ECB – In a Good Place or Just Complacent?

The ECB is of the view that downside growth risks have dissipated somewhat, this possibly helped by its recent actions which it suggests leave its current policy stance in a good place. However, amid a hint of what we think is a complacent upgrade about the EZ’s alleged resilience, we think, the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it maintains. We present what we consider to be several symptoms of a monetary policy transmission mechanism that, rather than functioning smoothly and effectively, is doing the very opposite and maybe increasingly so. Indeed, it shows both signs of a lack of supply of credit as well as clear indication that the cost of credit is not fully reflecting ECB easing. We would suggest that such signs of banking sector wariness may be a sign that global risks have materialised rather than dissipated, reasons why we think the ECB has more easing ahead of it.

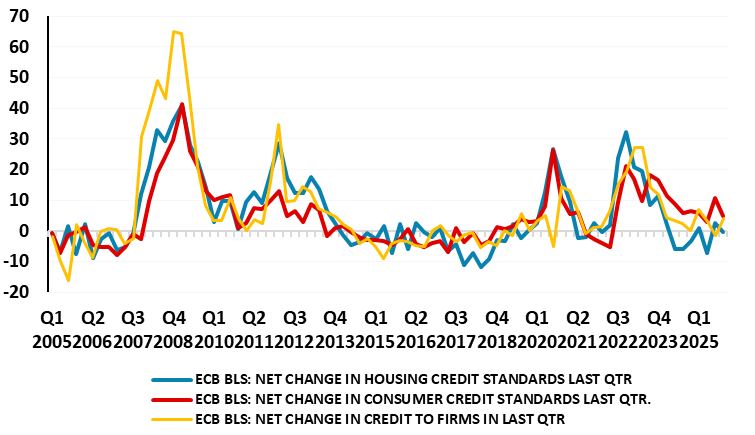

Figure 1: Banks Tightening Credit Standards Afresh

Source: ECB BLS, % balance

At the last ECB press conference on Oct 30 President Lagarde suggested that the ECB’s monetary transmission mechanism is running smoothly in every way and that policy was in a good place. In particular, she noted that ‘Everything that we see in terms of transmission leads us to believe that transmission is effective, is very much on time, and the numbers that we see in terms of interest rates charged to corporates, interest rates charged to mortgages, lead us to believe that that transmission is not impaired at all, but is functioning well’. This view has been echoed more recently by Frank Elderson, both a Council Member and Vice-Chair of the ECB’s Supervisory Board.

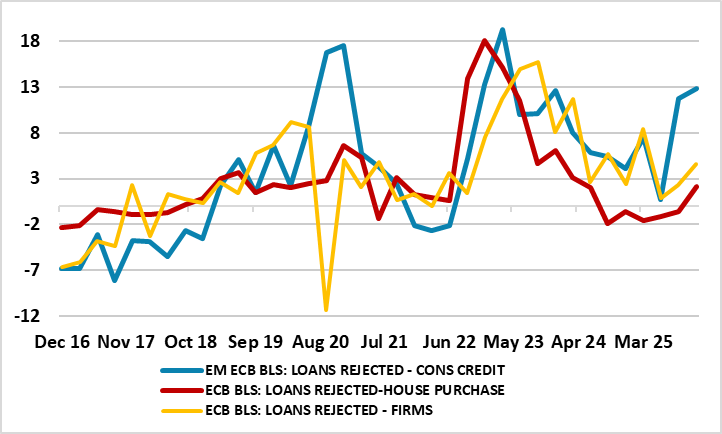

But both the recent ECB Survey of Access to Finance for Enterprises (SAFE) and the Bank Lending Survey (BLS) - published late last month but ahead if the Council meeting - suggests these are complacent views. In fact, and hardly a surprise despite the ECB suggestions to the contrary is that the reported net tightening credit standards merely accentuates trends in the two previous BLS. As such this is the first symptom of banks wariness if not unwillingness to lend (Figure 1) and on a broad basis, reflecting more circumspection in regard to lending to firms and households. This updated BLS therefore echoes what we have seen in other ECB surveys and in actual credit dynamics and thus underscores that banks are rationing the supply of credit. Admittedly, and as Figure 1 also shows, the extent of recent credit standard tightening is not significant historically, albeit unusual for this part of a monetary easing cycle yet to be ended. But more unusual, and seemingly more worrisome, is that banks are seemingly more willing to reject loan applications completely rather than just attach stricter credit standard criteria (Figure 2). This is very unusual for this part of the cycle, although the fact that loan rejections are the clearest for consumer credit is less surprising given the lack of collateral.

