Eurozone Flash GDP Review: Resilience or Irrelevance?

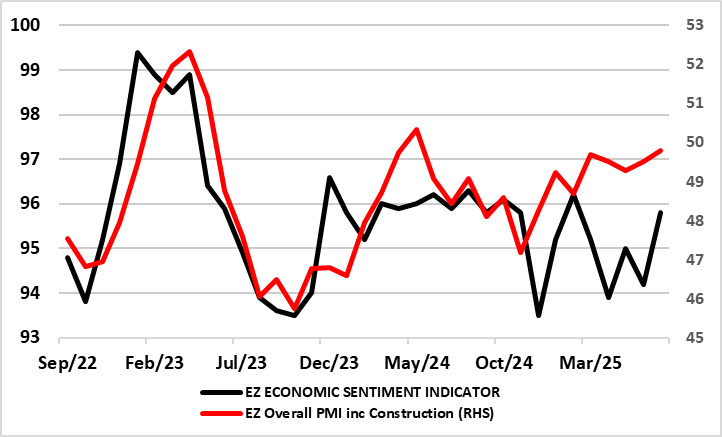

As we highlighted in our preview, for an economy that has seen repeated upside surprises and above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even after the Q2 data may show a modest upside surprise by rising 0.1% q/q (Figure 1). Admittedly, the data is down from what was an upwardly distorted Q1 result and comes with continued marked divergences within the main EZ economies. But while real economy considerations are now the major policy factor, the ECB seems to be in a much more risk management frame of mind and where policy freedom has been granted by clear disinflation. Those risks are obviously (but not solely) centred around the tariff outlook where amid what is still a lack of clarity of the details the recent agreement with the U.S. will largely be seen as pointing to the downside for both growth and inflation – something survey data still highlight (Figure 2). This helps explains our below consensus outlook for the EZ into 2026, even after a small upgrade to the 2025 outlook.

Figure 1: Weaker But Still Divergent EZ GDP Picture?

Source: Eurostat, Continuum Economics, Bloomberg

Continuing a series of upside surprises, EZ GDP overshot consensus in Q2, albeit coming in notch below ECB expectations. The data is still very much a correction back from the Q1 surge data (Figure 1), and chimes with upside risks hinted at by recent m/m increases in both manufacturing and construction that both conflict with softer survey messages but still show geographical divergences. Regardless, even though the flash GDP is released just a few weeks after the quarter it relates to, it may be even more effectively historic this time around. This is because the message it does provide will offer little guidance to the months and quarters ahead where the U.S tariff threat looms larger and threateningly, as the (admittedly somewhat better) EZ PMIs and European Commission survey data both very much highlight.

Notably, that above-trend growth in the last year came alongside what has been significant disinflation, this very much supporting our long-held view that weaker price pressures of late have been mainly supply driven and thus where weaker demand ahead could prolong, if not accentuate, such disinflation. Notably though, a weak(er) demand picture is reinforced both by the marked downgrade to the recent German economic backdrop and what looks like a sizeable involuntary inventory build in France. Indeed, both suggest more overall EZ spare capacity. It is questionable how businesses will react to the so-called trade deal with the U.S. But we think that with the European Commission data still very much below par this underscores a below-par growth outlook. We see flat to slightly negative GDP for this and the next quarter, now with 1.1% 2025 average growth but somewhat less in 2026 but with downside risks!

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been predicated on both a surge in Irish GDP as well as what was seems to have been an inter-related EZ export jump in anticipation of the US tariff imposition from April. In fact, whatever message imminent Q2 GDP numbers do provide will offer little guidance to the months and quarters ahead where the U.S tariff reality looms large and threateningly, as the EZ PMIs and European Commission survey data both very much highlight. But those alternative business survey readings are offering diverging signals (Figure 2), the Commission data very much undermined by a weak and possibly understandable manufacturing response that very much conflicts with the recent ECB assertion that ‘surveys point to an overall modest expansion in both the manufacturing and services sectors’. Given what is a very unfavourable trade deal with the U.S. we tend to identify more with the still sobering outlook (ie very much below par) offered by the Commission data, especially as fresh falls may be in the offing as the trade agreement takes effect!

Figure 2: Divergent Business Survey Complicate EZ GDP Outlook?

Source: European Commission, Markit, CE