ECB Council Meeting Account Review: Complacency Rules the Day as Financial Conditions Tighten!

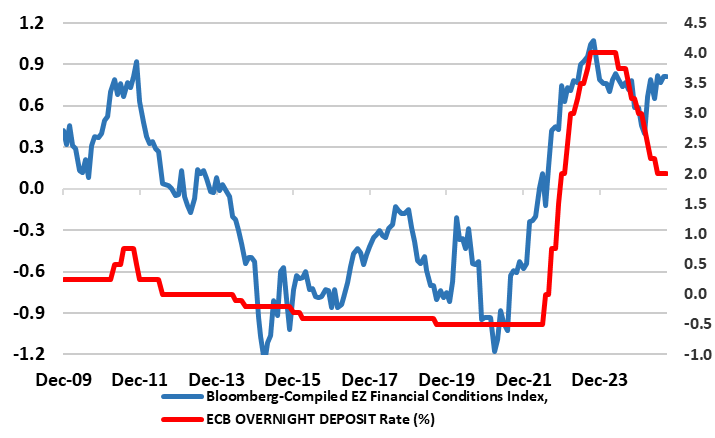

Unsurprisingly there was little in the account of the ECB Council Meeting of 10-11 September to suggest any rush to change policy with it clear that members on both sides of the hawks vs doves debate wanted more data amid what was considered to be great uncertainty. Thus, the ECB offered little in terms of policy guidance, albeit with the wording of the account implying perhaps more members seeing downside inflation risks than those seeing them biased to the upside. Little may be gleaned either from updated economic projections which only goes to show that an upward revision to the growth picture can be associated with a drop in underlying price pressures. All of which implies that even with growth risks seen as more balanced, this does not mean that disinflation cannot continue. The ECB may now be in mode in which something will now have to trigger further easing, but we think this will occur given tariffs and what are tight(er) financial conditions (Figure 1) likely to mean an undershoot of what we think is complacent and somewhat superficial ECB growth thinking.

Figure 1: EZ Financing Conditions Tightening Despite Policy Easing

Source; ECB, Bloomberg, CE

The overall tone was very much of no immediate pressure to change policy rates. Uncertainty could justify keeping interest rates unchanged. In particular, the current situation was likely to change materially at some point, but it was currently difficult to know when and in which direction. This is telling as the account highlighted worries also signalled by the IMF and the BoE yesterday, namely that the ECB in September were wary that elevated asset valuations in some market segments increased the risk of sudden and sharp price corrections if the current favourable risk sentiment were to deteriorate.

While economic projections were little changed on a net basis, it was contended that the resilience of the euro area economy meant that it remained in relatively good shape, despite the dramatic change in trade policy in the current year and overall geopolitical uncertainty. This supported the view that the strength in GDP growth in the first half of 2025 could not be explained by frontloading alone. At the same time, it was argued that growth had remained weak overall and vulnerable to several downside risks, including from persistent trade policy uncertainty, China’s re-routing of goods, an appreciation of the euro and political uncertainty.

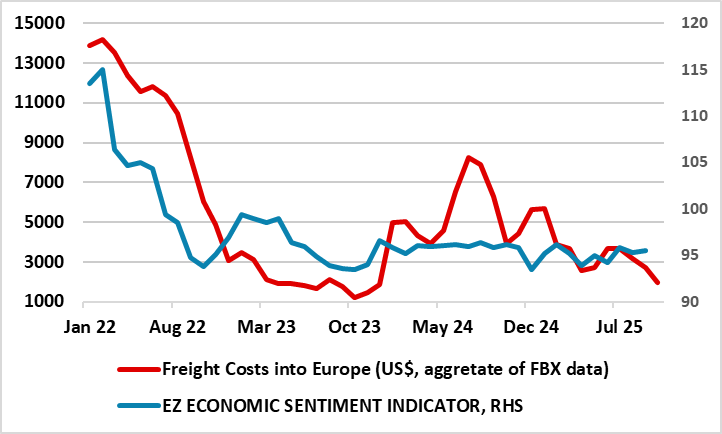

Even so, members assessed that risks to economic growth had become more balanced, something we think is complacent and based on too excessive focus on PMI data which have neither the sector or country breadth of European Commission data which suggest a more sobering backdrop. Indeed, as Figure 2 shows, this weak European Commission survey backdrop chimes with swings in freight prices into Europe and where the increasing recent weakness in the latter is indicative of a weak(er) domestic EZ economy as well as a further disinflation factor.

Figure 2: EZ Weakness Pulling Down Freight Costs

Source; Bloomberg, CE, European Commission, FBX Global

We think this weakness partly reflects a backdrop where despite the falls in ECB policy rates and Council assertions to the contrary, tighter financing conditions are actually increasingly evident (Figure 1) as the stronger euro, higher sovereign rates and spreads and an only moderate pass though of rate cuts to borrowers takes effect. Moreover, this Bloomberg computed measure of financing conditions may be underplaying the effective rise as (even the ECB accepts) EZ banks have been de-risking by skewing their corporate lending away from risky firms towards safer ones, something that the next bank lending survey (Oct 28) may corroborate, in turn highlighting that part of any decline in the observed cost of borrowing for firms could therefore partly reflect a compositional effect, which might mask true borrowing costs.

As suggested above, while the ECB may now be in mode in which something will now have to trigger further easing, we think this will occur given what are tight(er) financial conditions likely to mean an undershoot of ECB growth thinking. Thus, data dependence will probably trigger two more 25 bp cuts, probably late this year and early next, with at least one such move consistent with the ECB’s modest medium-term projected inflation undershoot of target!

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.