European Central Bank

View:

December 19, 2025

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

December 19, 2025 11:10 AM UTC

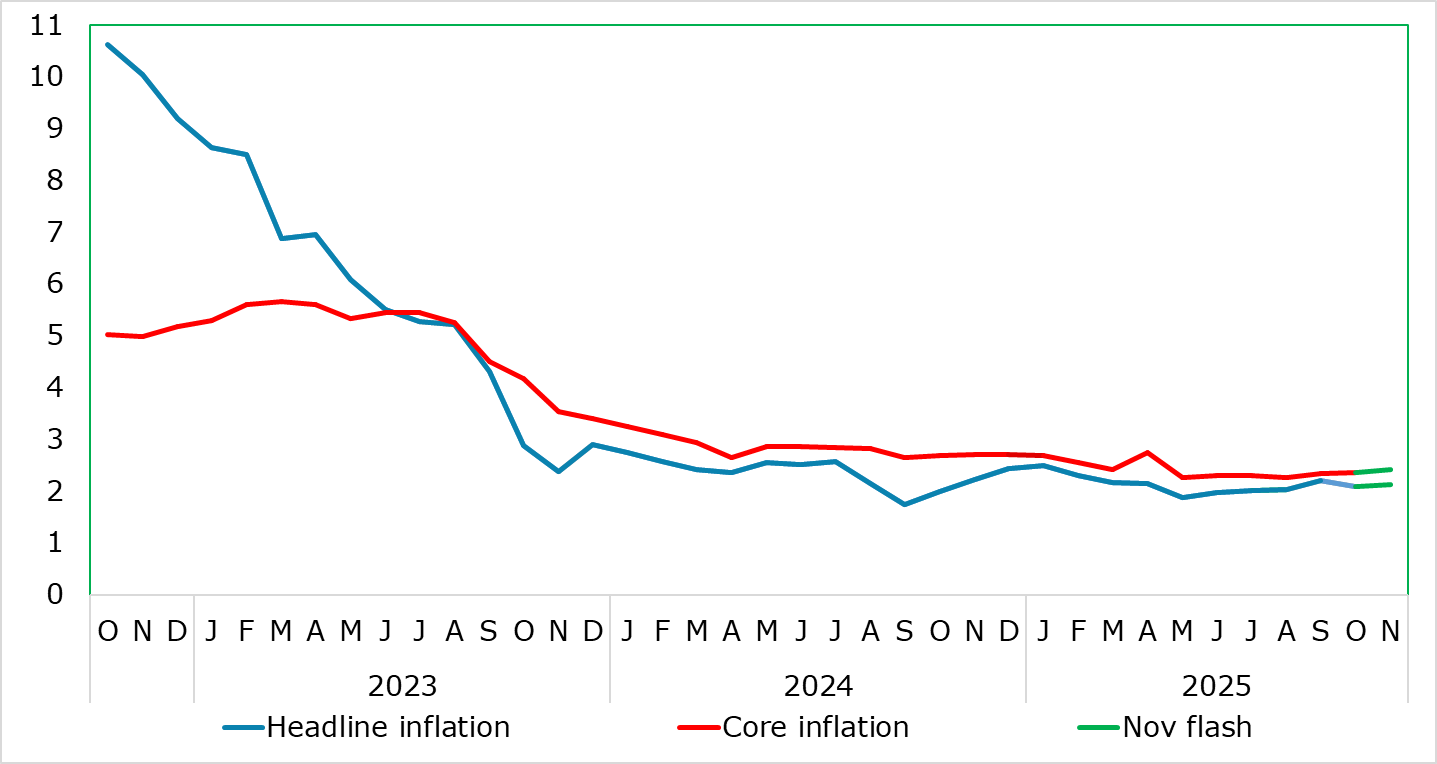

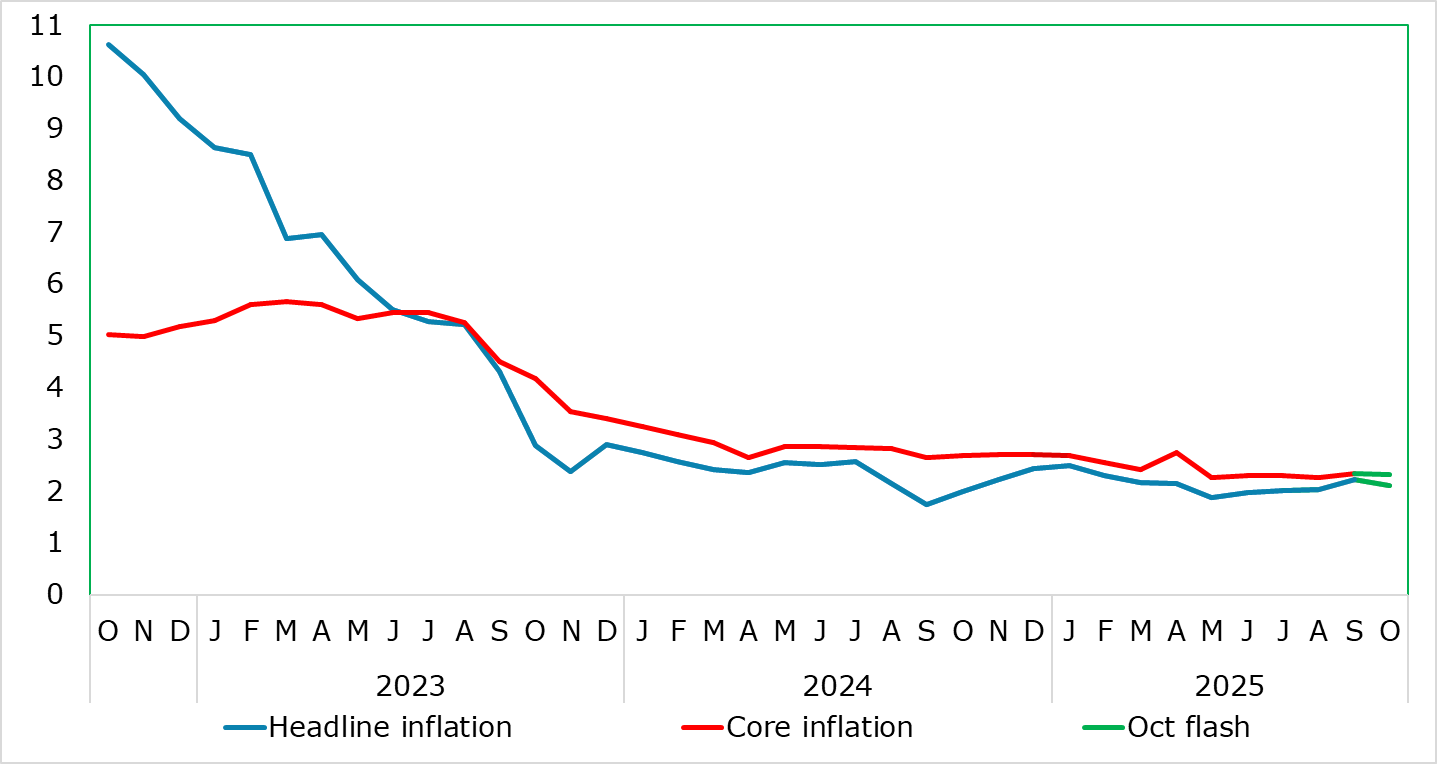

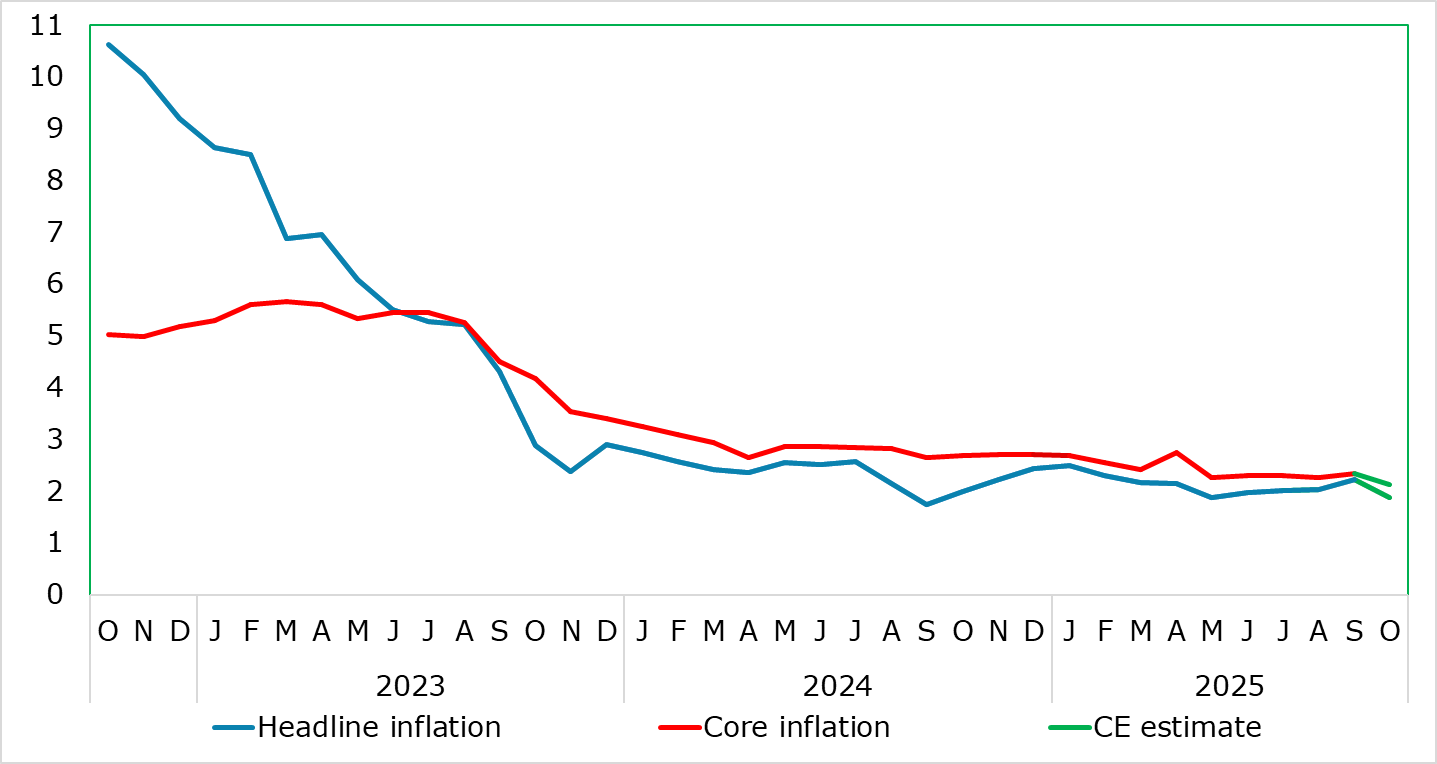

