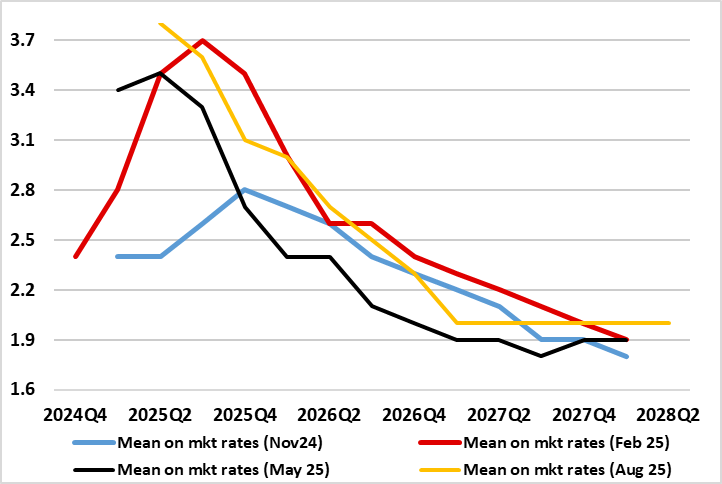

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relatively disparately. This partly reflects the alternative scenario building that now lies at the heart of policy thinking and which effectively demotes the baseline inflation projection’s importance. This very much complicates the policy outlook. Admittedly, familiar policy guidance (policy to be framed carefully as well as gradually) was offered but this surely masks similar divides that led to the dissents. More notably, the policy outlook is clouded even more than normal as the updated and somewhat higher CPI forecast (Figure 1) cannot encompass several likely downside risks, most notably a likely fiscal tightening of almost 2% of GDP looming. Thus, the message from those projections, may be far from authoritative, if not outright misleading but what we consider to be (still) too optimistic on growth.

Figure 1: BoE Projections No Longer Suggest Inflation Below Target

Source: BoE

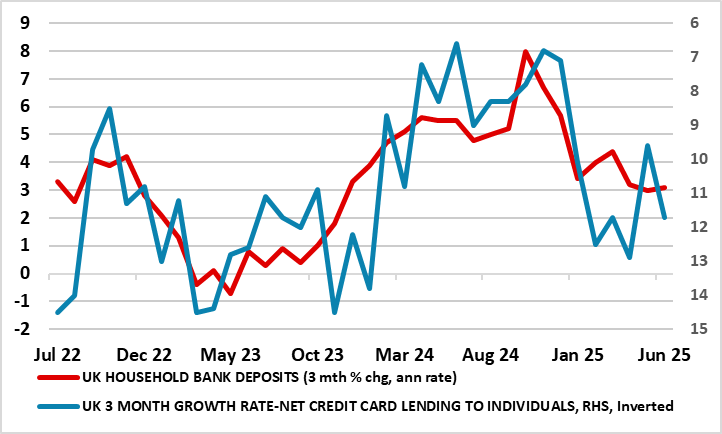

After what was widely considered to be a dovish hold at the last (June) MPC meeting, many will regard this to be hawkish cut. In a notable quirk, there were four dissents in favor of no move – MPC member Taylor preferred a 50 bp cut but shifted to 25 bp in order to reach the eventual 5:4 majority. As for assessment, in what was a real activity picture that has changed little in the last three months, there was seemingly little heed paid to much weaker labor market data late (especially outside of the official numbers) and also ever weaker consumer signs that question the BoE’s assertion about high household savings.

But amid what we consider to be a somewhat optimistic economic assessment, the BoE is reassessing the possible relationship between inflation/wages and growth. Indeed, the MPC judges that the upside risks around medium-term inflationary pressures have moved slightly higher since May. As a result, this chimes more with the inflation persistence scenario that the BoE has hinted at of late. The question being to what extent this is felt by the MPC majority and/or whether the alternative more disinflationary scenario still holds consideration. What is puzzling, it is clear is that previous MPC concerns about a ‘tight’ labor market have been diluted but from removed. Moreover, from our standpoint, over and beyond even softer labor market numbers there are other concerns that the BoE should be considering, not least, as suggested above, signs of consumer dissaving (Figure 2) that suggest household frailty and a likely further and possibly marked fiscal tightening – the latter surprisingly attracting little attention even in the press conference.

Figure 2: Households Saving Less and Borrowing More

Source; ONS, BoE, CE

The problem is that neither, because of a lack of detail, could be incorporated into the updated BoE projections. Thus, the message from those projections, apparently validating current market rate speculation by now showing inflation only reaching (and not undershooting) target perhaps only from mid-2027 (Figure 1) may be misleading. Indeed, we think that with the BoE regarding neutral policy rate as being well above 3%, at least one further 25 bp moves this year will be followed by another 50 bp in H1 2026. But we consider the risks are still for deeper and possibly faster cuts as we think the BoE is both over optimistic about growth prospects and over-estimating policy neutrality – NB a recent IMF insight pointed to Bank Rate bottoming at 3% and averaging just 3.2% next year, ie well below market thinking. One question here is if the BoE slows its QT program, as we assume will occur next month, will this have any overt bearing on conventional policy – of some note, this August MPR did raise the impact of QT on gilt yields, but only very slightly to a 15-25 bp range.