Figure 2: But Now Banks Also Rejecting More Loan Applications

Source: ECB BLS, % balance

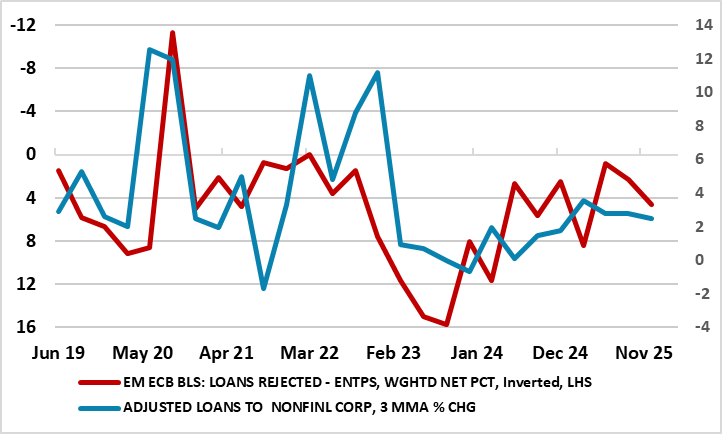

Unsurprisingly, with banks both partly warier and partly more unwilling to lend, it is not surprising that actual loan growth rates have started to slow. Indeed, this is very much the case for lending to firms where Figure 3 illustrates the logical and historical inverse relationship. The question is whether this slower loan growth is either/both supply or demand driven. In this regard, it seems that this is even more tangible evidence that the joint-threat posed by U.S. tariffs and global uncertainty is therefore becoming more of a reality rather than having diminished as is perhaps the central feature of what seems to be the latest ECB thinking – ie global risks and tensions have diminished.

Figure 3: Rejections and Tighter Standards Help Explain Weaker Loan Growth

Source: ECB BLS, % balance

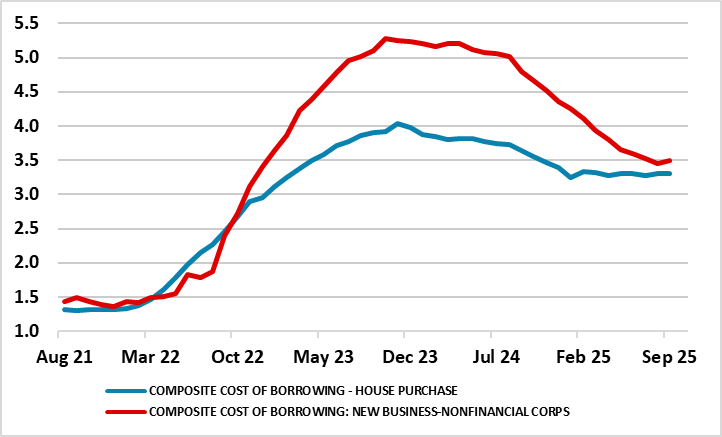

But perhaps the greatest indictment of monetary transmission mechanism alleged to be working effectively is the simple fact that actual lending rates to household and companies have failed to match the reduction in official rates – very much so as far as households are concerned. Indeed, with official easing worth some 200 bp, albeit this having shrunk somewhat in terms of how market rates have fared of late, it is worth noting that company lending rates have fallen some 25 bp less. But for households, actual effective lending rates have fallen just some 75 bp and have been stable to rising since the beginning if the year, despite the ECB cuts since that juncture. This is hardly normal, satisfactory let alone effective monetary transmission.

Figure 4: And Banks Have Not Been Passing on ECB Rate Cuts, Particularly for Households

Source: ECB (%)

Thus while the ECB may feel it (and the EZ) is a ‘good place’ we are warier whether it can stay there or at least improve in the manner that the ECB is both implicitly and explicitly suggesting. After all, our below consensus and ECB thinking outlook for GDP into 2026 does not depend on fresh weakness. Instead, the 0.8% projection for next year merely extends the Q3 result which is nothing more than a repeat of the underlying growth picture that the EZ has seen for the last two years or so. With this in mind, we feel that the ECB therefore needs to reassess its complacent view of the backdrop – and outlook - particularly regarding credit dynamics the slowing in which we see as being driven by tight(er) financial conditions. This tightening in financial conditions may also reflect another worrying message evident in a recent BLS as well as in some Council comments– namely that QT is not as neutral as the ECB has been alleging. This is something we have highlighted in the past and think will trigger an ECB response in terms of slowing QT now more likely in the new year.