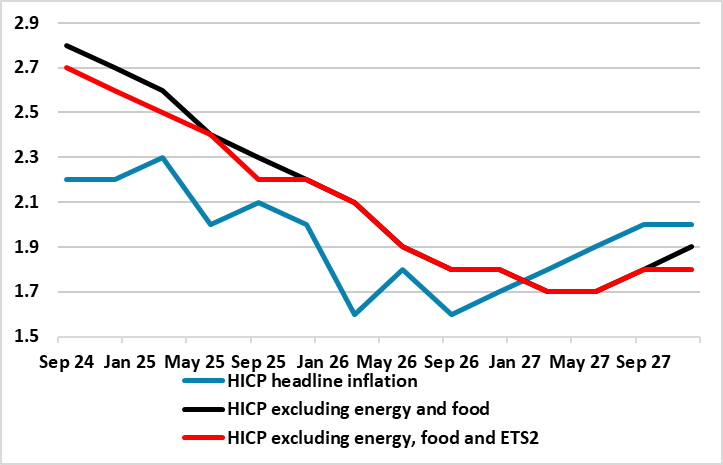

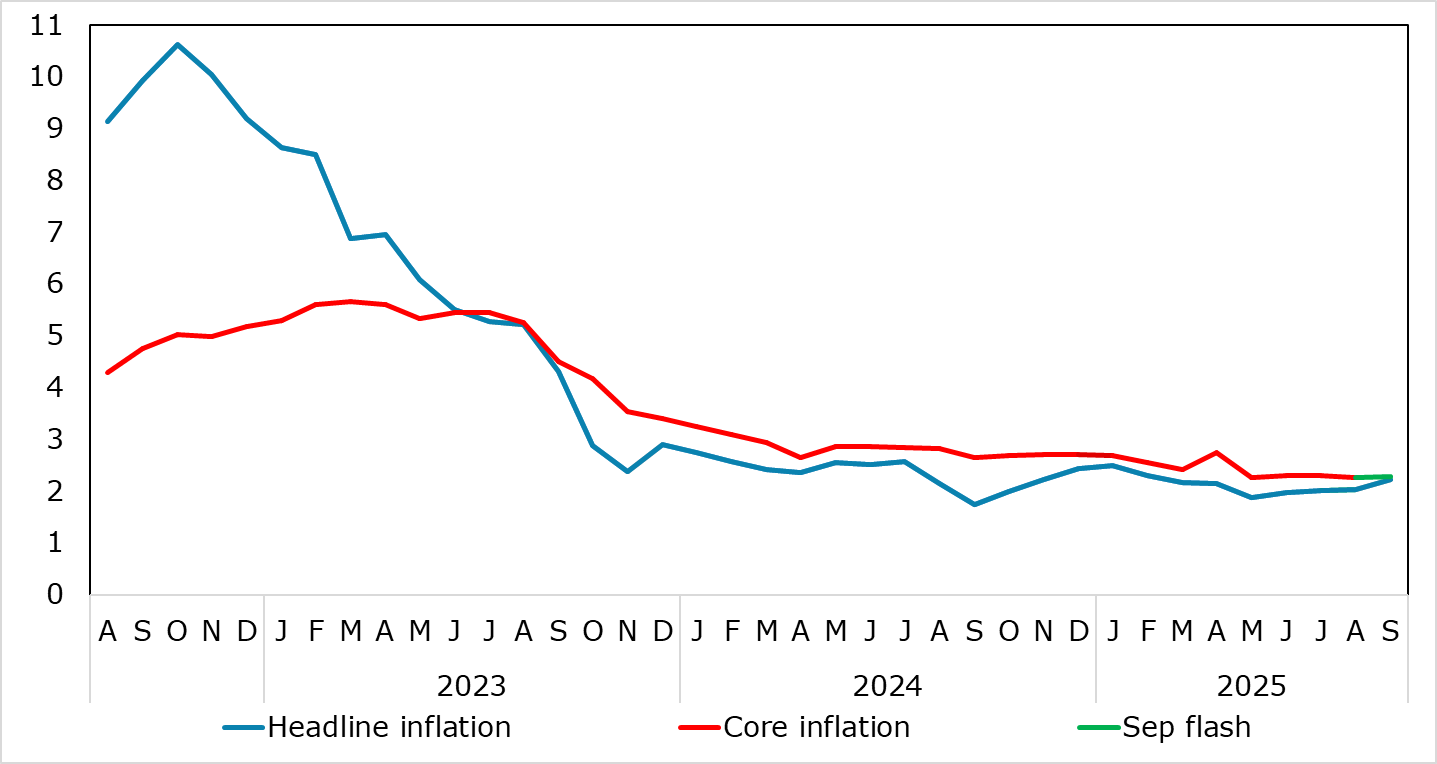

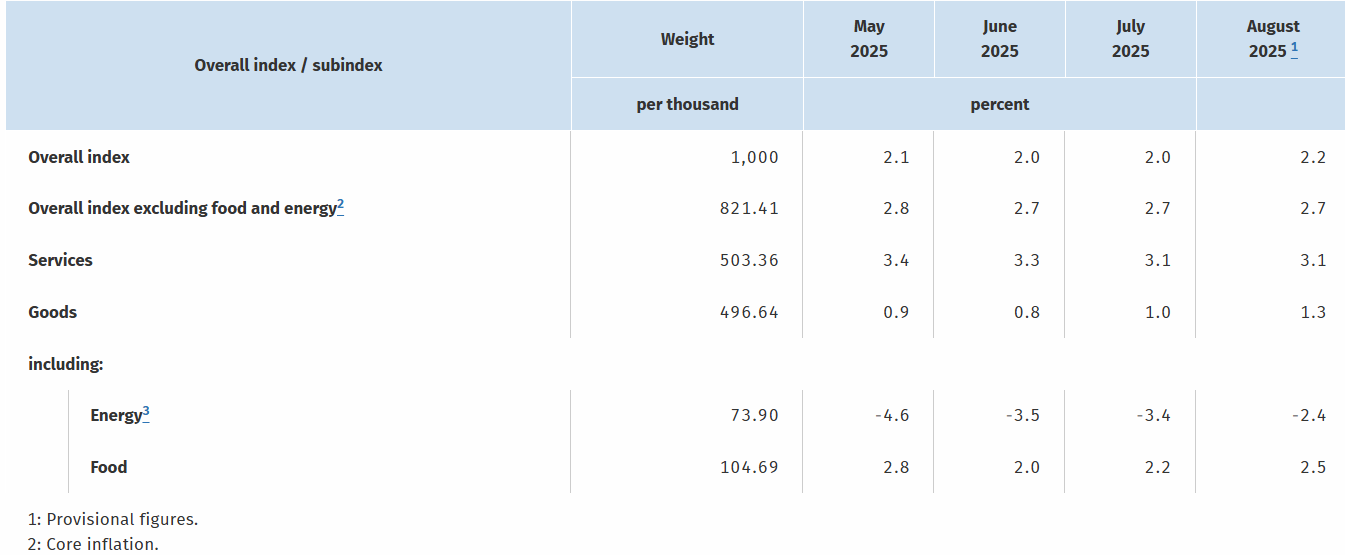

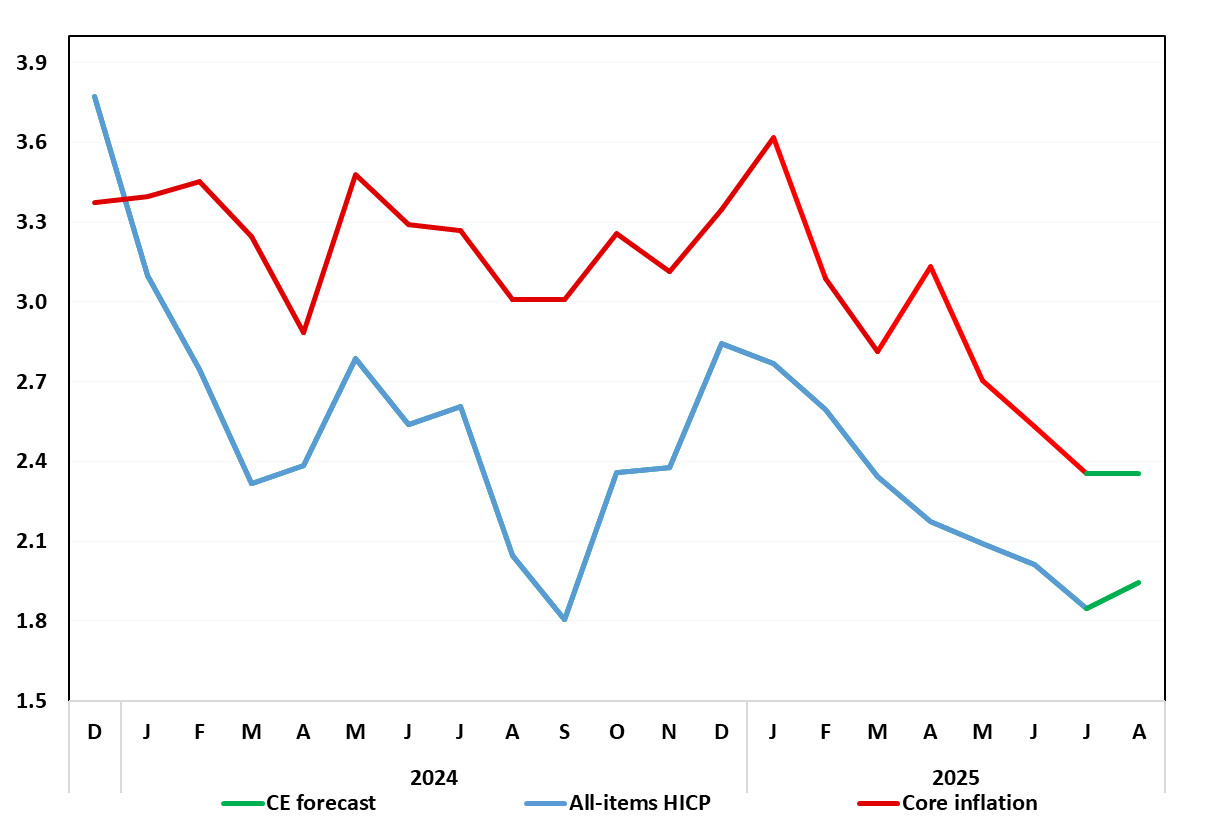

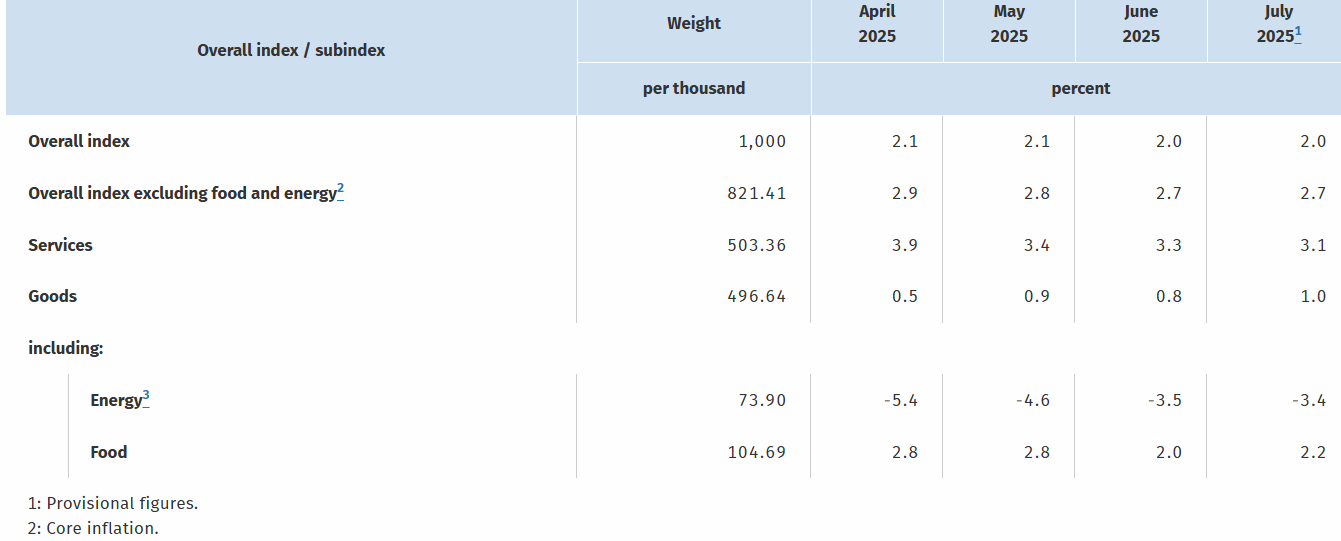

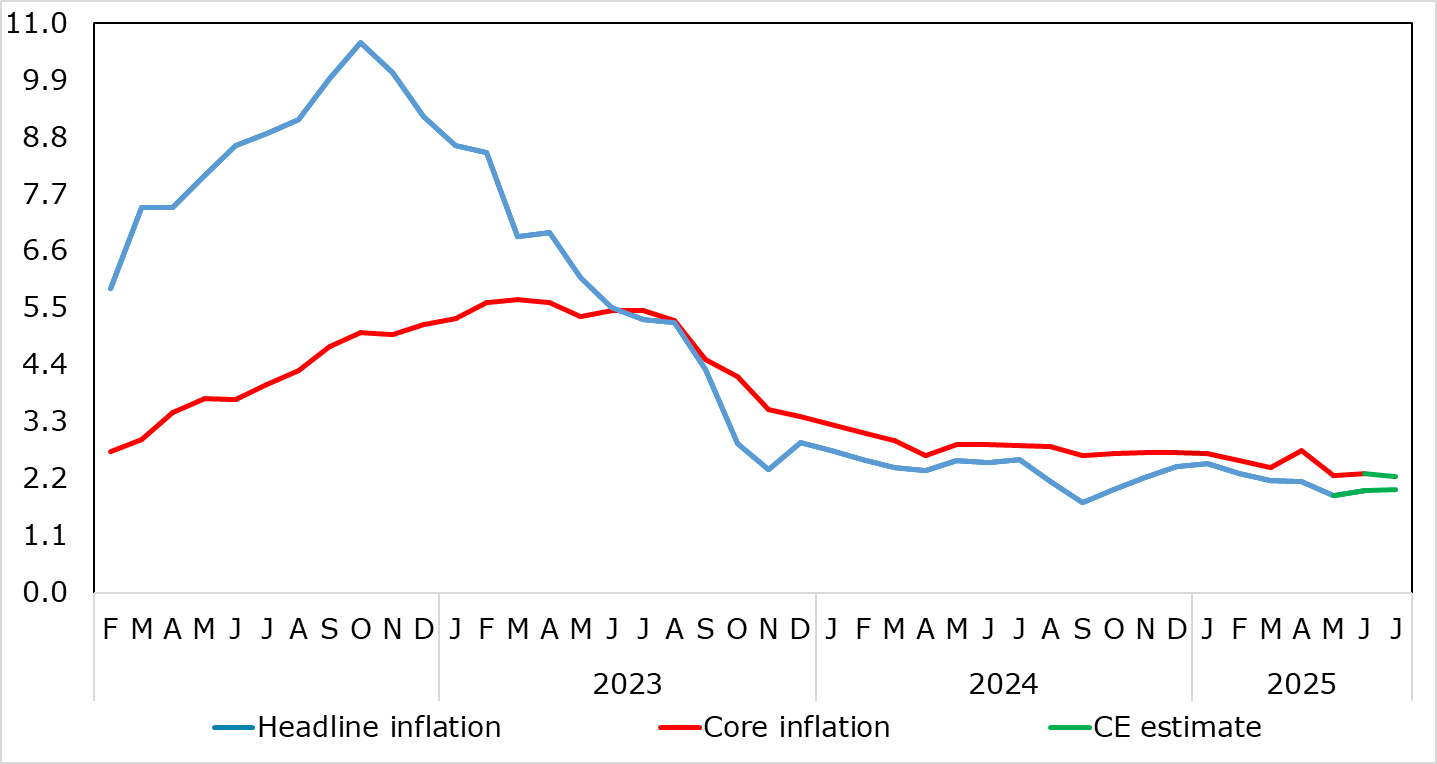

