ECB Preview (Dec 18): Still in Good Place – or Even Better?

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation and even growth risks lie. But the ECB Council is likely to reassert that downside growth risks have dissipated somewhat, so that the current policy stance ‘in a good place’. Regardless, we think that the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it alleges and where tariff related uncertainty persists. Thus we still see up to two more 25 bp cuts with the likely resulting discount rate of 1.5 % then being on hold until after 2027. What will be interesting will be the ECB’s first glimpse into 2028!

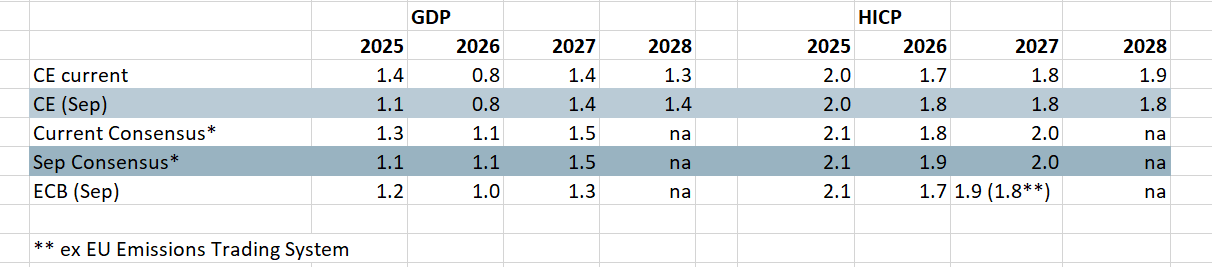

Figure 1: ECB Projections in Perspective

Source: ECB, Bloomberg, CE

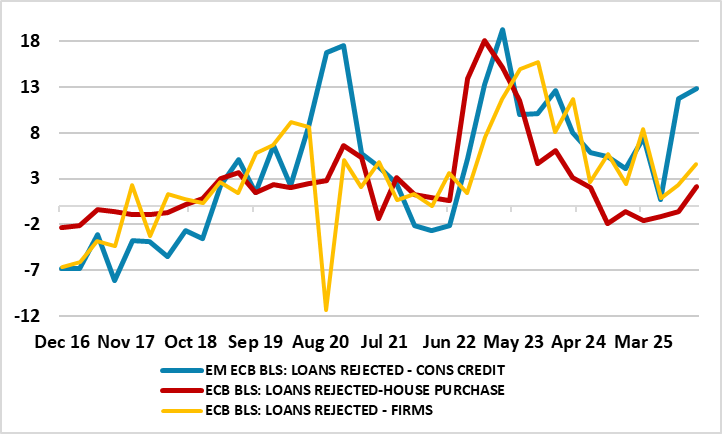

We see an array of indicators that trouble us - both in terms of survey data but particularly on the monetary side. Notably, even in nominal terms, private sector credit growth has slowed. Moreover, we have highlighted several symptoms of a monetary policy transmission mechanism that, rather than functioning smoothly and effectively, is doing the very opposite and maybe increasingly so. These include survey evidence suggesting banks being increasingly willing to reject loan applications completely (Figure 2), something completely overlooked at the last ECB meeting, at least as far as the official account suggests! We suggest that this fresh sign of banking sector wariness may be a symptom suggesting that global risks have materialised rather than dissipated. Notably, the recently released ECB Financial Stability Review (FSR) offers perhaps a less complacent picture, actually explaining why bank lending may have slowed of late.

In particular, the fresh increase in consumer loan rejections and the very modest drop in effective lending rates to the household sector can be seen in a perspective where consumer lending has shown signs of a mild deterioration in asset quality in recent quarters. According to the FSR, this is evidenced by a gradual, albeit contained, rise in aggregate non-performing loan ratios for consumer loans since late 2023. The concern voiced by the FSR is that while aggregate unemployment remains low, these developments, along with the recent slowdown of real wage growth, suggest that a subset of consumers with lower incomes could become financially constrained. This is particularly the case if economic conditions were to weaken more than currently expected, possibly leading to a further deterioration of asset quality in this loan portfolio. This suggest that signs of weaker consumer credit growth may be more supply orientated than demand.

