ECB Review: Hedging its Bets, Hoping to Stay in a Good Place

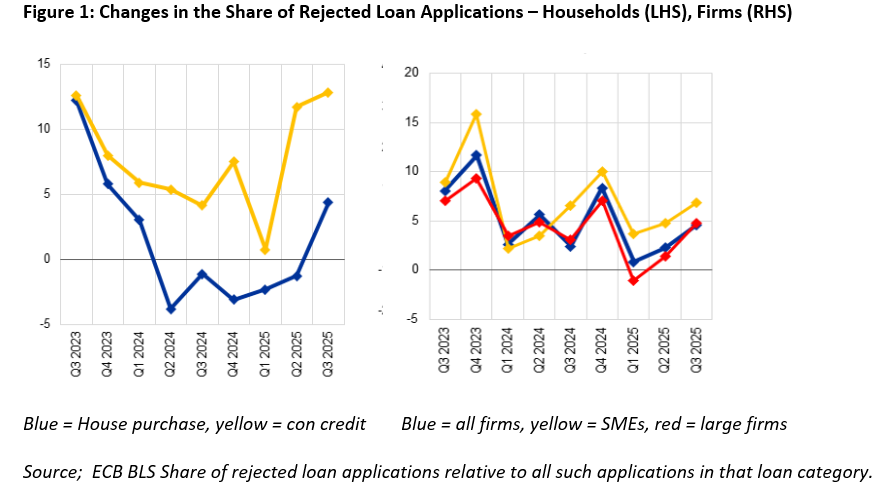

There ie nothing tangible in the ECB update today to suggest that a further easing is likely at the next meeting on Dec 17-18. However, amid a hint of what we think is a complacent upgrade about the EZ’s resilience alongside a perceived reduction in global risks, the easing window has not been closed. The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. But we feel that even if our call that a further rate cut may occur at the final Council meeting this year proves wrong then this merely defers what we still see up to 50 bp of easing through H2 next year. Moreover, the ECB will be loath to suggest anytime soon that the next move is more likely to be hike, not least as it may be reassessing an economic picture that it not as resilient as it has widely suggested and be wary that any such hints could turn current budget worries into a genuine fiscal crisis in parts of the EZ. In fact, the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it alleges (Figure 1) and where such banking sector wariness may be a sign that global risks have materialised rather than dissipated.

Council Divisions to Get Louder

Council divisions over the inflation outlook are likely to magnify when the ECB updates its projections again in December as this will include the first glimpse for 2028 where the outlook is even more uncertain that usual, complicated further by (necessary, tenuous and possibly revised) assumptions about the manner and timing of planned energy tariffs. These could actually take headline inflation back below 2% in 2028, albeit due to possible one-off base effects that would only stir deeper divisions with the Council. We, however, suggest that basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious.

President Lagarde today suggested that monetary transmission mechanism is running smoothly in every way. But as the recent ECB SAFE and BLS survey published earlier this week this is a complacent view. In fact, and hardly a surprise despite the ECB suggestions to the contrary as the reported net tightening credit standards merely accentuates trends in the two previous Bank Lending Surveys (BLS). This updated BLS therefore echoes what we have seen in other ECB surveys and in actual credit dynamics and thus underscores that banks are rationing the supply of credit as well as not fully passing on a clear lowering its costs (NB; the BLS noted a net increase in the share of rejected loan applications – for consumer as well as companies – see Figure 1). As such the latest BLS both corroborates and continues an ever worrying pattern, namely ever clearer weakness in corporate credit and which suggest ever more clearly that banks are increasing lending standards to firms, especially those exposed to the export sectors. The question is whether this is even more tangible evidence that the threat posed by U.S. tariffs is therefore becoming more of a reality rather than having diminished as is perhaps the central feature of the ECB update we received today – ie global risks and tensions have diminished. Thus while the ECB may feel it (and the EZ) is a ‘good place’ we are warier whether it can stay there or at least improve in the manner that the ECB is both implicitly and explicitly suggesting.

After all, our below consensus and ECB thinking outlook for GDP into 2026 does not depend on fresh weakness. Instead, the 0.8% projection for next year merely extends the Q3 result which is nothing more than a repeat of the underlying growth picture that the EZ has seen for the last two years or so. With this in mind, we feel that the ECB therefore needs to reassess its complacent view of the backdrop – and outlook - particularly regarding credit dynamics the slowing in which we see as being driven by tight(er) financial conditions.