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Som

December 18, 2025

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

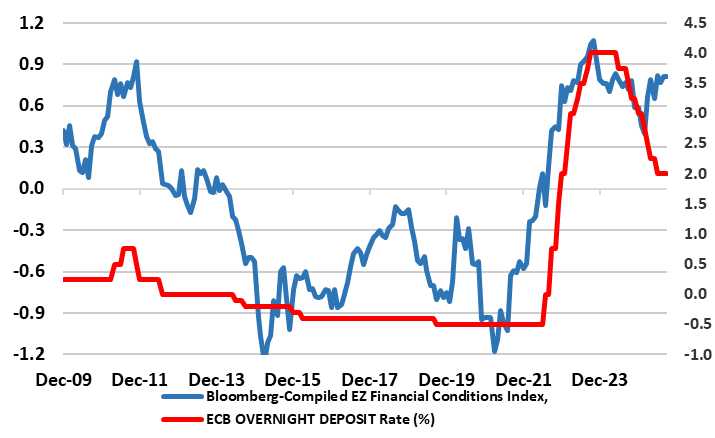

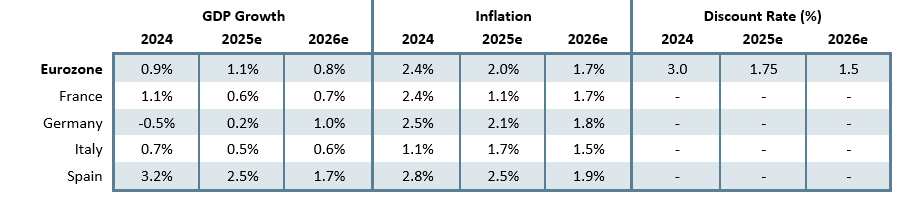

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

