ECB Review: Policy ‘On Hold’ Leaves Easing Door Open

Given the uncertainty overhanging policy makers worldwide, let alone in the EZ, the ECB was always likely to revert to stable policy after seven consecutive cuts which have taken the discount rate to its current 2%. In a much shortened statement, but which was more willing to highlight disinflation in labor costs, we still think this is a policy pause rather than a protracted hold, with rate cut likely to resume in September and probably once more again by end year. To us this reflects the added damage to both real activity and inflation that the rumoured circa-15% reciprocal U.S tariff will bring (Figure 1) but also because we think the ECB is under-estimating a disinflation picture reflecting still-tight financial conditions which is seeing slowing credit growth (Figure 2) and a softer labor market. As for this month’s ECB message, it is a clear wait and see, with the easing door left open as, after all, President Lagarde underlined policy now being on hold.

Figure 1: The ECB Tariff Scenario - Severe More Likely than Baseline?

Source: ECB June forecasts - baseline sees GDP growth of 0.9% (25), 1.1% (26) & 1.3% (27)

The EU, it seems, is willing to accept a deal that would see 15% tariffs on its exports to the U.S and possibly keep 50% on European steel but with other sectoral concessions for the likes of aircraft, spirits and medical devices. Possibly to save face, but also persuade Trump not to accentuate tariffs further, the Commission, is moving ahead with a possible arsenal of countermeasures, worth some EUR 93 bn (about 20% of EU exports to the U.S.). But this is posturing.

Regardless, a circa-15% deal will be seen by most as damage limitation in order to avoid an even more punitive 30% tariff that has been threatened. But in what may turn out to be more than 15% effectively, any such tariff would be more than the 10% rate the EU thought it would get just a few weeks ago and which forms the baseline for the ECB’s existing forecasts - something the latter clings to for the time being. But, although it is uncertain what the impact will be, we think that according to its recent scenario pictures, when the ECB updates its forecasts at the Sep 11 decision, it should be reining in both its inflation and growth outlooks more in line with its severe scenario (Figure 1). Indeed, the ECB largely sees tariffs as being disinflationary for the EZ and even if a trade deal is reached it may merely reduce current uncertainty not end it nor repair the damage it will cause. Albeit with likely Council divisions and possible dissents, this we envisage, should trigger a 25 bp cut on Sep 11, not least as the core 2026 and 2027 HICP readings are already down to 1.9%.

If so, this will hardly be the full story as our below consensus reflects other factors apart from the clear tariff threats.). Indeed, over and above what we think is over-optimism regarding the labor market, we think that the ECB has a complacent view on financial conditions and credit growth and this is why we see a further 25 bp cut by year end.

It is likely that the ECB bank lending survey (BLS) did play an important role in shaping ECB thinking this month, it still suggested that for firms with perceived risks related to the economic outlook continued to contribute to a tightening of credit standards. This came after the previous BLS made it clear that the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged.

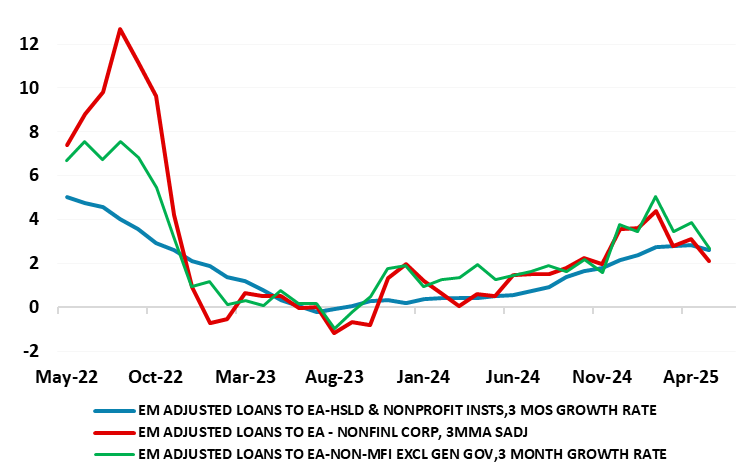

Figure 2: Credit Growth Already Softening Afresh – Notably on the NFC side

Source: ECB

And importantly, these concerns raised by banks may already be having a tangible negative impact. Indeed, while official credit growth data showed adjusted credit growth stable at 2.8% y/y in May (as President Lagarde underlined in her press conference), this masked a clear m/m softening, in both households but particularly non-financial company credit (Figure 2). Admittedly, this may be just more volatility but we (instead still) think this reflects banking wariness as highlighted in the BLS as well as what seems to be tighter financial conditions as opposed to a loosening in the latter that the ECB seem to discern, despite evidence to the contrary.

This tightening in financial conditions may also reflect another worrying message evident in a recent BLS as well as in some Council comments– namely that QT is not as neutral as the ECB has been alleging. This is something we have highlighted and think will trigger an ECB response in terms of slowing QT possibly in H2 this year.

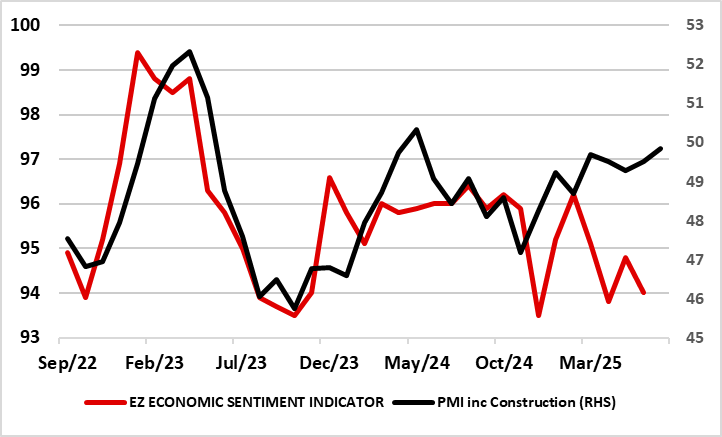

Figure 3: Business Surveys Offering Diverging Outlooks

Source; Markit, European Commission

Admittedly, the ECB pointed to EZ economic resilience, and may have drawn comfort from the slightly better PMI readings released earlier in the day, but we think this is hardly indicative of underlying activity, not least as alternative survey data paint a much more sobering picture (Figure 3). Regardless, the PMI still underscored that EZ disinflation trend continued and notably so in the closely watched service sector. It saw the stronger euro and US tariffs as likely to exert downward rather than upward pressure on inflation in the coming months. Overall, we see the combination of a less robust labor market and tight(er) financial conditions helping explain our below consensus (sub-1%) GDP outlook into 2026 and an ensuing persistent undershoot of the 2% inflation remit which may encompass a clear softening in services inflation in the next few months.