ECB Preview (Oct 30): Assessing the ‘Punchbowl’

As with recent Council meetings, what is important when the ECB gives its next (almost certain) stable verdict on Oct 30, is not what it says. Instead, in particular, it is how much the impression is left that the easing window has not closed. The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. But we feel that even if our call that a further rate cut may occur at the final Council meeting this year (Dec 17-18) proves wrong then this merely defers what we still see up to 50 bp of easing through H2 next year. Moreover, the ECB will be loath to suggest that the next move is more likely to be hike, not least as it may be reassessing an economic picture that it not as resilient as it has widely suggested and be wary that any such hints could turn current budget worries into a genuine fiscal crisis in parts of the EZ. In fact, the ECB may be starting to acknowledge that the outlook is clouded by a policy backdrop where financial conditions are tightening afresh and where this trend would intensify if formal rate hikes were even floated, let alone flagged.

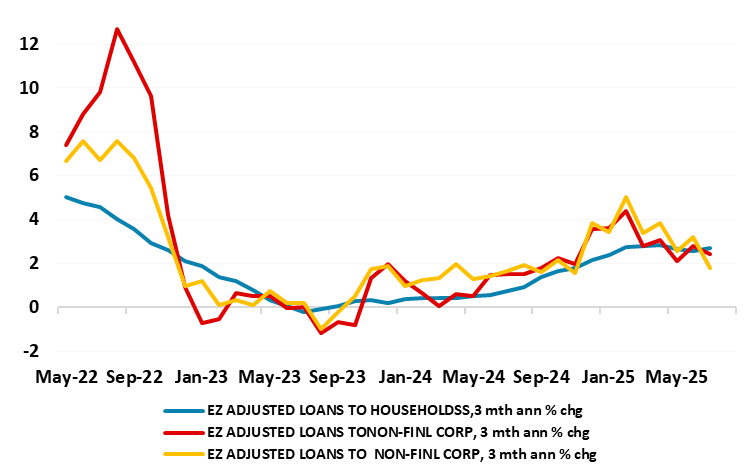

Figure 1: Credit Growth Already Softening Afresh – Notably on the NFC side

Source: ECB

Divisions Ever Louder

These divisions are likely to magnify when the ECB updates its projections again in December as this will include the first glimpse for 2028 where the outlook is even more uncertain that usual, complicated further by (necessary, tenuous and possibly revised) assumptions about planned energy tariffs. These could actually take headline inflation back below 2% in 2028, albeit due to possible one-off base effects that would only stir deeper divisions with the Council. We, however, suggest that basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious. In this regard, the October ECB meeting will be influenced by a series of economic released due in the immediate period ahead.

Are Banks Warier?

First, Tuesday’s (Oct 28) updated bank lending survey (BLS) will play an important role in shaping ECB thinking this month, not least as it suggested in the last two assessments that for firms with perceived risks related to the economic outlook continued to contribute to a tightening of credit standards. Indeed, July’s BLS made it clear that the tariff threat was taking a toll on banks’ willingness to lend and firm’s appetite to borrow even in March, ie well before the possible scale and breadth of the tariff threat emerged. Indeed, it does seem as if what credit growth there is is increasingly concentrated among larger and less risky firms. Indeed, results from the ECB survey on the access to finance of enterprises (SAFE) confirm that small firms have experienced a more muted decline in external financing costs than larger producers. Moreover, as the September Council meeting noted, banks have been de-risking by skewing their corporate lending away from risky firms towards safer ones. Thus, the decline in the observed cost of borrowing for firms could therefore partly reflect a compositional effect, which might mask true (and somewhat higher) borrowing costs – does this imply that the looming new BLS will corroborate that banks have become less willing to lend? If so, the ensuing change in borrower composition and the muted risk appetite of banks point towards the risk-taking and balance sheet channels of monetary policy operating less strongly for lower-income households and smaller firms during the easing cycle. Since these groups typically have higher marginal propensities to consume and invest, this heterogeneity in transmission may reduce the effectiveness of recent interest rate cuts in stimulating aggregate demand in the current context of high global uncertainty, this the view of ECB Chief Economist Lane.

Credit Growth Slowing – Already!