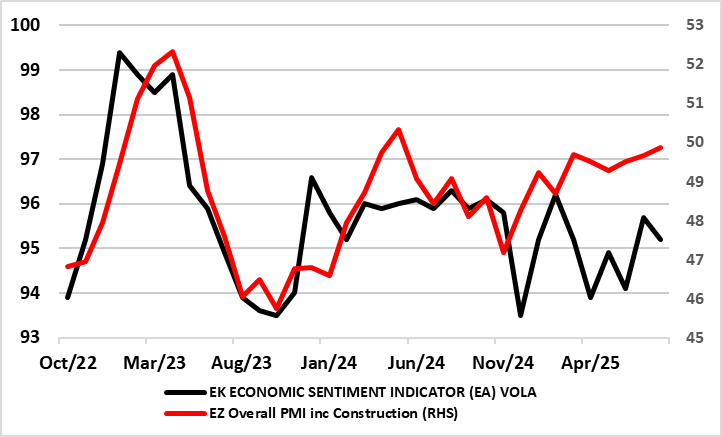

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

December 09, 2025

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 02, 2025

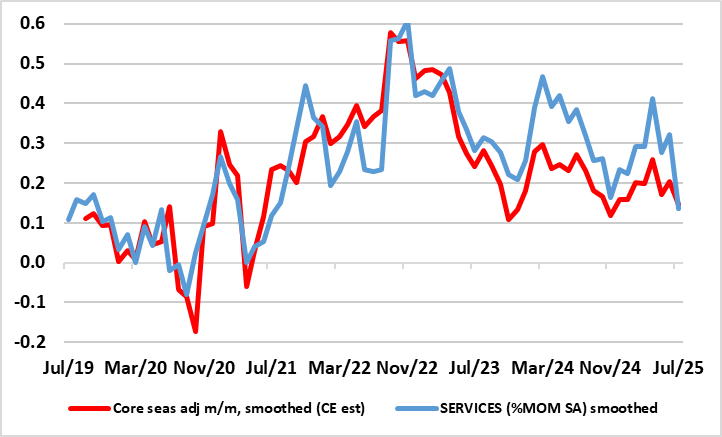

EZ HICP Review: Services Inflation Still Problematic?

