EZ HICP Preview (Dec 2): Services Inflation Less Problematic?

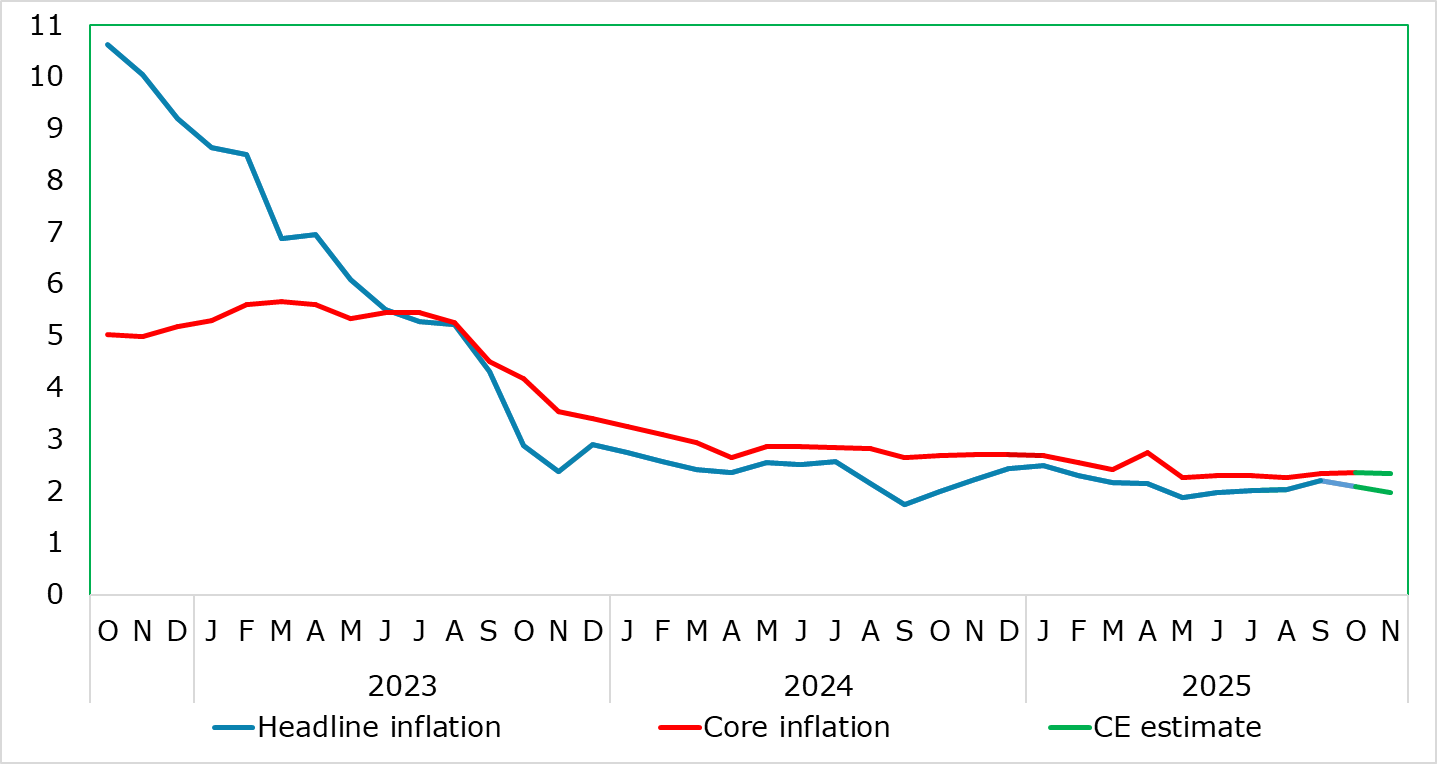

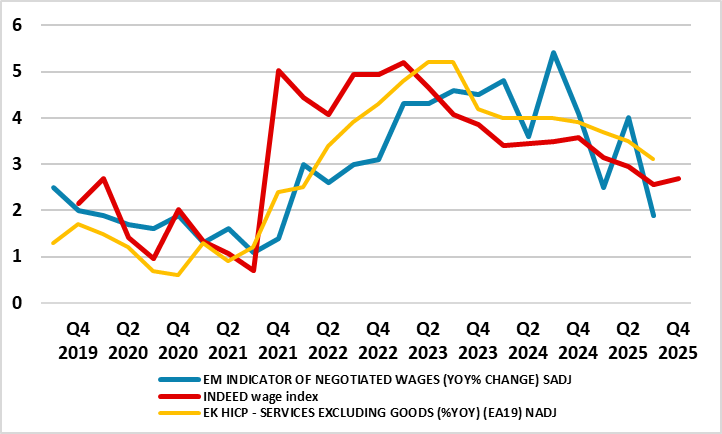

The HICP inflation picture has clouded somewhat of late at least to some. With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latter reflected a slight pick-up in services. However, we see this reversing and despite some m/m fuel rises, we see the headline down to 2.0% in the November flash and the core down similarly but to 2.3%. This chimes with adjusted data which, having also seen signs of services price resilience possibly re-emerging, overall soft core inflation is still evident as that same, adjusted m/m data (Figure 2) still show reassuring signs that suggest the ECB view for core inflation staying below 2% out to 2027 is very plausible. Thus is backed up also by wage (Figure 3) and business survey data (Figure 4)!