And importantly, any such concerns raised by banks may already be having a tangible negative impact. Indeed, while official credit growth data showed adjusted credit growth stable at 2.8% y/y in (as President Lagarde underlined in her press conference), this masked a clear m/m softening, in both households but particularly non-financial company credit (Figure 1) and it will be interesting whether the September money and credit data (Oct 28) continues this weaker trend. Admittedly, this may be just more volatility but we (instead still) think this reflects banking wariness as highlighted in the BLS as well as what seems to be tighter financial conditions as opposed to a loosening in the latter that the ECB seem to discern, despite evidence to the contrary. This tightening in financial conditions may also reflect another worrying message evident in a recent BLS as well as in some Council comments– namely that QT is not as neutral as the ECB has been alleging. This is something we have highlighted and think will trigger an ECB response in terms of slowing QT now more likely in the new year.

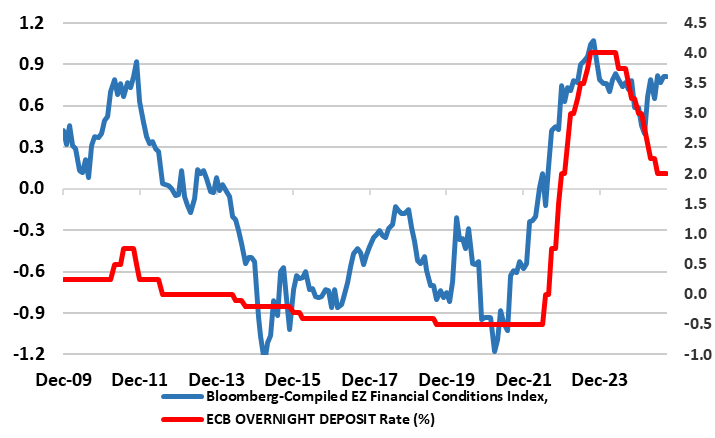

Figure 2: EZ Financing Conditions Tightening Despite Policy Easing

Source; ECB, Bloomberg, CE

Financial Conditions Far From ‘Normal’

As for financial condition indices (FCI), this is a concept of increasing note to the ECB and occupied much of the analysis by Lane (see above). The idea is that FCIs extend the concept of the monetary policy stance to a wider set of financial markets and beyond the level of accommodation or restrictiveness that is under the central bank’s direct control. Lane introduced a new “Macro-Finance” FCI that has been developed by ECB staff in order to overcome the lack of feedback problem. This basically suggest that despite a clear easing of late, the level of the FCI remains well above its historical sample average. It also notes that in period of marked uncertainty, monetary transmission is markedly weakened. This implies that a more powerful monetary intervention is required to deliver a given policy objective, all of which undermines any use of any particular official interest rate being able to offer whether the overall monetary stance if neutral, restrictive or loose. Indeed, the Lane assessment would back up our idea that EZ financial conditions are still tight in both absolute and relative terms and probably getting tighter in spite of cuts in official rates (Figure 2).

Resilience Questionable?

This help explains the still weak and likely even weaker economic backdrop to come, something that the third piece of important data next week may see, namely Q3 GDP (Oct 29-30). We see a flat q/q outcome for the EZ with the usual divergences among the member states. This is sub-consensus but not out of kilter with underlying EZ GDP trends of late which contrast very much with the cumulative 0.7% gain seen in H1 this year. Indeed, as for the EZ economy’s reslience of late, perspective is needed, perhaps more so than usual. As we have stressed before, recent GDP data gains have been predicated on both a surge in Irish GDP as well as what was seems to have been an inter-related EZ export jump in anticipation of the US tariff imposition from April. However, ex Ireland, EZ GDP has averaged around 0.2% q/q in the last 6-8 quarters, a run of data very much consistent with our 2026 GDP picture where we see no repeat of what has been profit-swing related Irish growth of late. The outlook is complicated by diverging business surveys with the EZ PMIs and European Commission survey data offering diverging signals, the Commission data very much undermined by a weak and possibly understandable manufacturing response that very much conflicts with the recent ECB assertion that ‘surveys point to an overall modest expansion in both the manufacturing and services sectors’.

As suggested above, given what is a very unfavourable trade deal with the U.S. we tend to identify more with the still sobering outlook (ie very much below par) offered by the Commission data, especially as continued weakness may be in the offing as the trade agreement takes effect!As for policy, it was former Federal Reserve Chairman William McChesney Martin, who suggested that a central banker’s task was to take away the punch bowl (ie tighten policy) when the party (economic expansion) gets going to prevent overheating and inflation. For the EZ, we would suggest that the part has been lacklustre and that, if anything, the ECB should, be adding to a punchbowl that is nowhere near full

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.