December 2, 2025 10:51 AM UTC

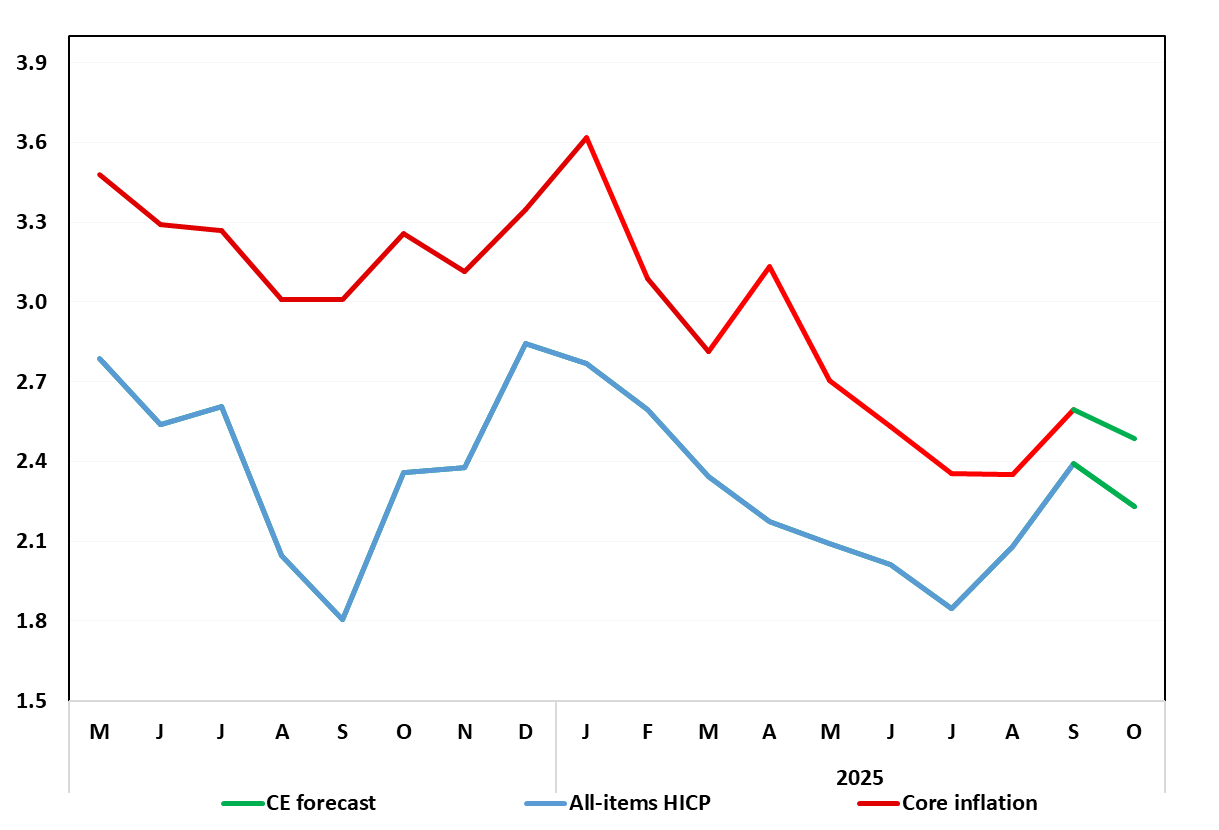

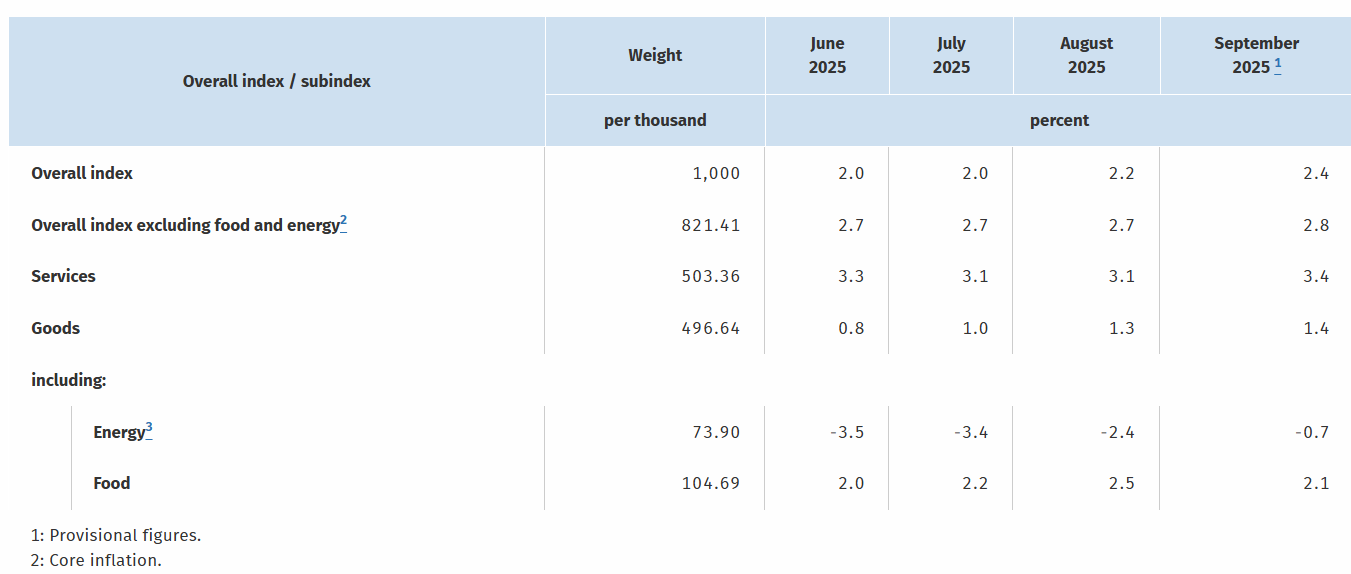

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above bo

November 27, 2025

ECB: Financial Stability Review Less Complacent than Council?

November 27, 2025 1:36 PM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Regardless, as the account of the Oct 29-30 Council meeting chimed with comments from the meeting’s press conference, it does seem to us as i

November 24, 2025

EZ HICP Preview (Dec 2): Services Inflation Less Problematic?

November 24, 2025 2:19 PM UTC

The HICP inflation picture has clouded somewhat of late at least to some. With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latte

German HICP Preview (Nov 28): Headline and Core To Edge Down Further?

November 24, 2025 9:00 AM UTC

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But a notch of this rise was reversed in the October number

November 14, 2025

ECB – In a Good Place or Just Complacent?

November 14, 2025 11:55 AM UTC

The ECB is of the view that downside growth risks have dissipated somewhat, this possibly helped by its recent actions which it suggests leave its current policy stance in a good place. However, amid a hint of what we think is a complacent upgrade about the EZ’s alleged resilience, we think, the

November 11, 2025

EZ Rates: 2026 ECB Easing But 2027 French Crisis?

November 11, 2025 9:45 AM UTC

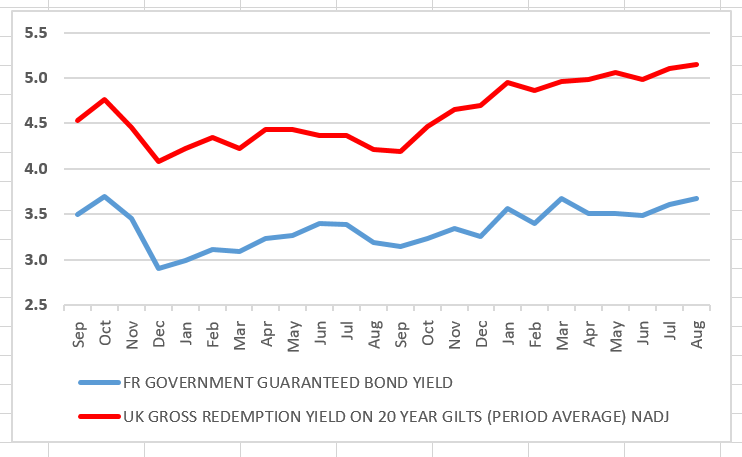

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. Howev

October 31, 2025

EZ HICP Review: Services Inflation Problematic?

October 31, 2025 10:39 AM UTC

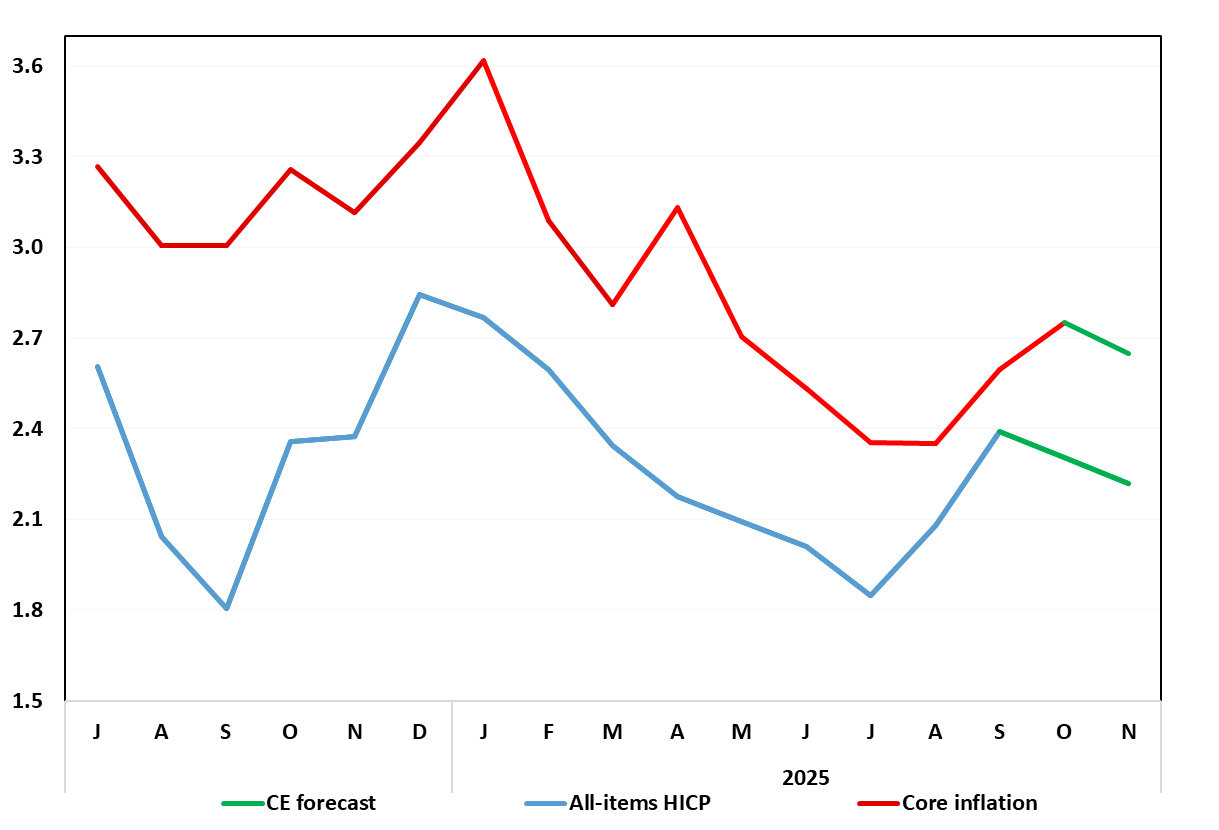

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latter reflected a slight pick-up in services (up 0.2 ppt to a six-mth high of