Figure 1: Headline Moves Back To Target as Services Edge Back Down

Source: Eurostat, CE, % chg y/y

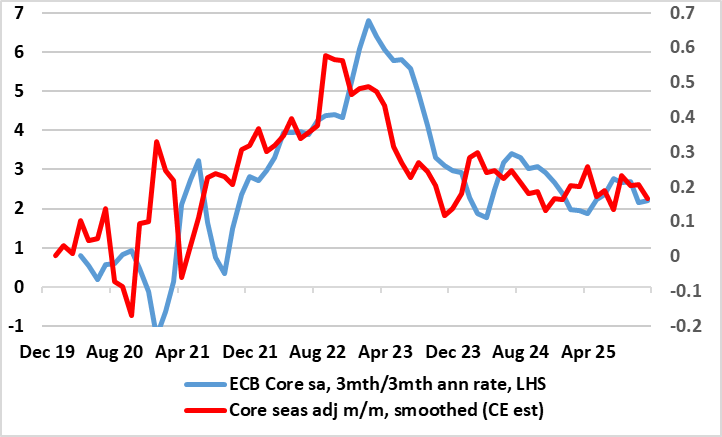

In contrast to food inflation in neighbouring economies (at least until recently), that for the EZ seems under control, actually slipping back further last month despite some adverse weather of late. Admittedly, services inflation, at 3.4% moved up further but from an August reading that was the lowest since March 2022 but despite this rise, it not only matches ECB thinking for the last quarter but still seems to be belatedly following in the footsteps of lower wage pressures (Figure 3) and where survey data for the sector also shows weaker price pressures. As a result, this trend and noise could bring the headline and core rate are seen dipping below 2% later in Q4 with base effects pulling the headline down toward 1.5% in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto. Notably, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core have reversed and are consistent with on-target inflation (Figure 2), albeit with some fresh spikes in adjusted services numbers!

Figure 2: Core Inflation Still Around, if not Below, Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE

This near-term outlook is actually shared by the ECB, which envisages headline HICP moving below and then staying below 2% target until H2 2027 but that the underlying rate (ex energy tariffs) nestling around 1.8%. Despite this benign outlook, the last Council meeting saw a clear(er) debate about the inflation outlook, where to many members the inflation outlook had softened slightly, because headline HICP is now seen undershooting the target not only in 2026 but also in 2027, and by an even wider margin when accounting for the upward effect on inflation from the introduction of the likely widening of the EU Emissions Trading System in 2027, the so-called ETS2.

Figure 3: Softer Wages Pressures imply Softer Services Inflation Ahead

Source: ECB, CE, Eurostat, % chg y/y

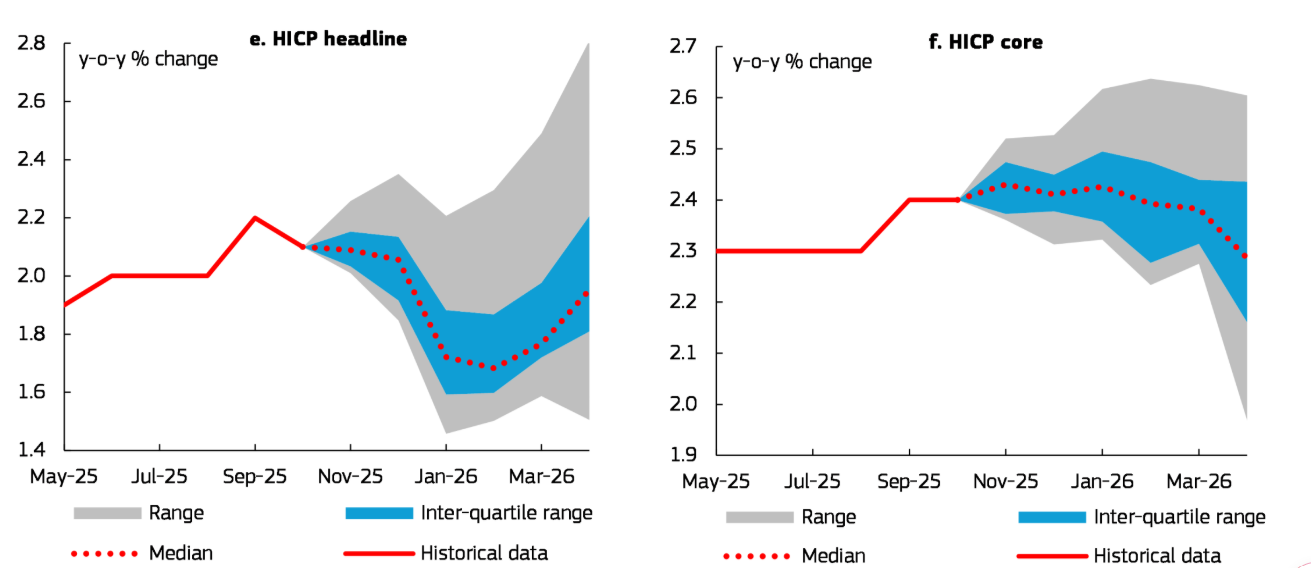

Price Survey Models Back up Softer Inflation Outlook

The outlook is backed up by survey data, notably the selling price expectations (SPE) figures in the monthly European Commission survey data. The outlook for near-term inflation emerging from models using SPE data remains broadly consistent with our projections. SPE models suggest that food inflation rebounds slightly until the end of the year, but then moderates in the first quarter of 2026, albeit with visible upside risks as indicated by increases in the upper quartile of the forecast range. SPE models confirm the stability of inflation in non-energy industrial goods within the 0.7-0.8% range. Information embedded in SPEs suggests that services inflation is expected to remain broadly stable until January 2026, before moving closer towards 3% in early April.

Figure 4: Business Survey Price Expectation Suggest Lower Inflation Ahead

Source: CE, European Commission

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.