EZ HICP Review: Services Inflation Still Problematic?

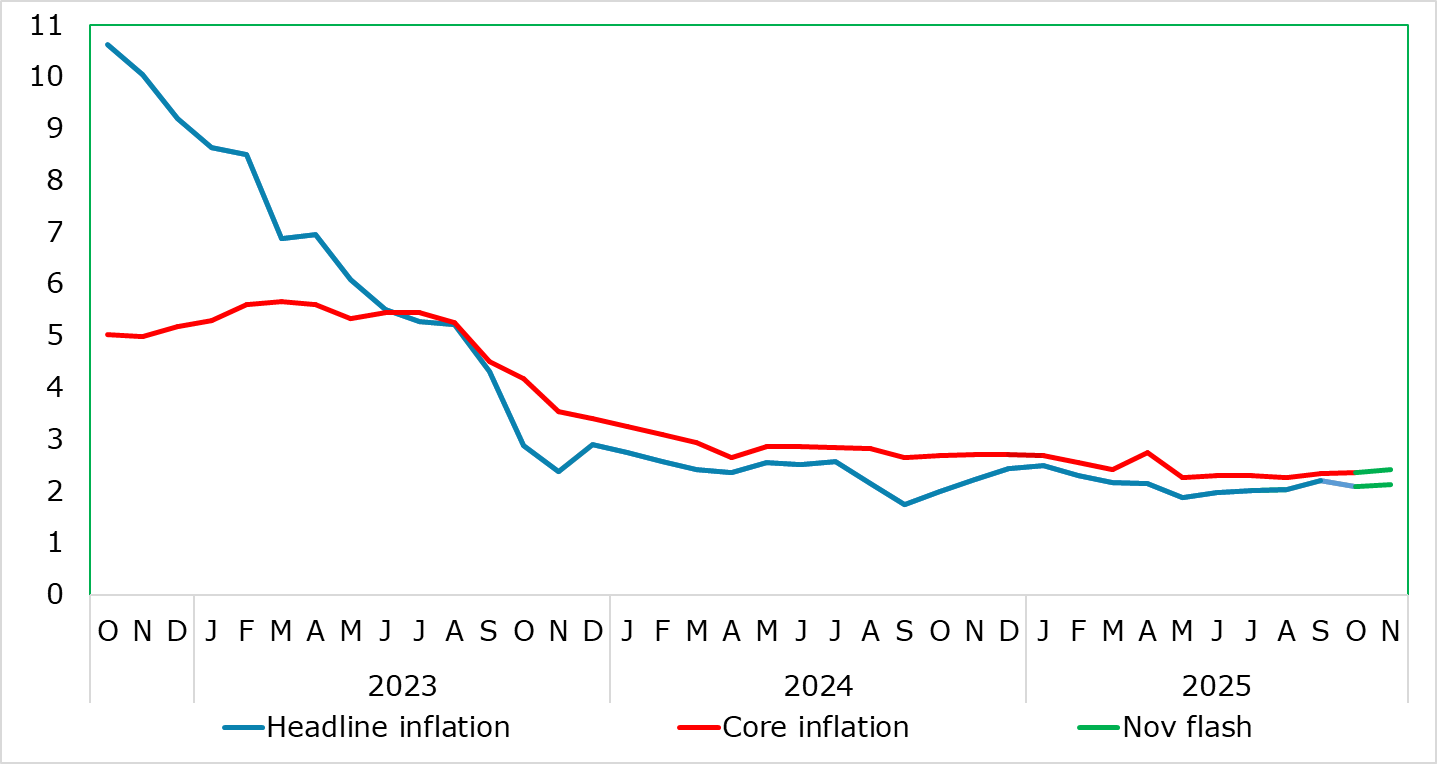

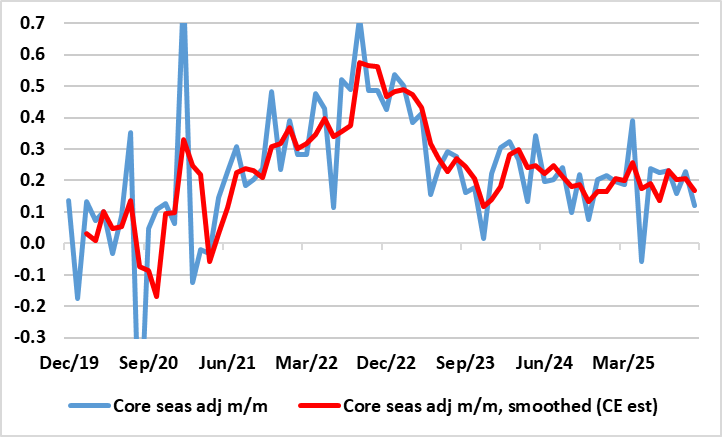

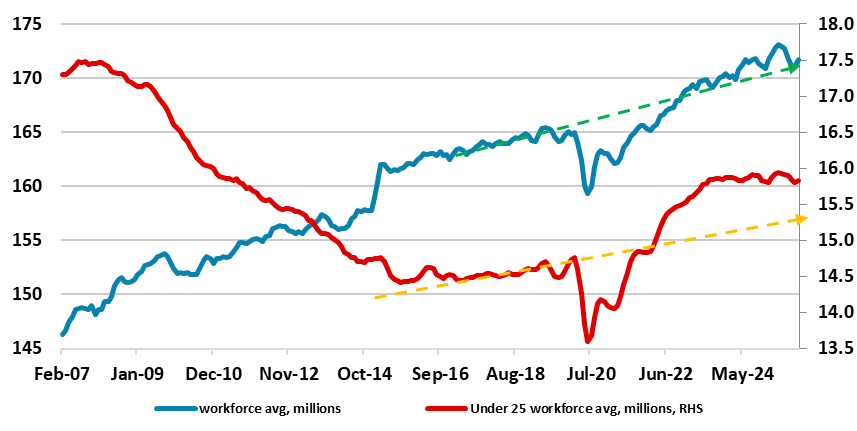

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above both consensus and probably ECB expectations. But the diehard hawks at the ECB will focus on the small further rise in services inflation to a seven month high of 3.5%, a shift higher echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, core inflation stayed at 2.4% (Figure 2) still supporting an ECB view for core inflation staying below 2% out to 2027 is very plausible. Thus is backed up also by (much softer) wage data which also very much suggest that the pick-up in services inflation is spurious and where more abundant labor supply is evident (Figure 3)!

Figure 1: Headline and Services Edge Back Up

Source: Eurostat, CE

In contrast to food inflation in neighbouring economies (at least until recently), that for the EZ seems under control, actually slipping back further in October and staying at 2.5% last month despite some adverse weather of late. Admittedly, services inflation, at 3.5% moved up further but from an August reading that was the lowest since March 2022 but despite this rise, it still seems to be belatedly following in the footsteps of lower wage pressures. Moreover, labor market data released today alongside that are showing a still clear rising workforce (Figure 3) may explain such weaker cost pressures.

Figure 2: Core Inflation Still Around Target in Shorter-Term Dynamics?

Source: Eurostat, ECB, CE

As a result, this trend and noise could bring the headline and core rate are seen dipping below 2% this month with base effects pulling the headline down toward 1.5% in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto. Notably, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core had reversed and are consistent with on-target inflation (Figure 2), albeit with some fresh further spikes in adjusted services numbers!

Figure 3: Softer Wages Pressures Due to Increasing Workforce?

Source: CE, Eurostat

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.