October 30, 2025

ECB Review: Hedging its Bets, Hoping to Stay in a Good Place

October 30, 2025 3:23 PM UTC

There ie nothing tangible in the ECB update today to suggest that a further easing is likely at the next meeting on Dec 17-18. However, amid a hint of what we think is a complacent upgrade about the EZ’s resilience alongside a perceived reduction in global risks, the easing window has not been c

Eurozone Flash GDP Review: The Haves and the Have-Nots

October 30, 2025 10:25 AM UTC

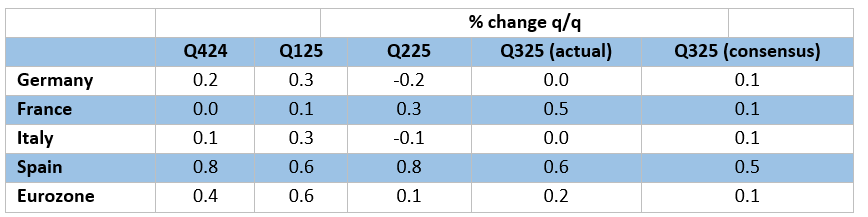

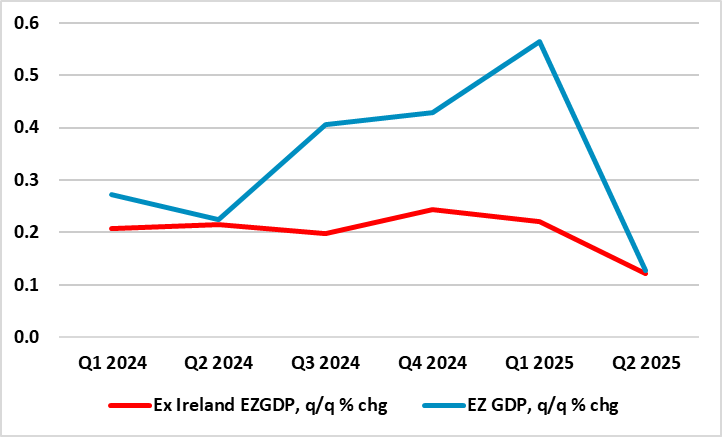

It continues to be the case that, for an economy that has seen repeated upside surprises and apparently above trend growth, now some 1.3% in the year to Q3, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking save to encourage a Council view of EZ eco

October 28, 2025

Eurozone: Tighter Credit Standards By EZ Banks Confirmed

October 28, 2025 9:44 AM UTC

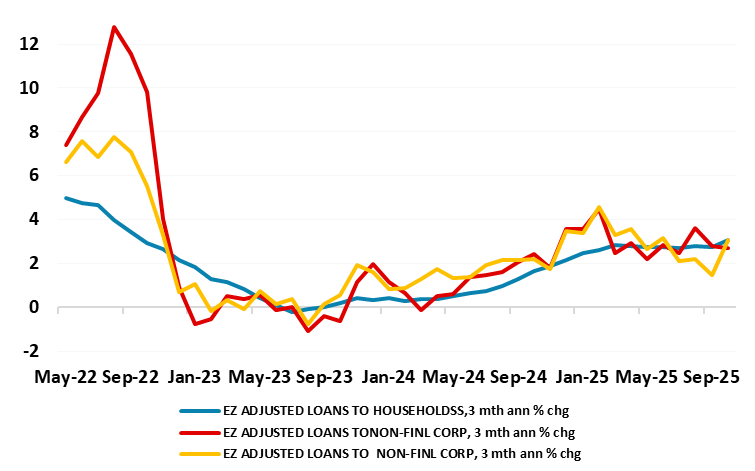

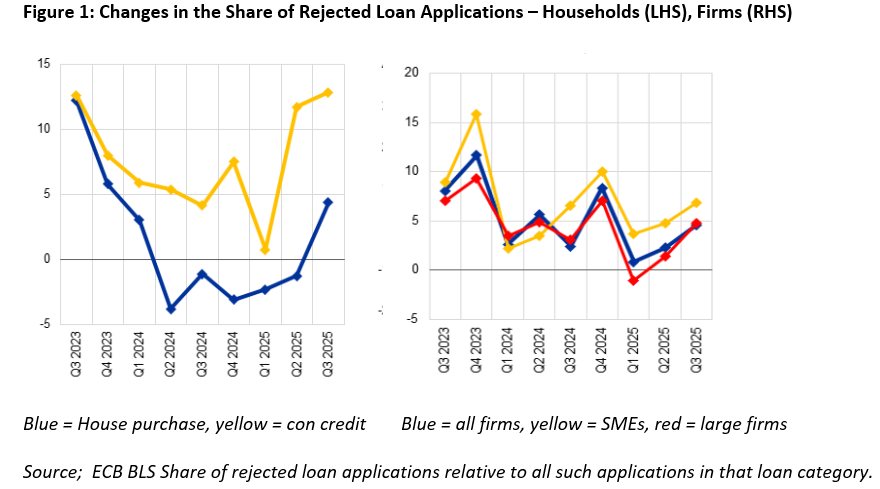

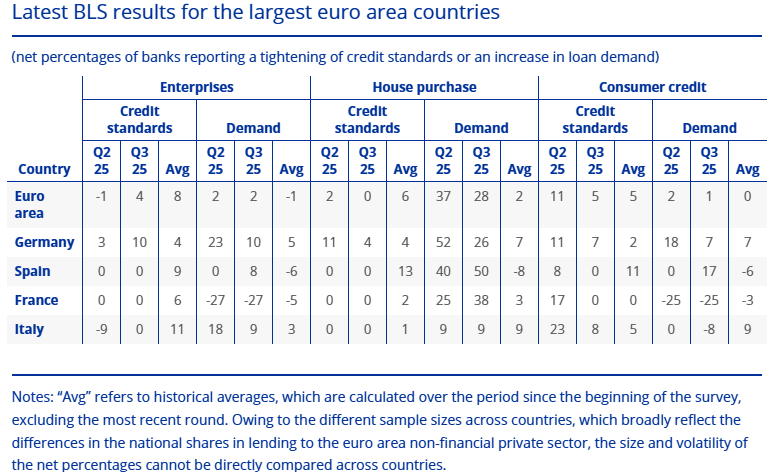

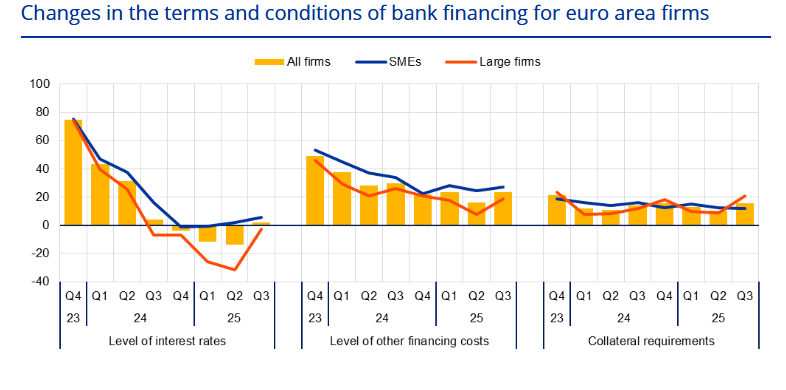

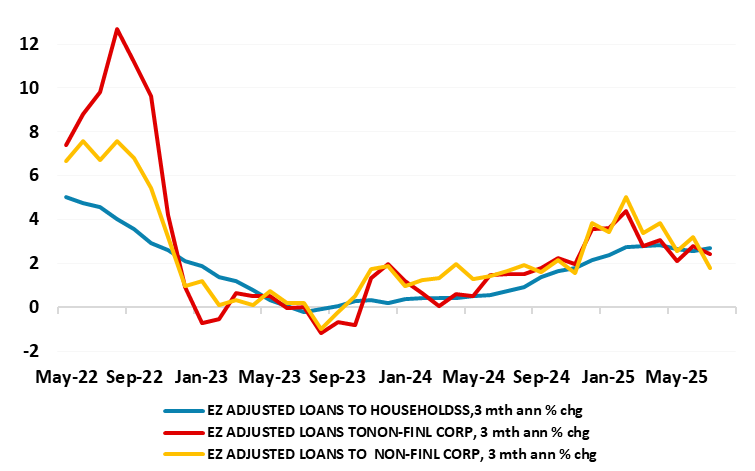

Hardly a surprise despite the ECB suggestions to the contrary as the reported net tightening credit standards merely accentuates trends in the two previous Bank Lending Surveys (BLS). This updated BLS therefore echoes what we have seen in other ECB surveys and in actual credit dynamics and thus un

October 27, 2025

ECB Monetary Worries Emerging as Corporate Credit Dynamics Weaken More Clearly

October 27, 2025 10:36 AM UTC

As a foretaste of the Bank Lending Survey BLS) due tomorrow, the ECB released two associated pieces of data today, both corroborating and continuing an ever worrying pattern, namely weakness in corporate credit. The data showed growth in later has fallen to its lowest in almost two years (Figure 1).

