Eurozone: Tighter Credit Standards By EZ Banks Confirmed

Hardly a surprise despite the ECB suggestions to the contrary as the reported net tightening credit standards merely accentuates trends in the two previous Bank Lending Surveys (BLS). This updated BLS therefore echoes what we have seen in other ECB surveys and in actual credit dynamics and thus underscores that banks are rationing the supply of credit as well as not fully passing on a clear lowering its costs (NB; the BLS noted a net increase in the share of rejected loan applications). As such the latest BLS both corroborates and continues an ever worrying pattern, namely weakness in corporate credit and which suggest ever more clearly that banks are increasing lending standards to firms, especially those exposed to the export sectors. The question is whether this is even more tangible evidence if the threat posed by U.S. tariffs is becoming more of a reality and that the ECB therefore needs to reassess its complacent view of the backdrop, particularly regarding credit dynamics the slowing in which we see as being driven by tight(er) financial conditions.

Figure 1: BLS Sees Tighter Credit Conditions for Firms

Source: ECB

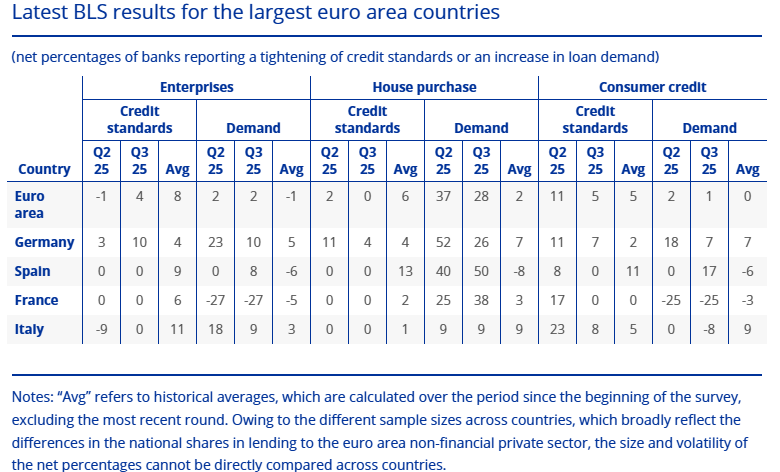

The (latest) October 2025 Bank Lending Survey (BLS), saw EZ banks report a small unexpected net tightening of credit standards for loans or credit lines to firms in the last quarter. Perceived risks to the industry or firm-specific situation and perceived risks to the economic outlook contributed to tighter credit standards, with the current high level of geopolitical uncertainty and risks connected to trade cited as reasons for discriminating across sectors or firms when issuing new loans. Several banks indicated more intensive monitoring and analysis. Across the four largest euro area countries, it was banks in Germany which reported the most overt a tightening of credit standards while banks in France, Italy and Spain reported unchanged credit standards. The net tightening was unexpected as, in the previous round, banks had anticipated that credit standards would be unchanged and it follows broadly unchanged credit standards in the second quarter.

Banks reported unchanged credit standards for housing loans and a moderate net tightening for consumer credit (net percentages of 0% and 5% respectively). Changes in banks’ risk perceptions were the main drivers of this tightening for consumer credit. Firms’ demand for loans increased slightly in the third quarter of 2025 but remained weak overall. Firms’ loan demand was supported in the third quarter by declining lending rates and by increased financing needs for debt refinancing or debt restructuring, while the impact of fixed investment, inventories and working capital was neutral. Several banks referred to a dampening impact on loan demand from global uncertainty and the related trade tensions.

Equally troubling, Banks reported a net increase in the share of rejected loan applications across all loan categories, with a more marked net increase for consumer credit. The net increase was larger than in the previous quarter and larger than the average reported since the beginning of 2024 across all loan categories. For housing loans, it was also the first net increase since the first quarter of 2024. The ECB reaction on Thursday to all of these monetary updates will be interesting – to put it mildly!