Figure 2: Banks Now Rejecting More and More Loan Applications

Source: ECB BLS, % balance

But the more discernible slowing in corporate credit growth may be more demand determined. The FSR notes that EZ corporates continue to face elevated debt servicing costs. While the recent cuts in interest rates have reduced costs for new corporate borrowing, the stock of outstanding debt is continuing to reprice at less favourable conditions, keeping debt service ratios elevated. Survey data show that most firms believe their financial positions are under strain from weaker external demand, which is squeezing their profitability. All of which suggests that such fresh signs of banking sector wariness that may be a sign that global risks have materialised rather than dissipated.

Admittedly, the ECB will upgrade its economic projections, most notably for this year, albeit failing to signal - let alone acknowledge - that recent above expectations GDP data gains have been predicated on both a surge in Irish GDP as well as what was seems to have been an inter-related EZ export jump in anticipation of the US tariff imposition from April. Thus the below-consensus 2026 outlook we see for 2026, namely 0.8%, is actually merely an extension of the ex-Ireland EZ GDP average growth rate of around 0.2% q/q in the last 6-8 quarters.

Against this backdrop, we remain somewhat sceptical about the apparent resilience, if not robustness, some are asserting about the EZ economic backdrop and even outlook. For a start, for an economy that has seen repeated upside GDP surprises, and apparently above trend growth, now some 1.4% in the year to Q3, GDP data do not seem to have much impact in derailing disinflation. Indeed, we continue to see sub-2% target inflation now through into 2027 and where the projection for the latter may be too high depending on whether EU Emissions Trading System levies will be applied (they may be deferred until 2028). Moreover, HICP inflation is seen dipping clearly into early-2026, possibly to 1.5%, something flagged by business survey selling price expectations. We continue to assert that weaker price pressures of late have been mainly supply driven. Thus, with weak(er) demand ahead (household spending is seen with further growth of just over 1% this and the following two years rising just ahead of disposable incomes) this should prolong, if not accentuate, such disinflation.

The ever-clearer Council divisions are likely to magnify when the ECB updates its projections again this month as this will include the first glimpse for 2028 where the outlook is even more uncertain that usual, complicated further by (necessary, tenuous and possibly revised) assumptions about planned energy tariffs (ETS2). As Figure 1 shows, according to current ECB thinking, ETS2 may add 0.2 ppt to inflation through 2027, this causing the pick-up in the headline to 2.0% by the end of that year – ex food and energy/ETS2 inflation stays at 1.8% by end-2027. However, at this juncture, while it is too early to assess how ETS2 would affect headline inflation over the longer term, the inflationary impact in 2027 might be short-lived, so that any one-off adjustment could unwind in 2028, pulling the headline back down to well below 2%. This s is important as politics suggest there is a risk that national governments might delay or only partially implement ETS2, which could lead to a more pronounced HICP undershoot in 2027 albeit with a higher-than-otherwise projection for 2028 a possible result.

We, however, suggest that basing policy on the spurious accuracy of forecasts three years out is both misleading and counter-productive. Instead, our continued call for still-lower ECB rates is based around the fact that financial conditions have tightened since the last ECB rate cut, both because of market swings but also by what may be banks being more cautious.

We still see a further two 25 bp rate cuts by mid-year and policy then being on hold into and through 2027. But even if ECB easing has ended, it is hard to see any early policy reversal, not least as it is difficult to see HICP inflation picking up strongly given both weakening jobs and wage growth and both direct and indirect tariff repercussions. The ECB may also be wary that any early hiking would only accentuate fiscal plights in some countries, thereby making what are currently budget problems turning into possible fiscal crisis. It will also be wary that it could add upward pressure to the euro, already at record highs in trade weighted terms, this clearly seen as disinflation issue for the ECB.