October 23, 2025

EZ HICP Preview (Oct 31): No Halloween Horror from HICP Update

October 23, 2025 12:09 PM UTC

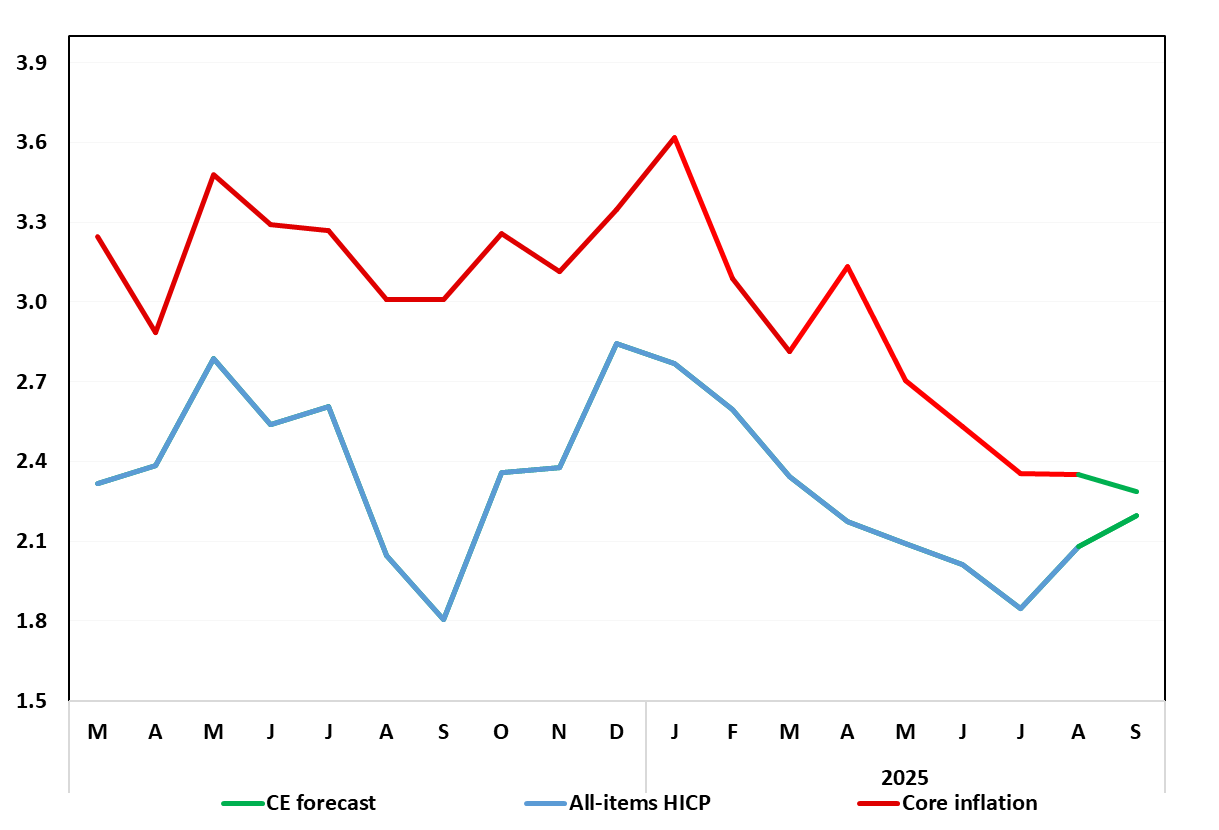

Mainly due to unfavourable base effects, EZ inflation has edged up in the last few months, but we think that this is temporary and that a fresh fall, possible to below the 2% target may occur in the October flash numbers – with a formal forecast of a 0.3 ppt drop to 1.9% and the core falling almos

October 22, 2025

Eurozone Flash GDP Preview (Oct 30): Resilience in the Dock?

October 22, 2025 9:11 AM UTC

As we highlighted repeatedly of late, for an economy that has seen repeated upside surprises and apparently above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. But we think this may shift as the ECB

October 21, 2025

ECB Preview (Oct 30): Assessing the ‘Punchbowl’

October 21, 2025 12:55 PM UTC

As with recent Council meetings, what is important when the ECB gives its next (almost certain) stable verdict on Oct 30, is not what it says. Instead, in particular, it is how much the impression is left that the easing window has not closed. The ECB is clearly split about whether policy has trou

October 20, 2025

German HICP Preview (Oct 30): Headline Core To Edge Down as Disinflation Resumes?

October 20, 2025 4:36 PM UTC

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But we see most, if not all, of this rise being reversed in

October 17, 2025

EZ Inflation Outlook: The Deeper Debate About 2028?

October 17, 2025 10:24 AM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Hawks perceive upside risks emerging while the dovish camp feels the opposite. These divisions are likely to magnify when the ECB updates its

October 10, 2025

Eurozone: Data Disappointments Off the ECB Radar

October 10, 2025 12:35 PM UTC

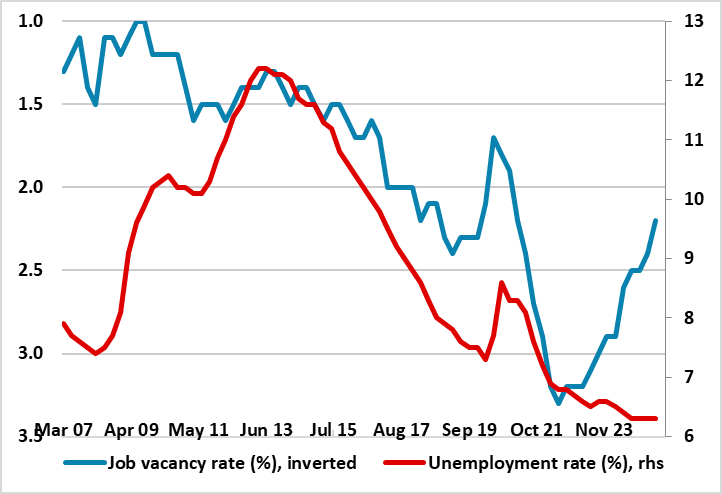

Although not fully high-profile,and mostly off the radar that the Council focuses on. the last few days have brought a series of data releases that will disappoint the ECB, certainly the hawks. These range from weak services production data, further signs of a loosening in the labor market and mor

October 09, 2025

ECB Council Meeting Account Review: Complacency Rules the Day as Financial Conditions Tighten!

October 9, 2025 12:52 PM UTC

Unsurprisingly there was little in the account of the ECB Council Meeting of 10-11 September to suggest any rush to change policy with it clear that members on both sides of the hawks vs doves debate wanted more data amid what was considered to be great uncertainty. Thus, the ECB offered little in

October 06, 2025

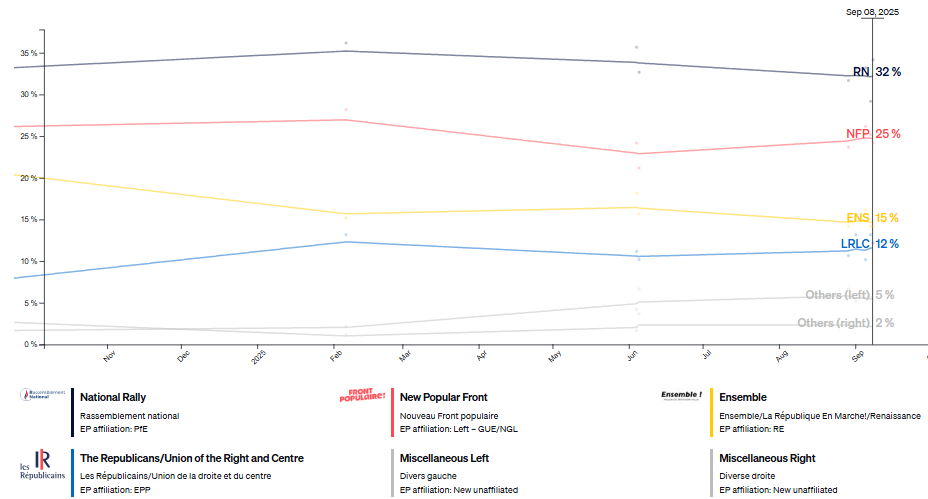

France: Prime Minister – Another One Bites the Dust

October 6, 2025 9:01 AM UTC

Either side of the English Channel, politicians are competing to see whether France or the UK can provide a prime minister with the shortest time in power. In the UK that was Liz Truss whose 49 days at the helm of the government in 2022 has now been surpassed by French PM Lecornu who has resigned

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

EZ HICP Review: Headline Inflation Moves Higher as Services Ticks Up From Cycle-low

October 1, 2025 10:28 AM UTC

A second successive upside surprise is unlikely to make inflation any more of an issue for the ECB at present. Instead, moderate concerns whether the apparent resilience of the real economy may yet falter should remain the order of the day, this possibly a result of a still somewhat unresponsive t

September 30, 2025

German HICP Review: Headline Higher And Core Rises Due to Fresh Services Push?

September 30, 2025 12:25 PM UTC

Germany’s disinflation process hit a further more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This (again) occurred largely due to energy base eff

September 24, 2025

EZ HICP Preview (Oct 1): Headline Inflation to Edges Higher as Services Slows to Fresh Cycle-low

September 24, 2025 10:54 AM UTC

As we have underlined of late, HICP inflation – at target for the last three months – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not be altered by the flash HICP dat

September 23, 2025

German HICP Preview (Sep 30): Headline Higher But Core to Fall Further?

September 23, 2025 2:21 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

DM Rates Outlook: Steepening Yield Curve The Old Normal?

September 23, 2025 7:53 AM UTC

• We continue to forecast further yield curve steepening across the U.S./EZ and UK, driven by cumulative easing. For the U.S. this can see a modest further decline in 2yr yields, but the prospect is for a move to a premium of 2yr to Fed Funds (unless a hard landing is seen). 10yr yields

September 22, 2025

Eurozone Outlook: Resilience or Irrelevance?

September 22, 2025 9:49 AM UTC

·· Yet again, and amid what may still be tightening financial conditions and likely protracted trade uncertainty, we have pared back the EZ activity forecast for 2026. However, the picture this year appears to be slightly better but this is largely a distortion and we think that the ec

September 11, 2025

ECB Council Meeting Review: Complacency Rules the Day!

September 11, 2025 2:08 PM UTC

A second successive stable policy decision was the almost inevitable outcome of this month’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. Also as expected, the ECB offered little in terms of policy guidance; after

September 09, 2025

France: Kicking the Fiscal Can (Again)

September 9, 2025 8:41 AM UTC

That France has seen the departure of yet another prime minister is no surprise, hence why financial markets took the confidence vote in its stride. Admittedly, French sovereign spreads and yields have risen in the last month, but even so the actual level of bond yields remains well below that of

September 03, 2025

ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

September 3, 2025 9:20 AM UTC

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council sugge

September 02, 2025

EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

September 2, 2025 9:34 AM UTC

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for Au

August 29, 2025

German HICP Review: Headline Back Higher But EZ Price Picture Still Reassuring?

August 29, 2025 12:12 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

August 28, 2025

ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

August 28, 2025 12:37 PM UTC

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy

August 26, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 21, 2025

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

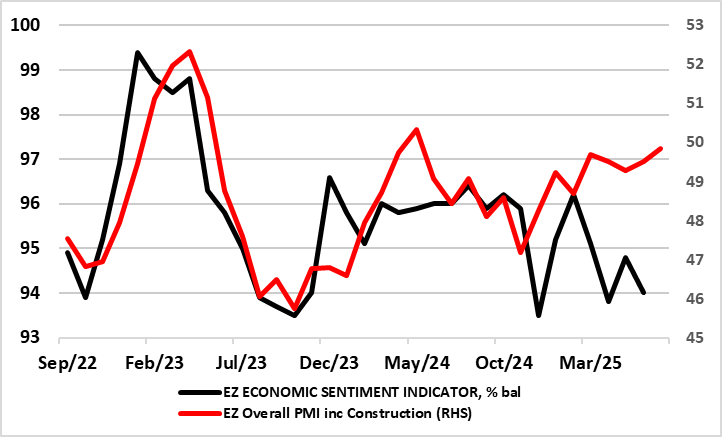

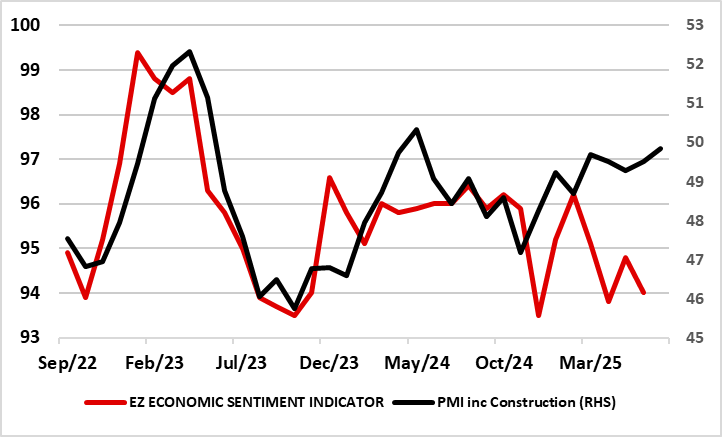

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

August 20, 2025

German Data Preview (Aug 29): Base Effects to Pull Headline Back Up - Temporarily?

August 20, 2025 1:39 PM UTC

Germany’s disinflation process continued, with the lower-than-expected July HICP numbers refreshing and reinforcing this pattern, with a 0.2 ppt drop to 1.8% y/y, a 10-mth low (Figure 1). This occurred in spite of adverse energy base effects albeit these likely to feature even more strongly in t

August 04, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 4, 2025 8:25 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

July 31, 2025

German Data Review: Services Inflation Slows Further?

July 31, 2025 12:39 PM UTC

Germany’s disinflation process continues, with the lower-than-expected July preliminary HICP numbers reinforcing this pattern, with a 0.2 ppt drop to 1.8%, a 10-mth low (Figure 1)! This occurred in spite of adverse energy base effects. Regardless, there was some reversal of June’s surprise and

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

Eurozone Flash GDP Review: Resilience or Irrelevance?

July 30, 2025 9:52 AM UTC

As we highlighted in our preview, for an economy that has seen repeated upside surprises and above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even after

July 29, 2025

EZ Real Economy – Diverging Sentiment Indictors Complicate Outlook

July 29, 2025 9:26 AM UTC

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been pr

July 28, 2025

U.S.-EU Trade Agreement: More a Framework Than a full Deal

July 28, 2025 9:08 AM UTC

In what seems to have been a fully-fledged political capitulation to the U.S. the EU, it seems, is accepting an agreement that would see an almost-blanket reciprocal 15% tariff on its exports to the U.S. But there still some imponderables, not least the range of sectoral concessions, whether EU me

July 24, 2025

ECB Review: Policy ‘On Hold’ Leaves Easing Door Open

July 24, 2025 1:48 PM UTC

Given the uncertainty overhanging policy makers worldwide, let alone in the EZ, the ECB was always likely to revert to stable policy after seven consecutive cuts which have taken the discount rate to its current 2%. In a much shortened statement, but which was more willing to highlight disinflatio

July 23, 2025

EZ HICP Preview (Aug 1): Headline at Target as Services Inflation at Fresh Cycle-low?

July 23, 2025 10:35 AM UTC

HICP, inflation – now at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation possibly accentuating Council divides. Despite adverse energy base effects, we see the flash July HICP staying at June’s 2.0% but up from May’s eig

July 22, 2025

DM Rates: QT adds to Budget Deficits Pressures

July 22, 2025 10:05 AM UTC

· Heavy issuance due to the U.S. budget deficit, plus Fed rate cuts will help further yield curve steepening in H2 2025. In EZ and UK, ECB and BOE QT is large and amplifies the amount of debt that the rest of the market has to absorb, which will also drives yield curve steepening al